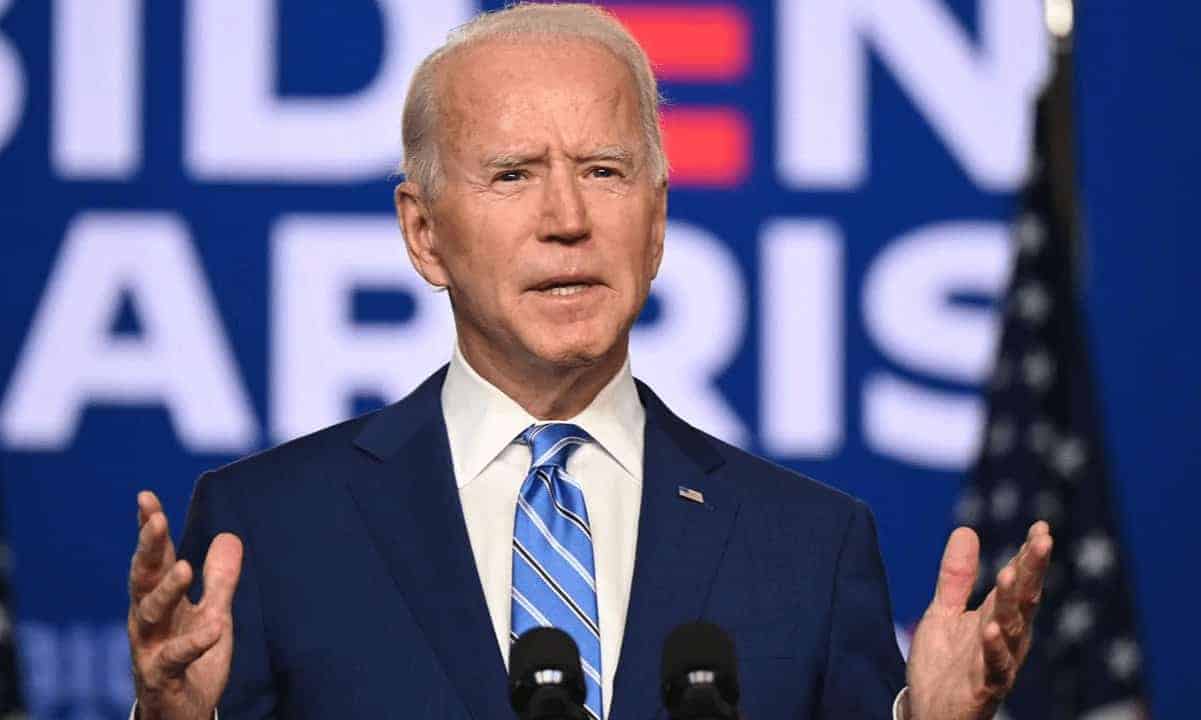

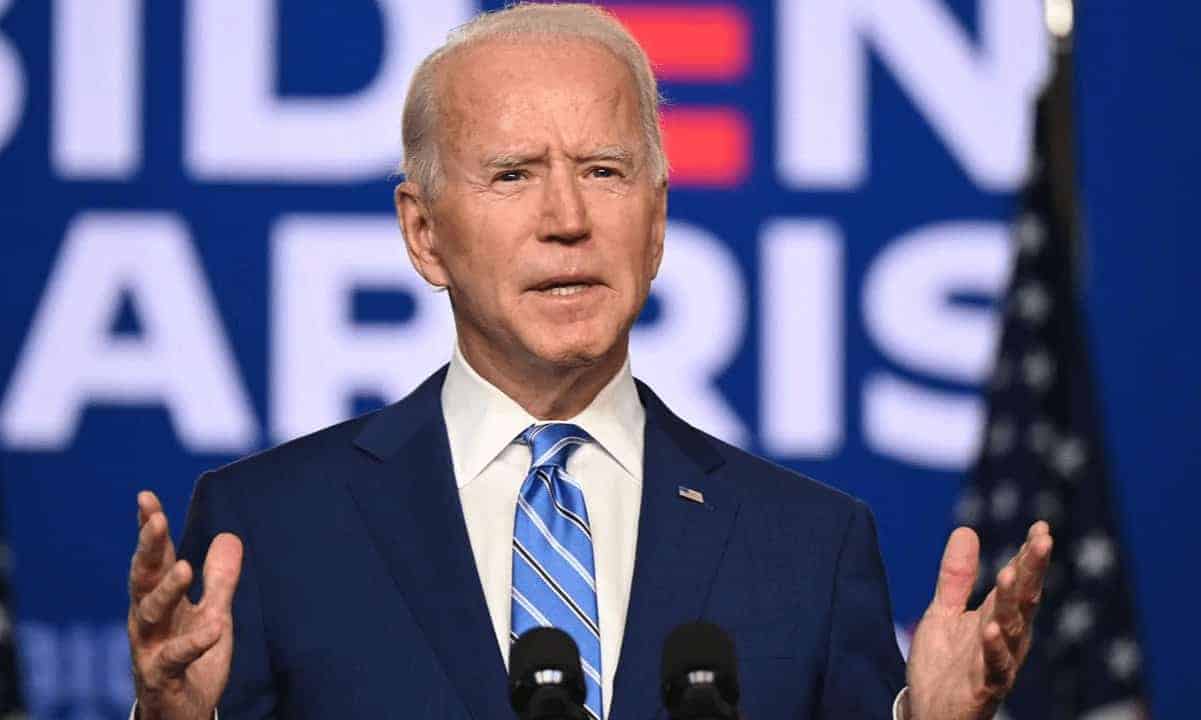

.A Republican-led effort to free American banks to provide crypto custody services has been shut down by the Democrat-led White House.

On Wednesday, the House of Representatives discussed and prepared to vote on House Resolution 109 (H.J. Res. 109), which would strike down prior accounting guidance from regulators to banks planning to offer the service to customers.

Hours before the vote began, however, the Biden Administration stated its intention to veto the resolution if it manages to pass through the House and Senate.

A Major Blow To US Crypto Banking

As explained in the White House’s statement, Staff Accounting Bulletin (SAB) 121 – the guidance that Republicans intend to invalidate – reflects the views of Securities and Exchange Commission (SEC) staff regarding the accounting obligations of firms safeguarding customers’ crypto assets.

“H.J. Res.109 would disrupt the SEC’s work to protect investors in crypto-asset markets and to safeguard the broader financial system,” wrote the Office of the President. “If the President were presented with H.J. Res. 109, he would veto it.”

For any act to become law, it must normally pass through both the House and Senate with a majority vote, and then be approved by the President. Should the President choose to veto, however, the act can only become law if it passes with a two-thirds majority vote in both chambers.

Wednesday’s resolution passed through the House, but only with 55% of the vote. All Republicans (207) voted in favor, alongside 26 Democrats.

Understanding SAB 121

According to the act’s sponsor, Mike Flood (R-Nebraska), the SEC did not consult the appropriate Federal banking agencies before publishing SAB 121, taking shortcuts around the traditional rulemaking process.

Indeed, he and other critics describe the bulletin as a disguised “rule” rather than “guidance,” claiming it is prohibitive to banks aiming to realistically launch crypto custody services.

“SAB 121 requires financial institutions and firms that are safeguarding their customers’ digital assets to hold those assets on their balance sheet, making it cost prohibitive to do so,” said Financial Services Committee chair Patrick McHenry in a press release Wednesday afternoon.

“This resolution will allow consumers to hold their digital assets in one of the safest way possible—through highly regulated banks and other financial institutions,” he continued.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 for CryptoPotato readers at Bybit: Use this link to register and open a $500 BTC-USDT position on Bybit Exchange for free!

The post appeared first on CryptoPotato