Bitcoin has stayed in a relatively tight range between $10,500 and $10,600.

Most large-cap altcoins performed similarly, except for Binance Coin. After a 9% increase for the week, BNB now occupies the 5th spot in terms of total market cap.

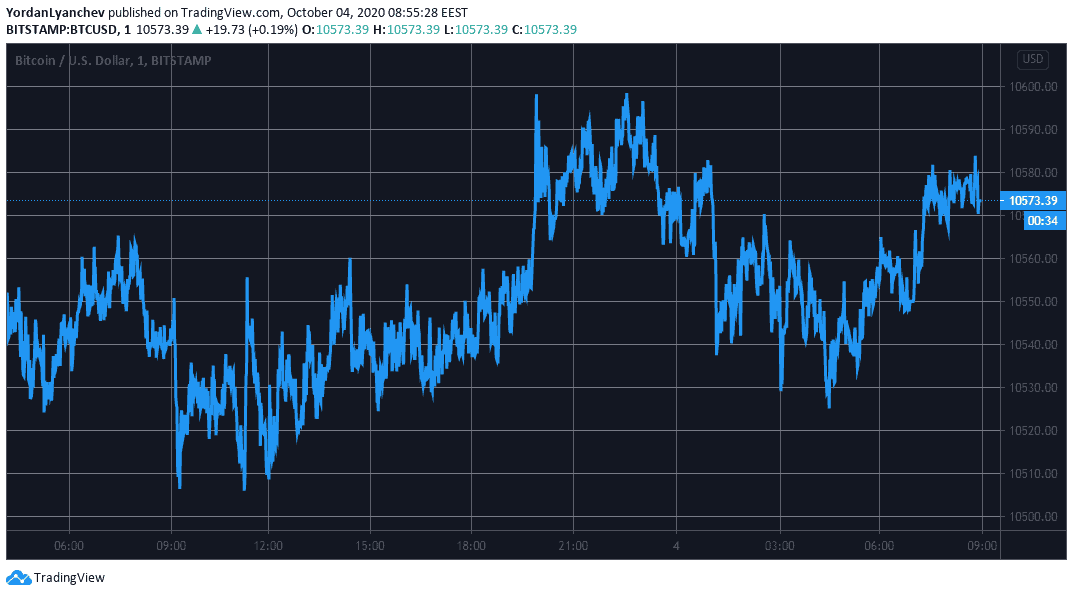

Bitcoin Remains In A Tight Range

Following the recent price declines from Friday and early Saturday, Bitcoin calmed down. Since yesterday, BTC dipped to a low of around $10,500 and jumped towards the intraday high of $10,600.

In the past 24 hours, BTC has stayed within that range. At the time of this writing, the primary cryptocurrency trades near the upper line at $10,570.

Despite Bitcoin’s stable price stance now, it’s worth mentioning the US stock futures. As reported yesterday, US President Trump was hospitalized shortly after Wall Street closed on Friday, and the news couldn’t impact the prices.

Similar events could easily drive more uncertainty in the markets, and catalyze price declines. As such, given Bitcoin’s recent increased correlation with the US stock indexes, the cryptocurrency could also be heading towards a price slump later today.

BNB To #5, Litecoin Back In The Top 10

Most of the larger-cap alternative coins have copied BTC’s 24-hour performance and stayed calm.

After insignificant movements, Ethereum is still beneath $350, Ripple trades at $0.233, Chainlink ($9.3), and Crypto.com Coin is below $0.15.

Nevertheless, the top 10 has seen two rotations. After a few weeks of hiatus, Litecoin has returned to the 10th spot due to a minor 1% increase.

The native cryptocurrency of the leading exchange Binance has increased by 4%, and BNB has surpassed Bitcoin Cash (-0.5%) for the 5th spot. On a macro scale, Binance Coin has surged by over 50% in a month.

PumaPay has doubled-down on its impressive price performance and has skyrocketed by another 60%. PMA is the most notable gainer in the past 24 hours and trades at $0.002.

Celsius follows with a 14% increase, THETA (11%), Energy Web Token (7%), and Hyperion (6%) are next.

Several tokens are deep in the red. Yearn.Finance has dropped by 16%, SushiSwap by 14%, and The Midas Touch Gold by 13%.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato