Disclaimer: The following price prediction should not be taken as investment advice as it is the opinion of the writer.

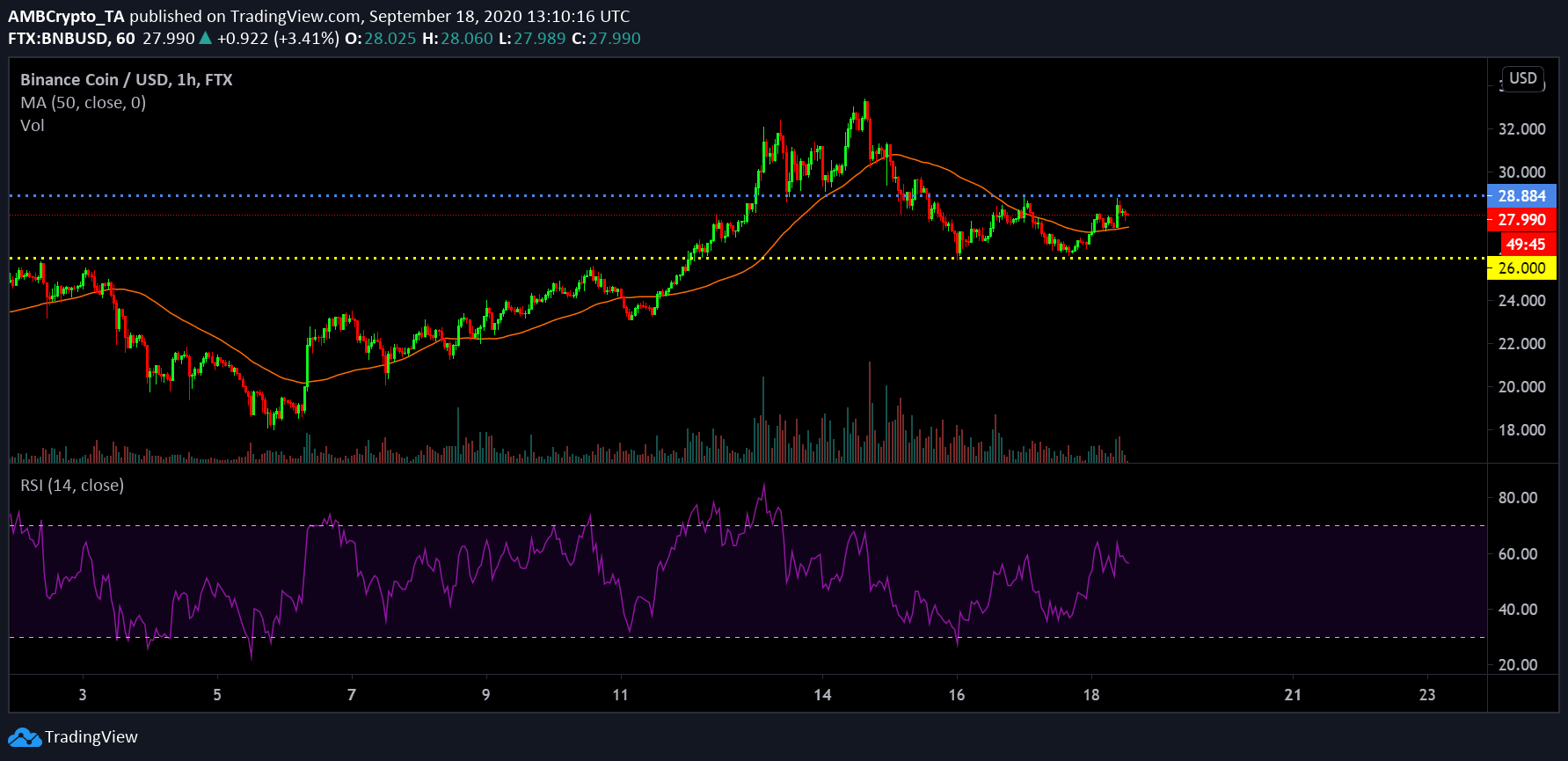

Just like Bitcoin, Binance Coin has been holding its own at the top of the recovery curve over the past week. Without undergoing a significant drop, Binance Coin has retraced from the support at $26 but failed to attain a position above $29. With sideways movement pretty prominent in the chart, Binance Coin registered a market cap of 4.04 billion with a trading volume of $724 million over the past day.

Binance Coin 1-hour chart

After clocking in a high on 14th September at $32, Binance Coin depreciated below the $30 range and dropped down to $26 within the next 24-hours. Although a major bounceback was not expected, the asset moved to re-test resistance at $29 yet again over the past week but another correction down to $26 was observed.

The asset is currently near $29 again but undergoing another move downwards. Such volatility is currently making it impossible to pinpoint a definite trend but the larger narrative is possibly pushing it towards a bearish chart. With the volume cutting short at a higher end of the valuation and RSI hitting close proximity to the over-bought position, the resistance at $29 is likely to hold for the time being.

Binance Coin 30-min chart

To trader under a risk-free scenario, a shorting position is feasible by keeping at an entry position at $28.03. Keeping an entry at $28 meant keeping the doors open for a recovery which may necessarily take place after receiving support from the 50-Moving Average. However, a stop loss at $30 should be safe enough as it is unlikely to be breached in the next few days due to the sell-side pressure.

Rounding up a Risk/Reward Ratio of 2.36x, a taking profit position can be placed at $25.70, in line with the support indicated by the Fibonacci Retracement lines. Awesome Oscillator suggested the momentum is yet to pick up in the charts, with the bears currently accounting for the slightest of advantage.

The post appeared first on AMBCrypto