(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Bad girl, sad girl, you’re such a dirty bad girl

Beep beep, uh-huh

You bad girl, you sad girl, you’re such a dirty bad girl

Beep beep, uh-huh

– Donna Summer

Who is the baddest bitch in the world? Tay Tay – nah, she’s just a pop star. Christine Lagarde – nah, she’s just a US puppet, not a puppet master. Kamala Harris – who the fuck is that?

The baddest bitch in the world, and probably the real second in command of Pax Americana is who appears to be a frumpy gnome-looking creature. She don’t dance no more, and probably never has, she makes money move. I’m talking about US Treasury Secretary Janet Yellen.

Bad Gurl Yellen, if she so pleases, can unilaterally remove individuals, companies, and/or whole countries from the dollar global financial system. Given that, for most, it is essential to have dollars to buy primary energy (oil and natural gas) and food, it is a death sentence to be removed from Pax Americana’s financial system. She calls it sanctions, some call it a death sentence.

From a financial standpoint, she is responsible for the rules and regulations that govern how the filthy fiat financial system operates. Since credit makes the world go ‘round, and this credit emanates from banks and other financial firms, her will has a significant impact on the structure of the global economy.

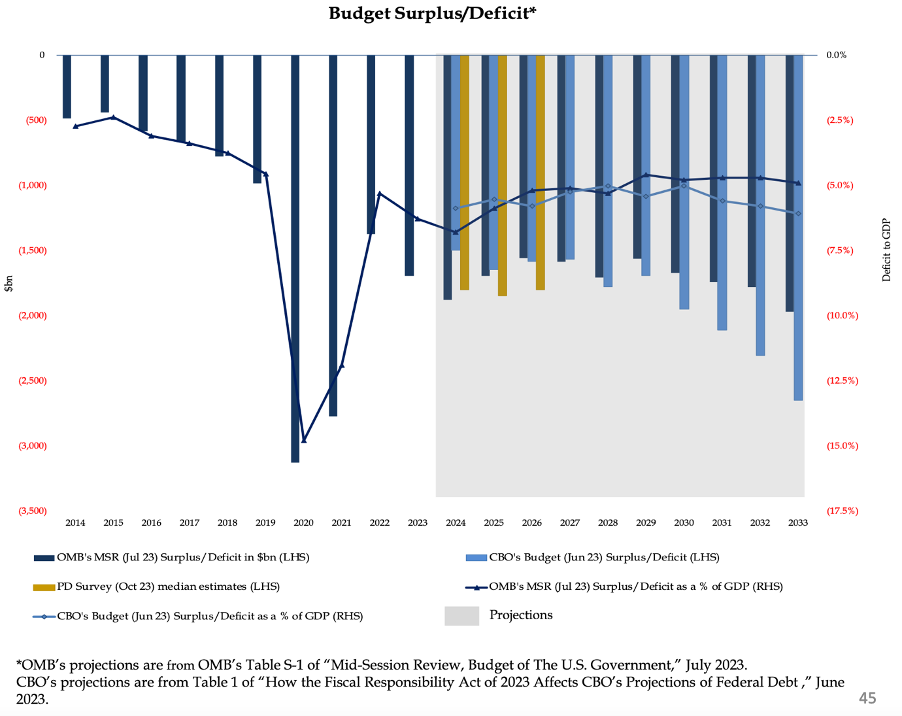

Her most important responsibility is ensuring that the US government is funded. She is called upon to issue debt in a judicious manner when the US government spends more than it earns via taxes. Given the gargantuan size of recent US government deficits, her role is that much more important.

But all is not well in Bad Gurl Yellen’s universe. Her baby daddy, Slow Joe the US President, is behind on his child support payments. Slow Joe ain’t like typical deadbeat fathers who blow their paychecks on booze and strippers. Slow Joe is addicted to spending money by blowing up far away countries in pursuit of … who knows what. He never saw a conflict that the empire’s war machine shouldn’t support. Fight a proxy war in Ukraine vs. the “evil” dictator Putin and the largest commodity exporter globally? Let’s fucking go! Support Bombardier Bibi Netanyahu in his quest to flatten the Gaza Strip, permanently displace millions, and kill tens of thousands of Palestinians, even if said support might lead to war with the Persians? America! Fuck Yeah!

Our gurl Yellen publicly supports her boss, but in private she is scrambling to ensure the empire can issue debt at an affordable price to keep the children fed. Who are the children? Baby boomers who are getting old, sick, and need an ever-increasing amount of healthcare goods and other entitlements. The military-industrial complex needs to be fed an ever-expanding defence budget to produce more bullets and bombs. Interest to rich savers needs to be paid so that promises are kept to hodlers of debt.

Yellen might be a bad bitch, but the market ain’t buying what she is selling. Yields on long-end treasury debt (maturities >10-years) are rising faster than short-end yields (maturities <2-years). This presents a deadly problem to the financial system called the “bear steepener”. I wrote about why this is so toxic for the banking system in my previous essay “The Periphery”.

What is she going to do to please her baby daddy – the same baby daddy who needs to go back to the welfare office in November 2024 to reapply for benefits? She needs to engineer a solution that buys the economy time. So, here’s Bad Gurl Yellen’s task list:

– Inject liquidity into the system so that stocks rise. When stocks pump, capital gains taxes rise, which helps pay some bills.

– Fool the market into thinking the Fed is going to cut rates, and thus remove selling pressure on the stocks of non-Too Big To Fail (TBTF) banks who are all insolvent.

– Fool the market into thinking the Fed is going to cut rates, which creates demand for long-term debt.

– Ensure the liquidity injection is not so large that the price of oil pops because of a weaker dollar.

The US Federal Reserve (Fed) at its recent meeting held interest rates constant and indicated it would further pause as it continued to evaluate the impacts of its rate hikes to date. At the same time, Yellen indicated that the US Treasury will increase the amount of short-dated bills issued, which is what money market funds (MMF) desire. MMF will continue pulling money from the Fed’s Reverse Repo Program (RRP) and buying T-bills, which is a net liquidity injection into the market.

The remainder of this essay will feature my arguments as to why I believe the above policy will result in the following:

- A net liquidity injection of $1 trillion, the current size of the RRP, into the global financial markets.

- This liquidity injection will power a rising US stock market, crypto, gold, and other fixed-supply financial assets.

- All other major central banks like the People’s Bank of China (PBOC), Bank of Japan (BOJ), and European Central Banks (ECB) will also print money because now that US monetary conditions are loosening they can print money without weakening their currencies.

- The market believes the US Treasury yield curve will bull steepen in the future.

- It will prevent a market fire sale of all non-TBTF bank stocks.

- Once the RPP runs dry going into the end of 2024, the US Treasury market Armageddon will reassert itself.

Ducks and Cucks

Fed chairman Powell is a duck, and his madam is Bad Gurl Yellen. You might think being a duck is a lowly position, but in Hong Kong, ducks live quite a pampered and rich lifestyle. Powell is by many accounts a centa-millionaire. But all the money doesn’t change the fact that he is Yellen’s, at the very most, towel boy.

This is one of the most important pictures for understanding the power dynamic at the upper echelons of the empire. Slow Joe and Yellen are instructing the duck Powell to fight inflation at all costs. Where is Kamala? Point proven.

The problem with raising interest rates to levels that are economically restrictive is that it would destroy the banking system. Therefore, the Fed plays a game where it pretends to fight inflation, but is always looking for a way to justify pausing its monetary tightening program. The easiest (and most intellectually dishonest) way that they accomplish this is by concocting misleading statistics about the level of inflation.

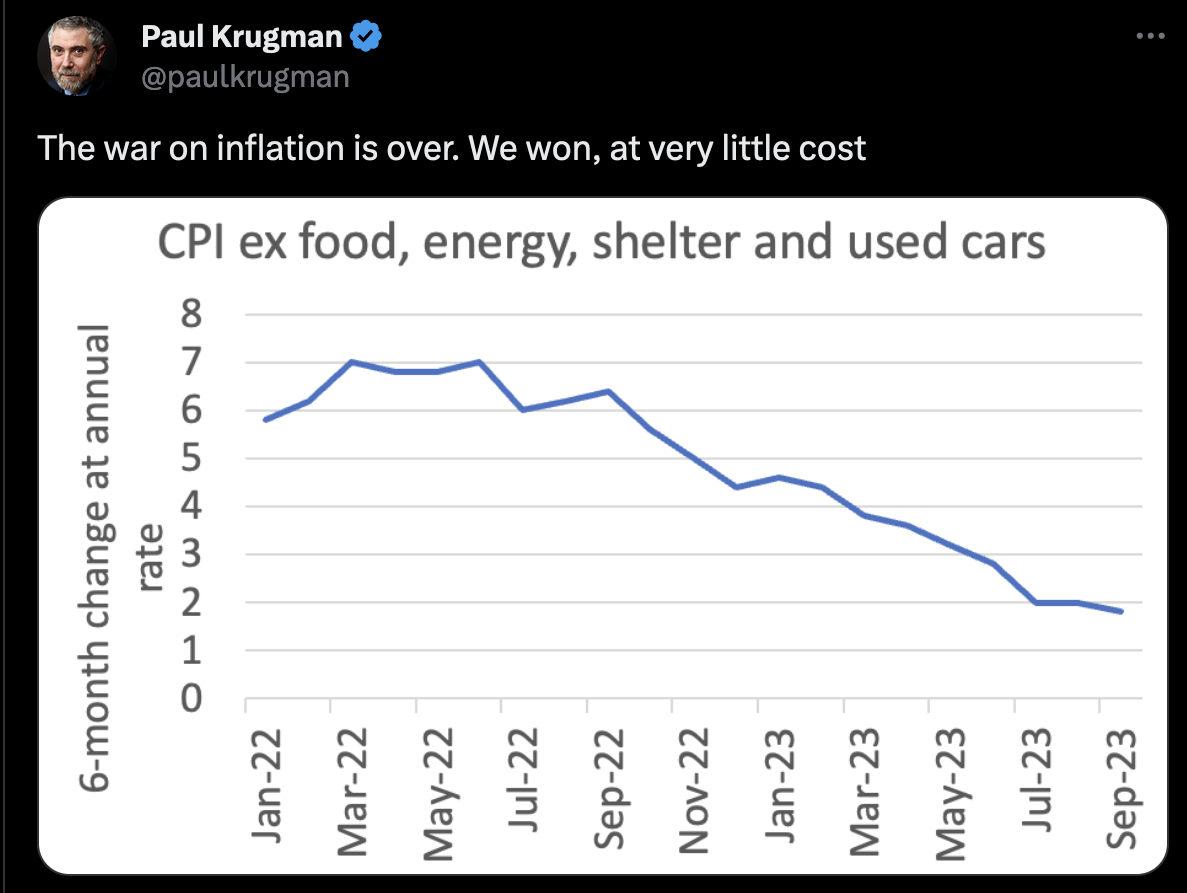

Government-produced inflation statistics are all bullshit. It is in the government’s interest to underplay the effects of inflation in order to convince the plebes that their eyes are deceiving them at the checkout counter. That sticker shock you get when buying a loaf of bread is not to be trusted because the government tells you inflation just isn’t there. To do this, bureaucrats create these baskets of representative goods that deemphasize the price rises of food and energy. Misleading inflation statistics are calculated based on the price changes of this basket.

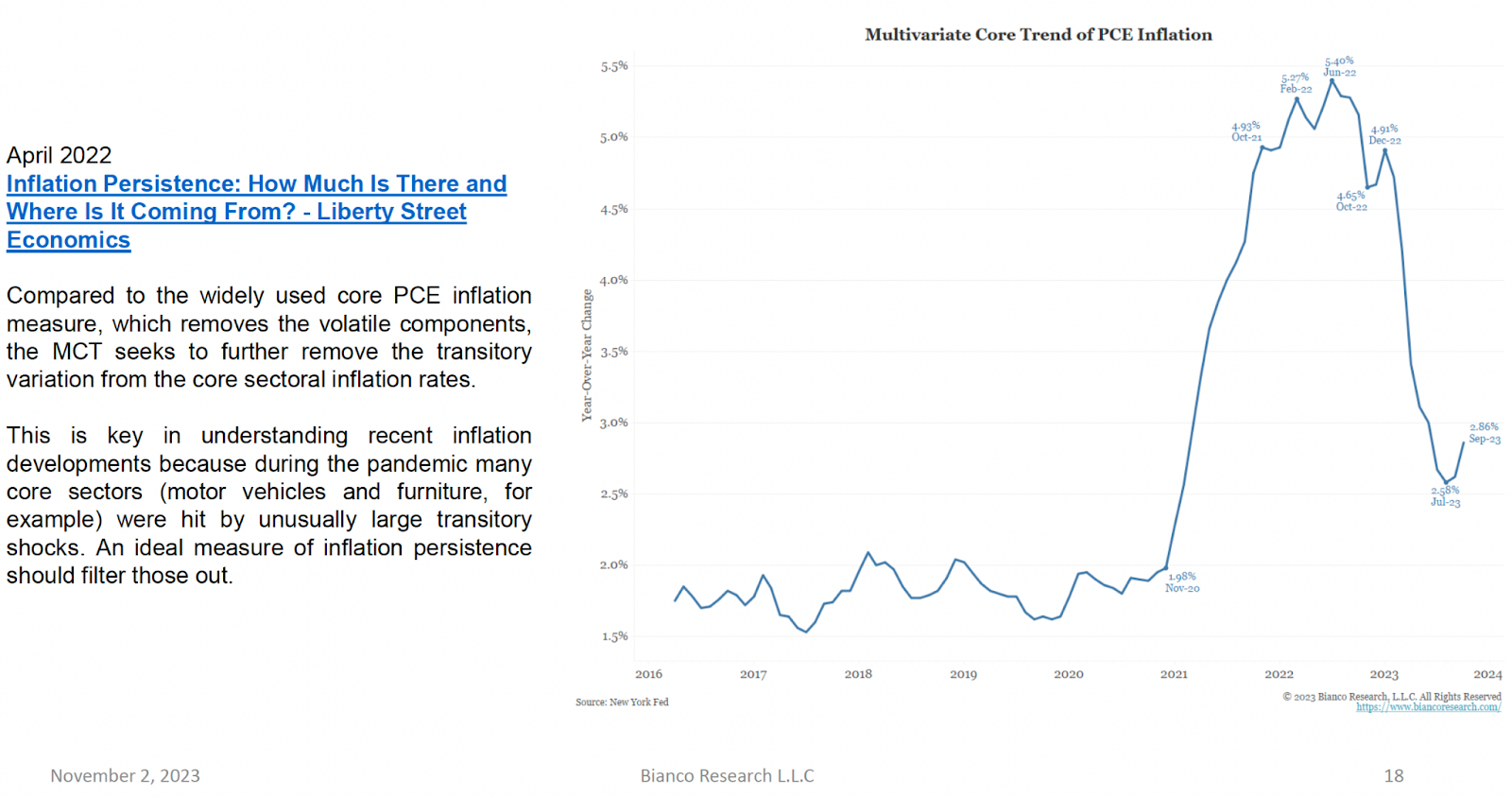

The Fed’s dislike of the high headline Consumer Price Index (CPI), which includes things like food to fill your belly and gas to power your chariot, has led them to do some fancy maths. Magically, this led to the creation of core CPI, or what they like to call “Core Inflation”. Core CPI excludes food and energy. But core CPI was too high, so the Fed tasked the staffers to remove the non-transitory elements of core CPI to get a better (read: lower) measure of inflation. After doing more magic maths, they created the Multivariate Core Trend metric.

The problem is that all these bullshit manipulated inflation metrics are above the Fed’s target of 2%. What’s even worse is, these metrics appear to have bottomed. If the Fed were truly fighting inflation, then they should continue raising rates until their fugazi inflation metrics are at 2%. But suddenly, Powell, starting at the September press conference, stated that the Fed would pause to see the effects of its hiking campaign.

My suspicion is that Powell got a little tickle from Yellen and was told that Momma wanted him to pause again and telegraph to the markets that the Fed was on hold until further notice. This is a deft policy response, and here’s my thinking behind it.

The market wants to believe a recession is coming next year. A recession means that the Fed must cut rates to ensure the dreaded deflation never takes hold. Deflation occurs as a result of falling economic activity that takes prices lower. Deflation is bad for the filthy fiat system because the value of assets that underpin debts (the collateral) decreases. This causes losses for creditors, meaning the banks and rich folks. Because of this, the Fed cuts rates.

As I explained in my previous essay, the market will pile into long-term US Treasury debt resulting from a weaker economic forecast. This, coupled with a general fall in interest rates due to Fed policy, means holders of long-term debt profit. The result is an eventual bull steepening of the yield curve.

The market will front-run this scenario and buy more long-term bonds than short-term. That’s because long-duration bonds make more money when interest rates fall than short-duration bonds. The result? The bear steepener stops, the curve gets more inverted, and then when the recession arrives in 2024, the curve bull steepens. The Fed accomplished all of this just by pausing twice at the September and November meetings and giving a forward-looking negative outlook on the economy. It is a win for Powell and Yellen because it doesn’t necessitate cutting rates to achieve this positive market response.

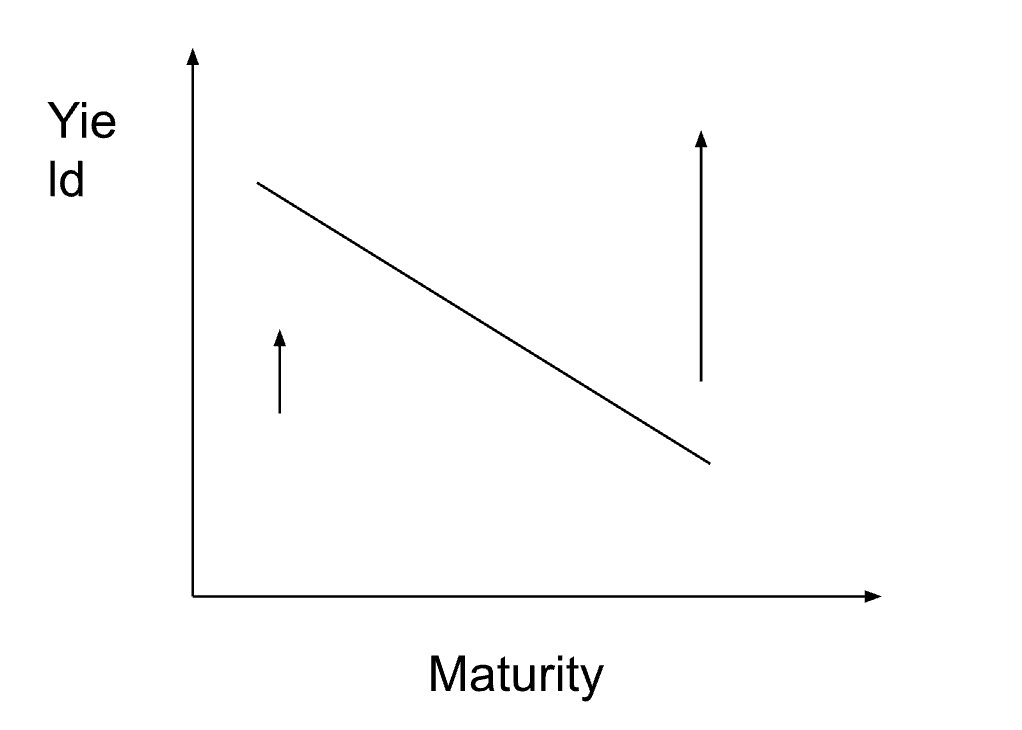

I’m going to illustrate the progression with a few simple charts. The longer the arrow the larger the magnitude.

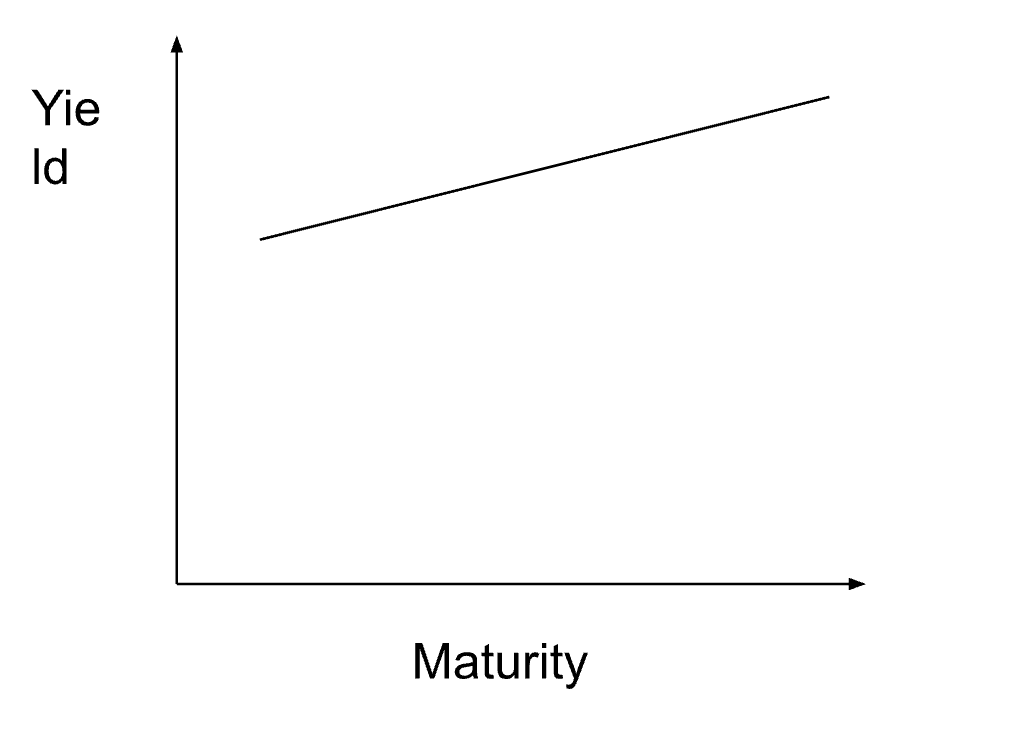

Chart 1:This is the bear steepener. The curve started inverted, and yields across the curve rose with long-end rates rising faster than short-end rates.

Chart 2: This is the resulting yield curve. As the bear steepener progresses, you get a positively sloped yield curve at higher rates. This is the worst possible outcome for bondholders and the banking system. Bad Gurl Yellen must do anything in her power to stop this from happening.

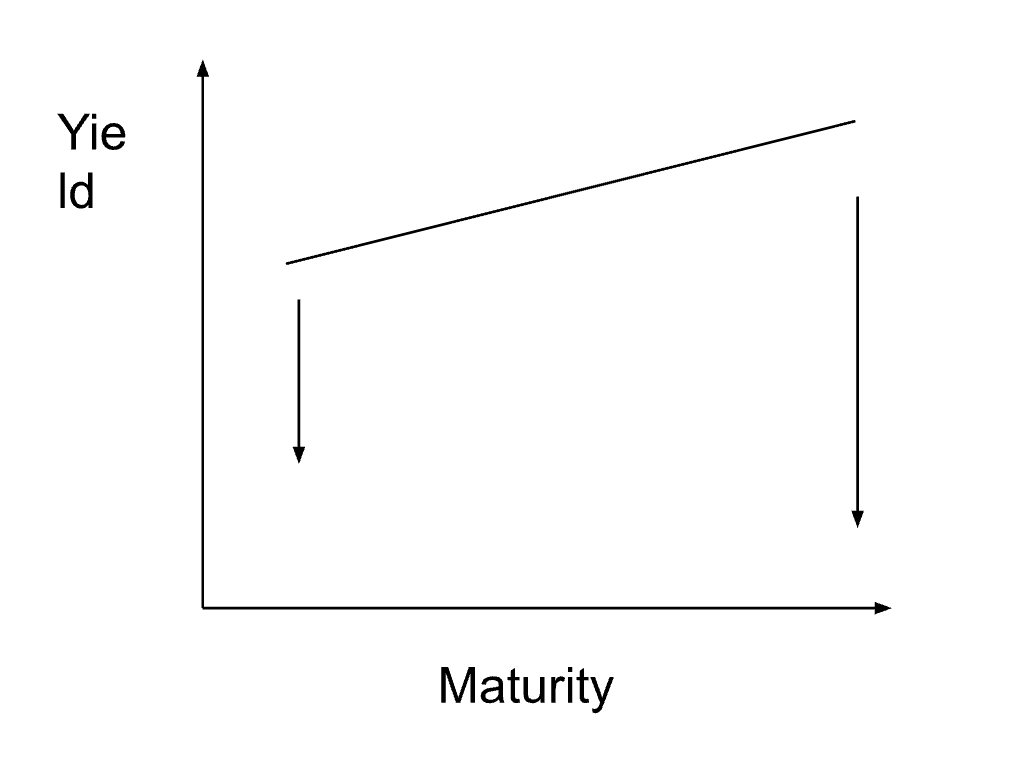

Chart 3: If Bad Gurl Yellen’s gambit succeeds and the market buys more long-end vs. short-end bonds; the curve will now re-invert.

Chart 4: This is the resulting yield curve. The curve has re-inverted, which is unnatural. The market expects a recession, which is why long-end yields are less than short-end ones.

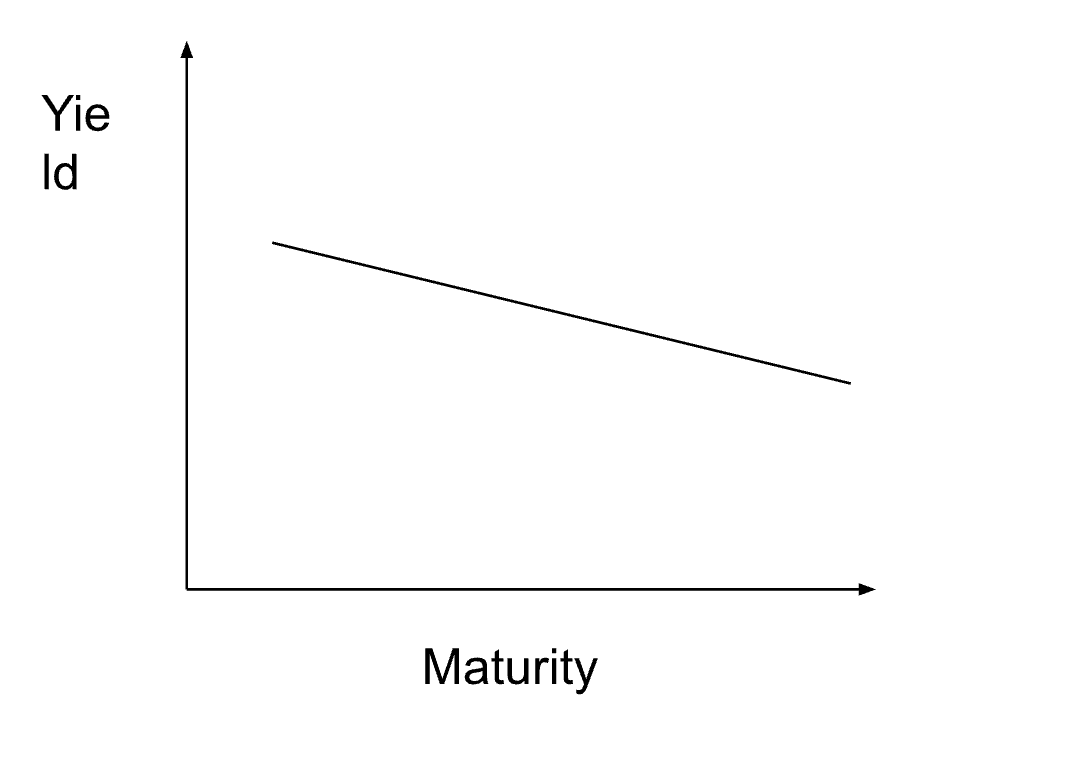

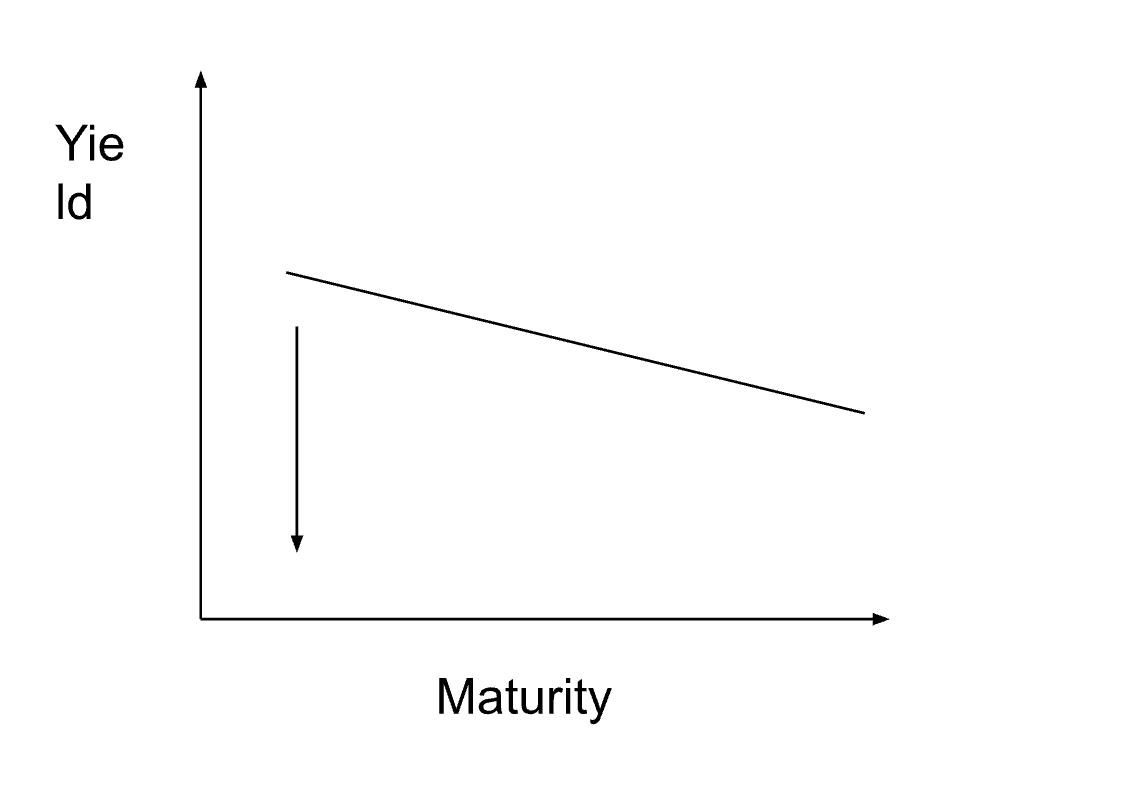

Chart 5: The recession comes or some TradFi firm blows up and the Fed cuts rates, which causes short-end rates to fall and long-end rates to remain constant. This steepens the curve.

Chart 6: This is the resulting yield curve. The curve has bull steepened after all these phase shifts. The curve is positively sloped, which is natural, and the general level of interest rates has fallen. This is the best possible scenario for bondholders and the banking system.

Banks Saved

The immediate impact of a re-inversion of the yield curve and an eventual bull steepener is that unrealised losses on Held-to-Maturity (HTM) US Treasuries on banking balance sheets fall.

Bank of America (BAC) reported an unrealised loss of $132 billion in the HTM asset bucket for the third quarter of 2023. BAC has tier 1 common equity capital of $194 billion and total risk-weighted assets (RWA) of $1.632 trillion. When you recalculate BAC’s capital adequacy ratio (equity / RWA) by reducing the equity by the unrealised losses it falls to 3.8%, which is well below the regulatory minimum. If these losses were recognized, BAC would be placed into receivership like Silicon Valley Bank, Signature Bank, First Republic, etc. The higher long-end treasury yields go, the larger the hole. Obviously, that ain’t happening. One rule for them, another rule for us.

The banking system is choking on all the government debt they accumulated in 2020-2022 at record high prices and low yields. BAC is a de facto state-owned bank due to its TBTF designation. But the rest of the non-TBTF US banking system is insolvent due to a combination of unrealised losses on treasury debt and commercial real estate loans.

If Yellen can engineer a policy that results in bond prices rising and yields falling, holders of bank stocks don’t have a reason to sell. And that forestalls the inevitable future where the entire US banking system’s balance sheet finds its way onto the US Treasury’s books. That would be extremely bad news bears for the creditworthiness of the US government, because the government would have to print money to guarantee banks made good on deposit withdrawals. No one would willingly buy long-term US Treasury debt in that situation.

Any Consequences?

The challenge is that if the Fed cuts rates, the dollar might weaken aggressively. This would put extreme upward pressure on the price of oil because it is priced in dollars. While the mainstream financial press and its intellectually bankrupt cheerleaders like Paul Krugman attempt to hoodwink the public into thinking that inflation doesn’t exist, any seasoned politician knows if the price of gas is up on election day, you are fucked. That’s why cutting rates at this juncture – when the Middle East is on the brink of war – would be political suicide. The price of oil could easily be close to $200 by election day next year.

Of course, if you exclude all the things people need to live and earn a living, inflation is non-existent. What a fucking muppet.

But what if inflation has bottomed, and the Fed is on pause while it accelerates? That is a possible outcome, but I believe any discontent due to rising inflation will be drowned out by the gangbusters US economy.

Economy Stronk

I do not believe there will be a recession in 2024. To understand why, let’s go back to the first principles of what contributes to GDP growth.

GDP Growth = Private Sector Spending (Net Exports, Investment are also included) + Net Government Spending

Net Government Spending = Government Spending – Tax Revenue

When the government net spends money by running a deficit, it powers a net increase in GDP growth. That conceptually makes sense – the government spends money to buy stuff and pay staff. However, the government takes resources away from the economy via taxation. Therefore, if the government spends more than it taxes, it is net stimulating the economy.

If the government is running massive deficits, it means that nominal GDP will grow unless the private sector contracts an equal amount. Government spending – or any spending, for that matter – has a multiplier effect. Let’s take an example that Slow Joe gave to the American public in his recent address about the various conflicts in which the empire is engaged.

The US government will increase defence spending. There will be many Americans making bullets and bombs used to kill all those terrorists and a greater number of civilians on the empire’s periphery. I’m pretty okay with that, so long as 10 civilians or fewer are killed per terrorist; that’s a “fair” ratio. Those Americans will take their blood money and spend it within their communities. There will be office buildings, restaurants, bars, etc. all built to service workers in the defence industry. This is the multiplier effect of government spending, as it encourages private-sector activity.

In light of this, it becomes hard to imagine a scenario where the private sector can contract enough to nullify the net benefit of GDP growth contributed by the government. In the most recent 3Q2023 data dump, US nominal GDP grew at 6.3% with an annual deficit of close to 8%. If CPI inflation is sub-6.3%, everyone wins, because real GDP growth is positive. Why would the voters be upset with this situation? Given that CPI inflation is at a 3-handle, it is going to take many quarters for inflation to get to a level that, in the minds of voters, outweighs the gangbusters US economy.

The deficit is forecast to be between 7% to 10% in 2024. The American economy, powered by the free-spending government, is going to perform very well. As such, the median voter will be quite pleased with a rising stock market, strong economy, and subdued inflation.

T-Bills

Yellen isn’t all-powerful. If she slams trillions of dollars worth of debt down the market’s throat, bond prices will fall and yields will rise. This would destroy any benefit experienced by the financial system due to the Fed’s pause. Yellen needs to find a pool of money that is perfectly happy to buy a fuck-ton of debt without demanding much higher yields.

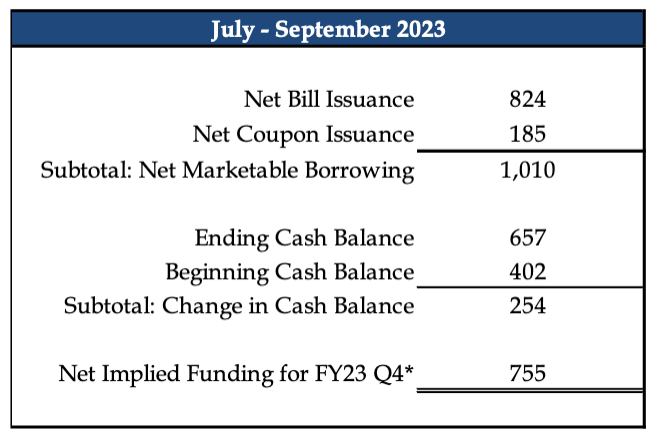

MMFs currently hold roughly ~$1 trillion in the Fed’s RRP. That means that MMFs yield close to the lower bound of the Fed Funds Rate, which is 5.25%. Treasury bills, like the 3-month or 6-month version, yield ~5.6%. MMFs park money with the Fed because the credit risk is lower and its money is available on an overnight basis. MMFs don’t sacrifice much in terms of yield to take lower risk. But if Yellen could offer more T-bills at slightly higher rates, MMFs would shift money out of lower-yielding RRP into higher-yielding T-bills.

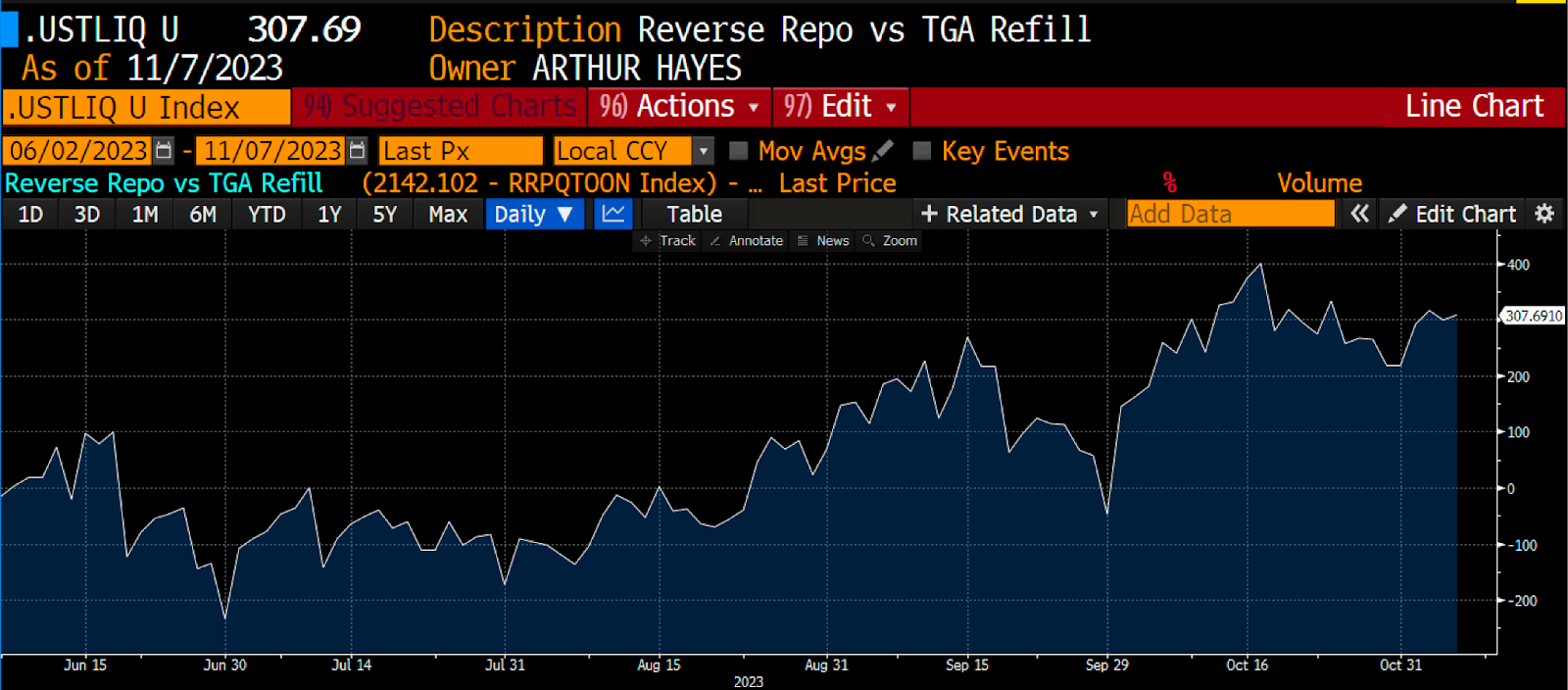

In the latest quarterly financing report, Yellen committed to increasing the amount of bills issued. One can argue that the selloff in long-end treasuries would have been worse if not for the $2 trillion parked in RRP. Bear in mind that earlier in June of this year, Yellen restarted borrowing after the US politicians “shockingly” agreed to increase the US debt limit, allowing them to spend more money. At the time, the RRP stood at $2.1 trillion. Yellen has since sold a record amount of bills, and RRP balances halved since then.

Yellen issued $824 billion of bills and RRP declined by $1 trillion. Success!

Refer to my essay on dollar liquidity, entitled “Teach Me Daddy”, to fully understand why, when RRP balances decline, dollar liquidity rises. The one caveat is that if Yellen increases the Treasury General Account (TGA), it negates the positive liquidity defects of falling RRP balances. The TGA is currently ~$820 billion, which is higher than their target of $750 billion. As a result, I don’t see a situation where the TGA rises from here – instead, I think it’s likely to stay constant or fall.

As the RRP is drained, $1 trillion of liquidity will be released into the global financial markets. It will probably take six months to fully exhaust the facility. That estimate is based on how quickly RRP fell from $2 to $1 trillion, as well as the forecasted pace of debt issuance.

Before I move on to how some of this money will find its way into crypto, let me briefly cover how other central banks will likely respond.

Weak Dollar

When more dollars are sloshing around in the system, the price of a dollar relative to other currencies should fall. This is great news for Japan, China, and Europe. Each one of these countries faces financial issues. They come in different flavours, but ultimately money printing is needed to prop up some part of the financial system and the government bond markets. However, all central banks are not created equal. Because the PBOC, BOJ, and ECB don’t issue the global reserve currency, there is a limit to how much they can print before their currencies get trashed relative to the dollar. All these central banks have been hoping and praying for the moment that the Fed eases so they can too.

These central banks can ease as well because the Fed’s policy will have the most impact due to the truly mind-boggling sums involved. That means on a relative basis, any money printing done by the PBOC, BOJ, and ECB has less impact than the Fed. When translated into currency terms, the yuan (China), yen (Japan), and euro (Europe) will strengthen vs. the USD. They can print money, save their banking systems, and prop up their government bond markets. Finally, dollar-priced energy imports become cheaper. That contrasts with the recent past, wherein printing money caused their currencies to weaken vs. the dollar – which in turn increased dollar-priced energy import costs.

The result is that alongside a massive dollar liquidity injection, there will be a corresponding yuan, yen, and euro injection as well. The amount of fiat credit available on a global aggregate level is set to accelerate from now until the first half of 2024.

Dumb and Smart Trades

Considering all of the fiat liquidity sloshing around the global markets, what should one purchase to outperform the currency debasement?

Well first, the dumbest thing one can do is purchase long-term bonds with a buy-and-hold mentality. This positive liquidity situation lasts so long as the RRP > 0. When the RRP = 0, then all the issues with long-term bonds reemerge. The last thing you want to do is load up on illiquid long-term debt of any kind that you are unable to profitably exit when the liquidity situation changes. Therefore, the dumbest expression of this trade would be to buy long-duration debt, especially government debt, and be mentally prepared to hodl it. You will experience a market-to-market gain today, but at some point, the market will start to discount the impact of further RRP balance decreases and long-end bond yields will creep higher, which means prices fall. If you are not a skilled trader, you will crush your golden egg with your diamond hands.

A medium-smart trade would be to go long on short-term debt with leverage. Macro Trading God himself, Stan Druckenmiller, told the world at a recent Robinhood interview with another deity, Paul Tudor Jones, that he went mega-long 2-year treasuries. Great trade, brah! Not everyone has the stomach for the best expressions of this trade (hint: it’s crypto). Therefore, if all you can trade are manipulated TradFi assets like government bonds and stocks, then this isn’t a bad option.

A trade that’s a bit better than the medium-smart trade (but still not the smartest) is to go long on big tech. Specifically, companies with any relationship to artificial intelligence (AI). Everyone knows that everyone knows that AI is the future. This means anything AI-related will pump, because everyone is buying it too. Tech stocks are long-duration assets and will benefit from cash being trash once more

As I alluded to above, the smartest trade is going long crypto. There is nothing else that has outperformed the increase in central bank balance sheets like crypto.

This is a chart of Bitcoin (white), Nasdaq 100 (red), S&P 500 (green), and Gold (yellow) divided by the Fed’s balance sheet indexed at 100 starting March 2020. As you can see Bitcoin smoked (+258%) all the other assets when deflated by the rise in the Fed’s balance sheet.

The first stop is always Bitcoin. Bitcoin is money and only money.

The next stop is Ether. Ether is the commodity that powers the Ethereum network, which is the best internet computer.

Bitcoin and Ether are crypto’s reserve assets. Everything else is a shitcoin.

Then, we get to other layer-one blockchains that claim to be an improvement on Ether. Solana is an example. These all got beaten up real bad during the bear market. As such, they will levitate off extreme lows and provide great returns for intrepid investors. But, they are still all overhyped, me-too, pieces of shit that won’t overtake Ethereum in terms of active developers, dApp activity, or Total Value Locked.

Finally, all manner of dApps and their respective tokens will pump. This is the most fun, because down here is where you get the 10,000x returns. Of course, you’re also more likely to get rugged, but where there is no risk there is no return.

I love shitcoins, so don’t ever call me a maxi!

The Path Forward

I’m keeping an eye on the net of [RRP – TGA] to determine if dollars are flooding the markets. That will determine if I increase the pace of T-bill sales and Bitcoin purchases as my confidence rises alongside an expectation of an increase in dollar liquidity. But I will stay nimble and flexible. The best-laid plans of mice and men have a tendency to falter.

\

\

Since Bad Gurl Yellen got the green light to borrow again in June of 2023, a net of $300 billion has been injected. This is a combination of a reduction in the RRP plus an increase in the TGA.

The ultimate wildcard is the price of oil and the Hamas v. Israel war. If Iran is drawn into the war, then we should consider that there will be some disruption to the flow of oil to the overleveraged West. It then becomes politically difficult for the Fed to pursue a hands-off approach to monetary policy. They might have to raise rates to combat higher oil prices. But on the other hand, one could argue that there would be a recession due to the war and higher energy prices, which would give the Fed licence to cut rates. In either case, uncertainty rises, and the initial response might be a selloff in Bitcoin. As we have seen, Bitcoin has proven to outperform bonds during times of war. Even if there was an initial phase of weakness, I will buy dips.

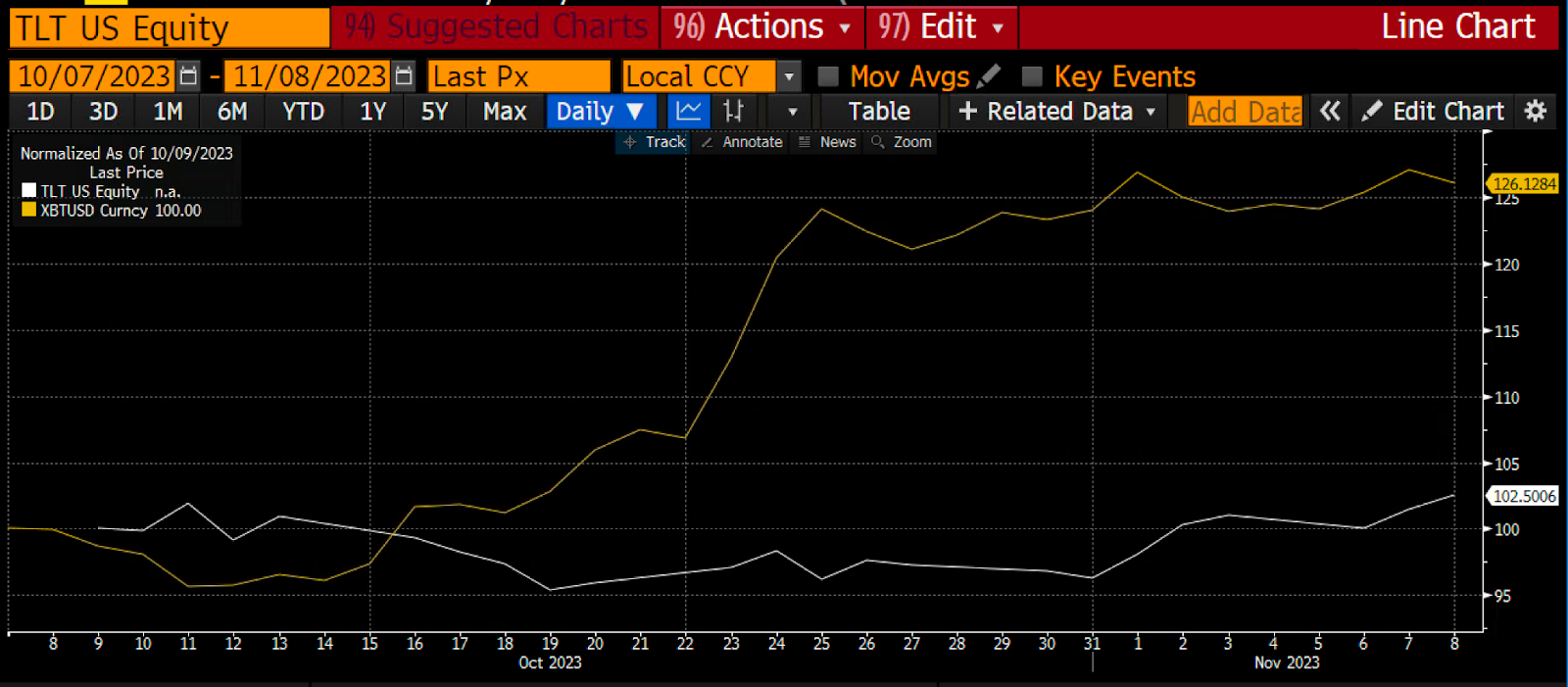

TLT rose 3% vs. Bitcoin jumping 26% since the onset of the Hamas / Israel war.

If this RRP drawdown is the goal of Bad Gurl Yellen, then it will only last for so long. All of the US Treasury market concerns that caused 2s10s and 2s30s to scream higher in a bear-steepening fashion and exert stress upon the financial system will return. Yellen hasn’t convinced her baby daddy to stop drankin’ or fornicatin’, and thus, after a lull, Bitcoin will reassert itself as a real-time scorecard on the health of the war-time fiat financial system.

Of course, if those in charge of Pax Americana committed themselves to peace and global harmony … nah, I’m not even going to finish that thought. These mofos have been practising war since 1776, with no signs of letting up.

Related

The post appeared first on Blog BitMex