Intercontinental Exchange’s bitcoin derivatives arm, Bakkt, posted a fresh all-time high today. The New York-based company that started in 2018 stated that the latest record in BTC futures trading activity on its platform is a 36 percent jump from its previous all-time high. This comes after Bakkt clocked almost $150 million in bitcoin futures volumes last month.

New ATH For Bakkt Bitcoin Futures: 15,955 ($200M+) Contracts Traded

A few hours ago, Bakkt took to it’s Twitter to announce the news of its Bitcoin futures market hitting a new all-time high.

Another record day in the books for our physically delivered futures:

15,955 Bakkt Bitcoin Futures were traded today, representing over $200M of volume and a 36% increase from our previous all-time high 📈

— Bakkt (@Bakkt) September 15, 2020

According to the data shared by the firm, 15955 BTC futures contracts worth over $200 million changed hands. This latest achievement represents a 36 percent increase over the last recorded ATH.

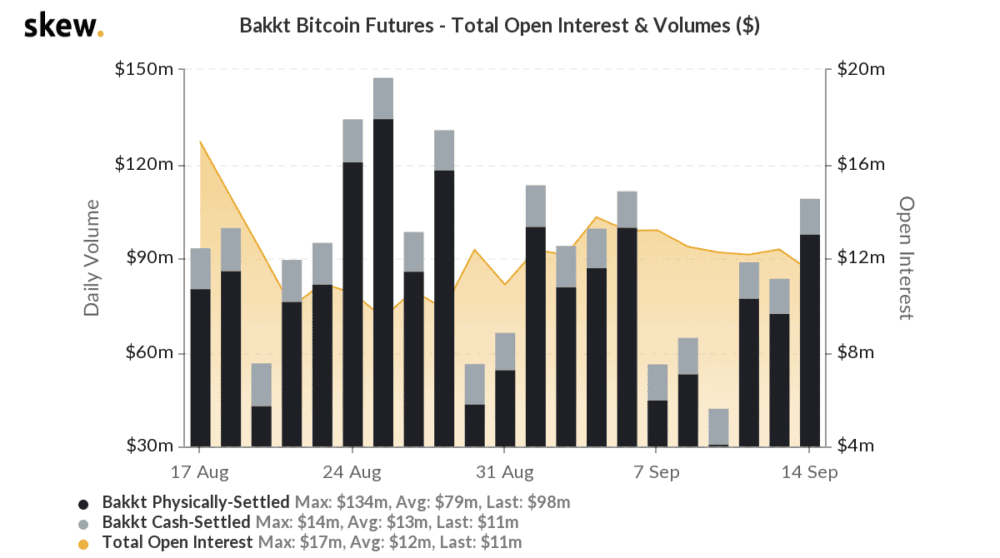

Data from crypto market analytics provider Skew shows that open interest for bitcoin futures trading on Bakkt moved up towards $16 million from $11 million clocked last Friday.

This is clearly a milestone for the platform that largely caters to bitcoin investment interests of institutional investors. Also, it comes on the heels of BTC futures trading volumes doing rounds around the $150 million number on Bakkt on August 25 (almost a month back).

Overall BTC Derivatives Market Is Bullish

As reported by CryptoPotato yesterday, numbers point to a surging bullishness in the bitcoin futures and options markets. Futures traders on BitMEX have flipped long. Buy liquidations/long bets for XBTUSD topped $20 million.

After dipping below the $4 billion on September 4, open interest for Bitcoin futures reclaimed the $4 billion level back again on Monday. The indicator has plateaued since then. Daily futures trading volumes surged to $11 billion on Monday, moved to $12 billion yesterday after dropping down drastically from $16 billion to $8 billion on the 9th.

Apart from bullish futures trading activity, positive sentiment also exists amongst Bitcoin options traders. Amongst all option contracts that traded on Monday, the most active ones were those ‘calling’ for Bitcoin (BTC) price, hitting a maximum of $36,000 by the end of the year. Options traders also placed long bets on $28,000 and $32,000 BTC prices, respectively.

Also, a total of 2000 Bitcoin options contracts that traded Monday on CME called for BTC prices to hit $11,500, $12,000, and $12,500 by October 20.

The news didn’t have much of an effect on bitcoin price, which is just a couple hundred dollars shy of touching the $11,000 price point again. However, BTC is still up 6 percent on the week and looks primed for a rally.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato