A few hours ago, global cryptocurrency exchange giant OKEx halted withdrawals much to the chagrin of traders and investors. Bitcoin prices fell as a response to additional reports of founder Xu Mingxing being arrested over a week ago. However, what should be more concerning is the amount of BTC held by the exchange’s wallets. Data says that the value of holdings is easily worth $2.3 billion.

Around 200,000 BTC Worth $2.3 Billion Stashed Up in OKEx Wallets

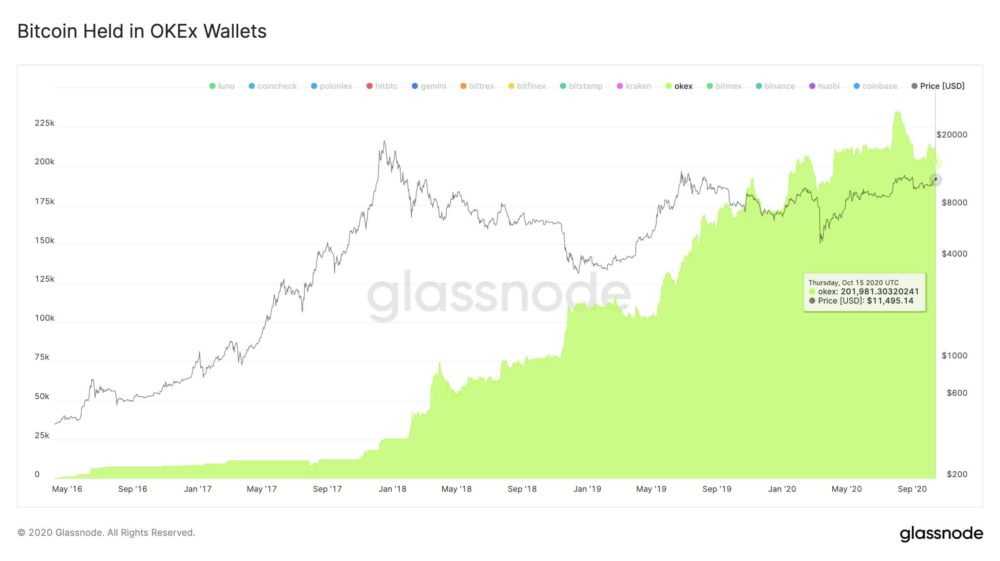

After the latest mess surrounding OKEx withdrawals, on-chain market analysis firm Glassnode released data pertaining to the number of bitcoins held by the exchange, and the numbers are pretty significant.

According to our data, around 200,000 BTC (1.1% of the circulating bitcoin supply) are currently held in #OKEx wallets. That is around $2.3 billion worth of $BTC stored in the exchange’s vaults.

Although OKEx CEO Jay Hao has assured users that their funds are safe and that there’s no “cause for alarm,” the vastness of the above bitcoin stash is pretty alarming. Especially because it is controlled by one single organization.

And also, because the official who has access to the private keys is currently ‘out of touch’.’The OKEx folks haven’t been able to reach out to the person. Since he/she started cooperating with ‘a public security bureau in investigations where required’.’Such huge BTC stashes put them at risk of falling prey to coordinated attacks that target centralized points of failure. And if not that then large fund transfers.

When BTC Funds Started Moving Out Of BitMEX En-Masse Post CFTC Intervention

After BitMEX founders were accused by CFTC for violating anti-money laundering laws followed by the arrest of CTO Samuel Reed, a massive BTC outflow took place. Glassnode tracked all the movements.

As per the firm’s initial set of data on October 2, around BitMEX held almost 170,000 BTC collectively in their wallets. But then a few hours later, the withdrawals began. From the day of the announcement of the charges till October 5, over 45,000 bitcoins had already found their way out of BitMEX, with the largest ‘negative net flow’ of 44,000 BTC happening on October 2.

All in all, BitMEX experienced a drop of nearly 27 percent as far as bitcoin deposits are concerned. Surely, the volume of these transfers was incredibly high. But bitcoin price didn’t flinch and actually rose to top $11,750 a few days back.

Bitcoin markets have matured a lot in the last 11 years with the increased infusion of liquidity. They can absorb massive sell orders even from such huge BTC holdings. As for the OKEx news today, bitcoin price fell more than 2 percent but has started to show signs of upward movement.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato