Anyone that has used Ethereum for anything recently will have noticed a surge in gas fees. The DeFi boom of 2020 is largely responsible for this as demands on the creaking network increase. Ethereum and ERC-20 tokens make up the foundations of DeFi, and it has become painfully evident that the network cannot take the load.

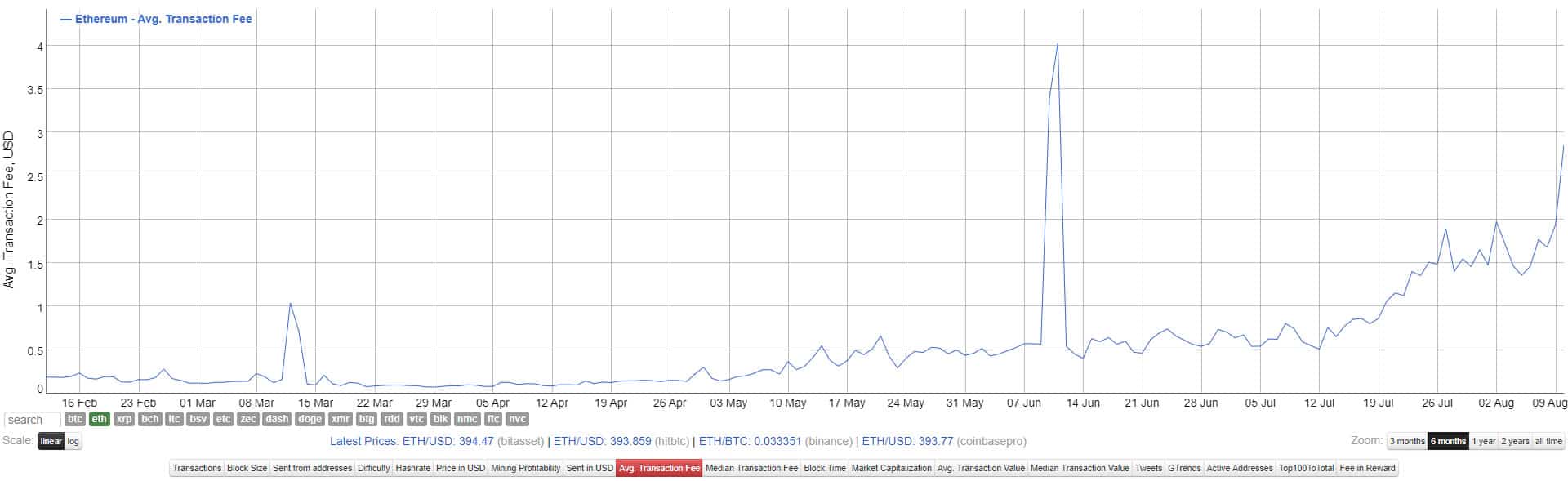

Average Ethereum fees have surged to just under $3 as of August 10, according to Bitinfocharts.com. Aside from a spurious spike in June, this is the highest they have been since mid-2018.

What’s worrying is that this time around, it has not been just a single spike, but a gradual increase which indicates that they will not be going back down in a hurry. The median transaction fee chart paints a similarly grim picture with an increase to $1.4, its highest level since January 2018.

DeFi: A Whales Game

The surge in gas fees makes pretty much all smaller DeFi transactions impractical. Removing a small amount of farmed COMP, say $40 worth, from the platform and sending it to Metamask would cost $46.5 in gas fees at the time of writing.

With the costs of depositing and withdrawing crypto into DeFi smart contracts skyrocketing for smaller amounts, it would be fair to say that the nascent sector, in its current state, is really only profitable for whales.

The increase in network charges has not gone unnoticed among the crypto community. Crypto investor and developer, 0xNick, observed that over the weekend, ETH fees were three times higher than Bitcoin’s.

“Yesterday, the fees paid on Ethereum were 3 times higher than on Bitcoin. It was also a Sunday.”

DeFi superuser ‘DeFi Dad’ pointed out that there are ways to avoid the ‘brutal’ gas fees by hunting around for DEX aggregators.

Gas is brutal but here’s a few saving graces thanks to subsidized fees/gas and L2 solutions.

@Dharma_HQ in-wallet Uniswap trading

@matchaxyz DEX aggregator

@loopringorg spot trades for a cent

@1inchExchange DEX aggregator + CHI token

Also check @ETHGasStation prices! pic.twitter.com/OqbGI7Xeed

— ⟠ DeFi Dad ⟠ defidad.eth (@DeFi_Dad) August 10, 2020

Ethereum Price Update

Ethereum prices are holding just under $400, which is the savior for those that bought over the past two years. Prices dropped to an intraday low of $385 yesterday but managed to recover quickly.

At the time of writing, ETH is trading at $395, but it has become clear over the past week or so that the resistance barrier above it is going to be a hard one to break.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato