|

Bakkt’s bitcoin futures and custody platform launch on 23 September is a shot in the arm for crypto, but in addition to boosting bitcoin it could also raise the profile of Ethereum.

The long-awaited physically settled futures should qualitatively shift market composition toward greater institutional influence.

A crypto trading and payments ecosystem, Bakkt is a subsidiary of Intercontinental Exchange, the owner of the New York Stock Exchange. Bakkt hopes to quicken the pace of institutional bitcoin adoption. Its custody pitch for best of class offering comes in its securing of $125 million of insurance protection for its bitcoin “warehousing” custody arrangements.

The bitcoin price reacted positively on the announcement from Bakkt. As it happens, the timing more than cancelled out the unsurprising news that the US SEC was delaying a decision on the three ETF proposals before it.

Bakkt and a clutch of new entrants from big finance are up against Coinbase, which recently bought industry wallet and custody pioneer Xapo, originally founded by Argentine tech and crypto entrepreneur Wences Casares.

This acquisition has significantly improved Coinbase’s already well-regarded institutional custody service, launched in July last year.

Trying again with the crypto payments opportunity

And, of course, Bakkt is about much more than a futures product and associated services. The Intercontinental Exchange company wants to help kickstart crypto payments. It has brought Starbucks and Microsoft on board to help.

Starbucks along with Apple Pay, are the mobile payments leaders in the US., followed by Google Pay and Samsung Pay. Contactless payments has a lot of catching up to do in the US and Bakkt’s wants to be part of the story when it comes to modernising the industry. Out with cheques (checks) and cards and in with contactless and mobile is what is needed – and has already happened in large parts of South East Asia and Europe, but not the US.

Whether buying coffee with bitcoin catches on we won’t know until the ecosystem is in place which will be in a few months, according to Bakkt. Volatility is the big barrier (along with scalability) for crypto payments and Bakkt’s futures are an excellent hedge for merchants and miners, precisely because of its physically settled nature.

Pulling the know-how together and putting the rails in position could in truth probably be more important than ultimately what runs on those rails – Bakkt is starting with bitcoin but also wants to be the go-to place for institutions interfacing with the digital currency asset class in general.

Bakkt is clearing looking to cover all the bases. And it looks to have achieved that while still beating the competitors with Ledger X prematurely announcing a product launch only for the regulator to slap it down. Bakkt is an exchange business so naturally it has shown itself open to bitcoin as a legitimate tradeable instrument. But although the daily and monthly futures contracts will get all the attention for now, the crypto payments part of the ecosystem could not only prove more interesting but in the longer run the better risk-return proposition.

Just as Bakkt could end up being welcoming to the crypto world beyond bitcoin, similarly it is not holding back in blue sky ambition, as revealed in its choice of partners.

Teaming up with Microsoft is smart. The software giant has recently brought Ethereum to its suite of Azure cloud tools and services. Indeed, co-founder of Ethereum Vitalik Buterin made an appearance on stage at this year’s Microsoft Developer conference.

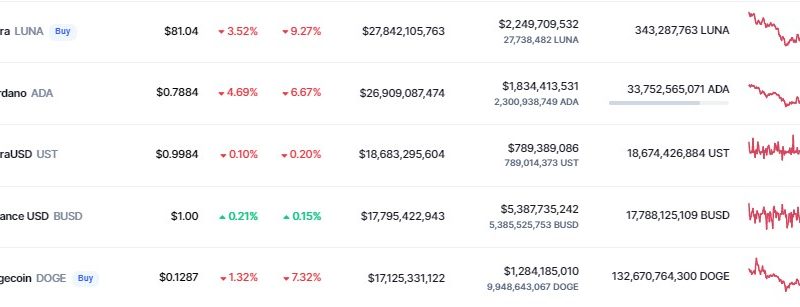

Ethereum, along with the rest of the altcoin pack, has been underperforming bitcoin since April. The price gap between bitcoin and Ether has been widening, as seen in the chart below, but perhaps a change s coming.

Ethereum 2.0 roadmap intersects with Bakkt – not priced in by market

Like bitcoin, Ethereum has its governance issues, but at least in Ethereum’s case there is now a way forward to Ethereum 2.0. Bitcoin core devs have got tech changes coming but they are more piecemeal and incremental, with an overall consensus roadmap still lacking. The Ethereum community on the other hand has mapped out a route to a scaled future.

But the market has become accustomed to viewing all Ethereum roadmap updates as just more noise. That’s fair enough given the chaotic progress that is the curse of network governance, but in the battle of the Ethereum rivals none have come close to challenging Ethereum’s leading position in dapps.

That is important because Bakkt could give the Ethereum 2.0 roadmap the sort of strategic adoption lift that could permanently set it apart from the dapp platform opposition.

None of this has been priced in by the market yet. It is a value that has been almost completely overlooked, perhaps not surprising with bitcoin dominance at 68.3%.

Naturally, the bitcoin futures product needs to be bedded in before Bakkt tries it hand with other cryptoassets, but even if Ethereum’s not the next to receive the futures treatment it would be a surprise.

Ethereum is the no. 1 decentralised finance platform

However, there doesn’t even have to be a futures to trade – after all Ethereum is first foremost a smart contract platform.

Ethereum has already seen one life as a platform for raising capital in the great ICO bubble. That could be coming around again, less speculatively fuelled, as Ethereum becomes the base layer for a Bakkt tokenised securities platform, for example.

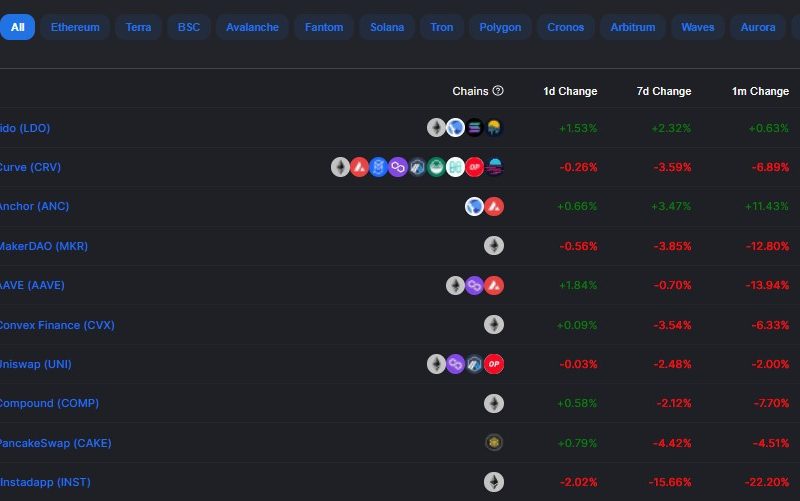

Ethereum is already the number one decentralised finance (DeFi) platform.

A Binance Research report published in June this year highlights the already existing dominance of Ethereum in the DeFi sector, which it defines as:

“An ecosystem comprised of applications built on decentralized networks, permissionless blockchains, and peer-to-peer protocols for the facilitation of lending/borrowing or trading with financial instruments.”

The report goes on to note that: “Today, a large majority of DeFi protocols are being built on Ethereum. Collateral locked on Ethereum-based DeFi applications are collectively worth over USD 500 million (more than 1.5 millions of ether), as of June 5th.”

Claims that the vast majority of EOS transactions are by bots and fears that Tron and its colourful CEO Justin Sun could be losing their way, is good news for Ethereum, despite its own problems of expensive development costs and an unforgiving and unloved smart contract language in Solidity.

Eventually there will be an altcoin rally, albeit not as broad-based as seen in the past.

The performance of top altcoins continues to disappoint but when the bitcoin earthquake settles down a little, those platforms with running applications and meaningfully sized user bases will start to be noticed again.

Ethereum is sure to be first in line for inspection when the time to diversify away from bitcoin makes sense again.

The Bakkt ecosystem could become one of the vital legs of future price support for Ethereum.

ETH is up 7% over the past 24 hours, trading at $196.

The post appeared first on Ethereum World News