Leading cryptocurrency exchange Binance has completed its Q4 2019 burn of the Binance coin (BNB). It was the 10th quarterly token burn the exchange has done since the launch of the BNB in July 2017.

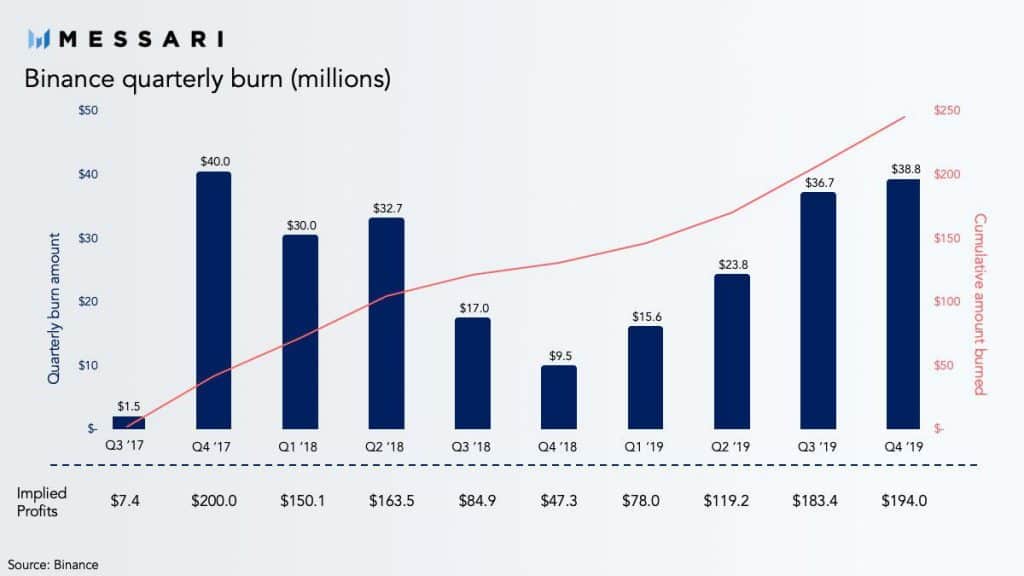

The event, which took place during the weekend, saw a total of 2.2 million BNB worth more than $38 million destroyed. Although the figure represents a mere 1.1% of the total supply of BNB, it is Binance’s second and third-biggest burn in terms of USD and BNB, respectively.

What Is A Token Burn?

Although token burn is a common word in the cryptocurrency space, not very many have a clear understanding of what it means.

Token burn refers to an intentional effort used by token creators to reduce the circulating supply of their tokens. This is done through the permanent destruction or removal of a certain amount of the coin from the total amount that will ever exist. This mechanism is majorly used for deflationary purposes.

Binance, in its whitepaper, promised to burn 20% of its quarterly profit, until half of the initial 200 million total supply of the BNB token has been taken out. The previous one was in October, and the exchange burned $36.7 worth of BNB.

The numbers imply that Binance made a profit of $194 million in the last quarter of 2019, as shown in the chart below, which is just $6 million shy of what the company made in the bull run of 2017.

Binance Token Burns. Source: Messari.io

What’s Behind The Increased Profit?

Aside from being the largest crypto exchange in the world by trade volume, Binance is arguably one of the most prominent builders in the crypto space. The exchange is always seeking new ways to expand its service by establishing new partnerships and releasing new features and products for its customers across the globe.

Changpeng Zhao, CEO of Binance, revealed that one of their products – Binance Futures – was mainly responsible for the surge in their profit margin over the last quarter. Binance Futures was launched in September, and it allows traders to enjoy up to 125x leverage on specific trading pairs.

BNB Overview: Positive

Many believe that a token burn would result in a price rally in the value of an asset since the total supply has been reduced. However, BNB, in the past, failed to react decisively. The overall supply of the cryptocurrency now stands at 187,536,713 BNB, leaving the company with 87,536,713 BNB more to burn, according to the whitepaper. With the rest of the crypto market in the green today, BNB is currently trading at $17.53, a 2.20% increase on the daily chart.

The post appeared first on CryptoPotato