Bitcoin’s volatility is high this week, as the price has dropped from $19000 to $16900. The price hike was supported by the “shortage of supply” narrative. Looking at how the supply is not short anymore and based on data from Chainalysis, the change in BTC held on exchanges in the last day is 39.51k BTC, above the 180-day average. However, trade is ongoing with the same intensity and 24 hours ago, on November 26, 2020, Bitcoin experienced the largest one day drop in price. It decreased from $19.55k to $17.18k.

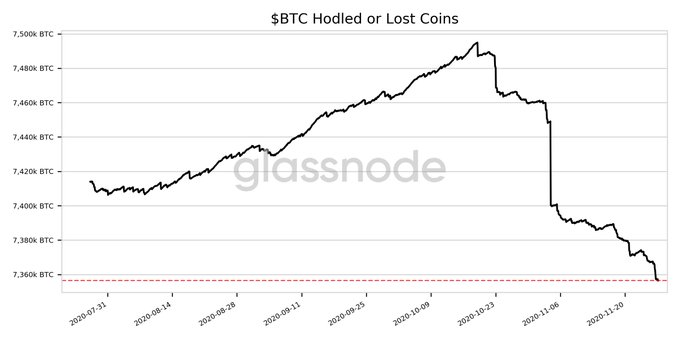

However, as this narrative changed, Bitcoin HODLed on spot exchanges hit a 4-month low of 7,356,470.120 BTC.

The Bitcoin reserve on spot exchanges is now climbing up, after dropping consistently since October 2020 and more Bitcoin from the mining pool is hitting exchanges. Recently OKEx opened up withdrawals and crypto is leaving exchanges and hitting other exchange wallets.

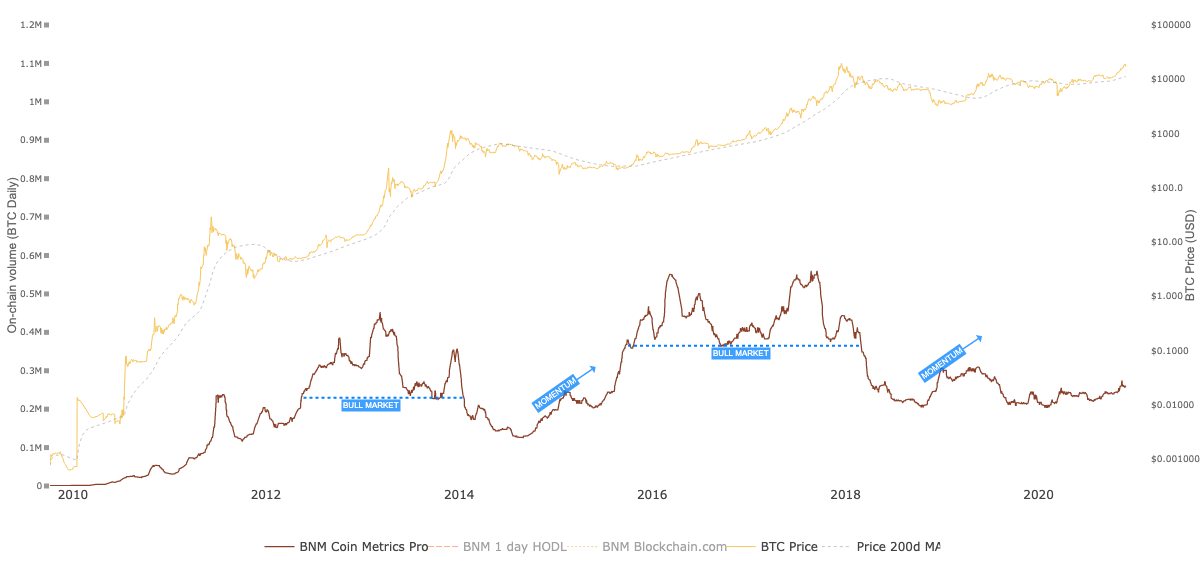

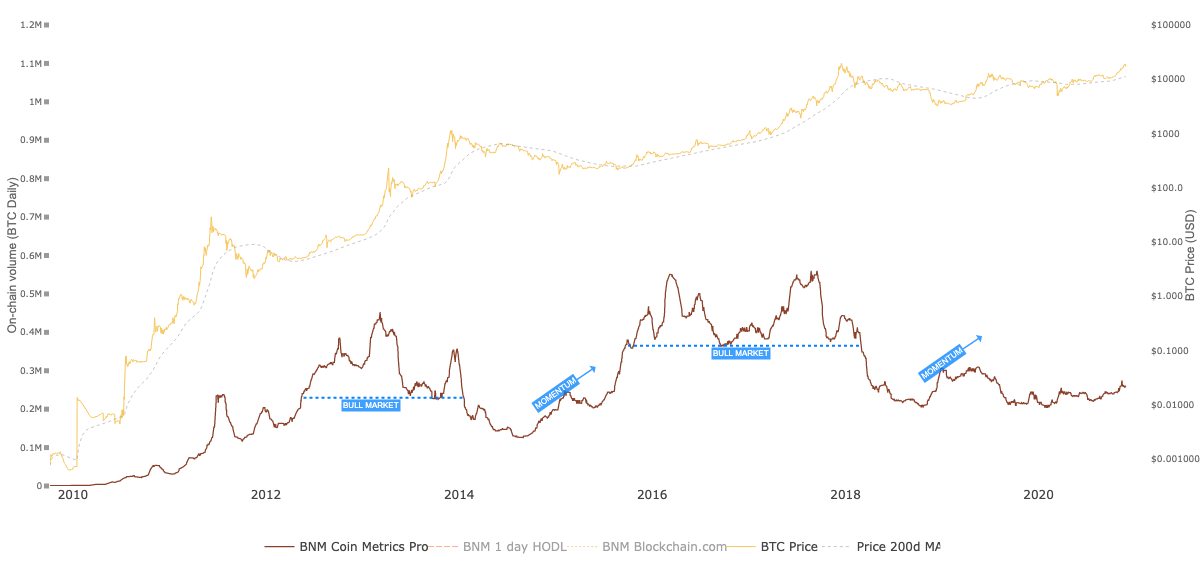

Based on data from CryptoQuant, OKEx NetFlow is negative. As HODLers book profits on other exchanges, this may have started on East Asian exchanges as well. Bitcoin in transit has experienced a steady increase, in the past week. This may be a result of HODLers and miners booking unrealized profits. HODLer volume was up 46.58k when the price was above $19000 and Bitcoin network momentum was below 0.3 M since the beginning of 2020. Besides, the Bitcoin Network Momentum Chart by WillyWoo did not even register the price rally to $19000 as a bull run.

Bitcoin Network Momentum Chart || Source: Woobull Charts

The previous two bull runs registered on the chart as a bull run, however, considering that the current price rally did not register as a price rally. This offers the possibility of a bull run before the end of 2020. Alternately below the end of the current phase of the market cycle.

Since the past week, HODLer volume, or the number of transactions by wallets that were inactive for 52+ week have considerably increased. There isn’t much evidence that institutions are selling, however, retail traders may be selling as the price dropped after rallying towards the previous ATH. Since Bitcoin’s momentum and volatility are still at the same level, this may possibly be a signal of a rally before the end of the cycle.

The post appeared first on AMBCrypto