Every market has it’s defining entities. In the cryptocurrency market, none are more sought after than Binance. Founded in 2017, the exchange traversed the world before settling in the Mediterranean island of Malta, and while 2018 was a year to forget for the market and the exchange, 2019 was a year to BUIDL.

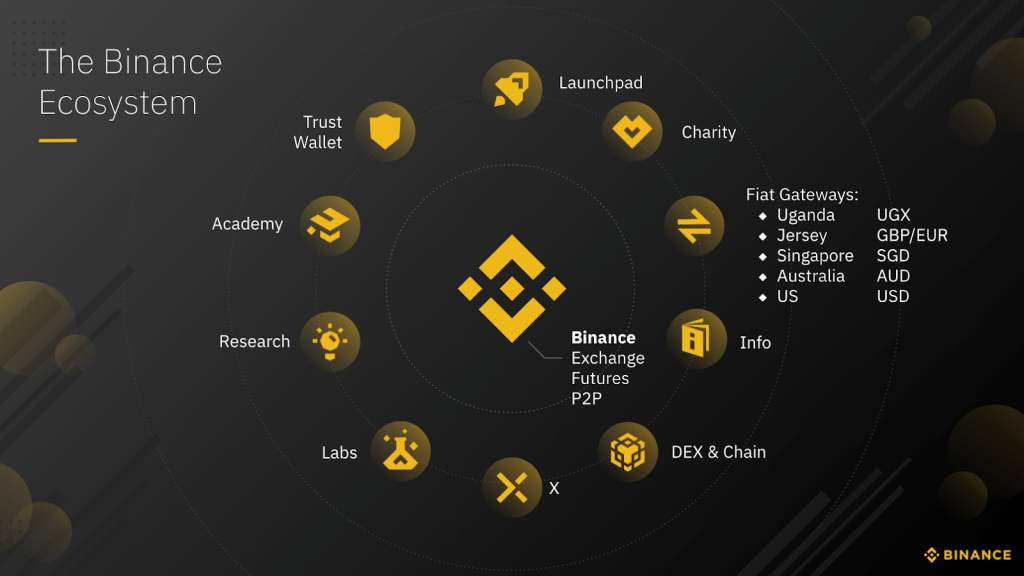

Binance structured their ecosystem to cover every aspect of the crypto-world, right from the very basic exchange functions to giving back to the community. The eight facets of their ecosystem comprise – Exchange, Academy, Research, Launchpad, Charity Foundation, Trust Wallet, Labs, DEX.

Token-surge

Binance saw their own token, BNB, as well as other tokens rice in sync, owing to the Binance LaunchPad, their IEO platform.

The year of token sales and coin-offerings evolved into the year of exchange-offerings, and the Binance Launchpad had a big part in it. Right off the bat, in January, the token sale of BitTorrent was extinguished in less than 15 minutes. Changpeng Zhao, the CEO of Binance described the demand for the BTT tokens as “astronomical,” with the offering generating $7.2 million from the sale of just under 60 billion tokens.

Binance tied their own token Binance Coin [BNB] to the token launch, with an update to their IEO process. In March the exchange stated that token-sales on the Binance Launchpad would be done via a “lottery system,” based on BNB holdings rather than a first-come basis. Hence, with every token-sale, there was a parallel increase in the price of BNB.

During the first six months of the year, as Bitcoin posted a massive 250 percent price surge peaking at $13,800, BNB surged by over 600 percent, trading at just under $40 in June 2018. Among the large-cap coins, BNB saw the second-highest YTD surge, behind ChainLink [LINK].

Source: BNB/USD on TradingView

This system incentivized users to buy-and-hold BNB prior to a token sale. Inevitably, BNB saw price surges during the token-sales of Matic Network [MATIC], Harmony [ONE], Elrond [ERD] and WINk [WIN]. In July, Binance updated their “holding period,” to a variable amount, prior to their announcement of said project.

Shrewd investors were ‘gaming the system,’ buying and selling prior to a sale, but with the update “long-term BNB hodlers,” would be benefitted said Bobby Ong, the co-founder of CoinGecko, a cryptocurrency data aggregator. He told AMBCrypto,

“The incentive is now to hold for long period of time to get a chance to get lottery tickets for future Binance Launchpad IEOs.”

BNB saw its value surge, in the first half of the year – as both utility and investment. Speaking to AMBCrypto, Yi He, the CMO of the exchange stated,

“We are excited to see the growing number of BNB holders and liquidity. To date, there are over 1000,000 on-chain BNB (BEP token) addresses and over 300,000 BNB ERC-20 addresses; the BNB on-chain transactions have exceeded 28 million times. BNB’s utilities are the essential fuel of BNB’s value. “

King-maker

In the second quarter of the year as Bitcoin began its run-up to five-figures, Binance was caught in the middle of a storm. Bitcoin SV [BSV], the infamous hardfork-of-a-hardfork spawned in November 2018, was in the crosshairs of many exchanges, following the antics of its founder and self-proclaimed Bitcoin creator, Craig Wright.

A slew of exchanges including Binance and Kraken delisted BSV, with CZ even calling Wright a “fraud.” Zhao attributed this to be the “right thing,”and even attributed the late-2018 drop to the “fork,” that birthed BSV.

Despite many backing Binance’s move, and other exchanges following-suit, this led to a crucial debate about the power that an exchange the size of Binance had. Some referred to the move as Binance adhering to the community’s consensus backed by the #WeAreAllHoldonaut movement, others questioned if they were ‘Kingmakers.’

Coinmetrics’ co-founder NicCarter stated,

to be clear, Binance was absolutely right to delist BSV because a tiny minority hashrate coin is incredibly insecure and liable to be exploited. but it also does evidence how much power exchanges have

— nic carter (@nic__carter) April 15, 2019

Hack-Attack

The old adage ‘you’re never safe,’ is always relevant for the cryptocurrency industry. After a slew of exchange hacks, 2019 saw the biggest breach of the year when Bitcoins worth $40 million was stolen from Binance. On May 7, the exchange stated that hackers stole 7,000 BTC, 2 percent of their total BTC holdings from the exchange’s hot wallet.

Binance added that the SAFU [Security Asset Fund for Users] fund will be used to compensate the users affected. Once again, Binance was caught in a heated debate on crypto-twitter, when CZ, based on a suggestion, floated the idea of a “re-org” i.e. a reorganisation of the Bitcoin blockchain by creating a ‘double-spend’ scenario and cancelling the ‘hack-transaction.’ The rollback was met with stern criticism, with many claiming it would go against the “immutability” principle of Bitcoin, and have further long term consequences.

Acknowledging the controversial-nature of the re-org, CZ himself stated,

cons: 1 we may damage credibility of BTC, 2 we may cause a split in both the bitcoin network and community. Both of these damages seems to out-weight $40m revenge. 3 the hackers did demonstrate certain weak points in our design and user confusion, that was not obvious before.

— CZ Binance (@cz_binance) May 8, 2019

Problems and Paradise

With the ‘kingmaker,’ and ‘re-org’ debates out of the way, Binance started steamrolling ahead. Following on from the announcement of the Binance decentralized exchange on their native-Blockchain, the Binance Chain, back in April, the exchange added Trust Wallet support in June. Binance Chain saw yet another addition in the same month, with the exchange unveiling the Bitcoin-pegged token, BTCB. But there was more to come.

Binance.US

A few days prior to the Facebook Libra launch, Binance made its presence in the US known. On June 14, the exchange announced its partnership with BAM Trading Services to enter the United States under “BinanceUS,” registered with the Financial Crimes Enforcement Network [FinCEN], and officially began operations in September. This news came immediately after the exchange, in an updated Terms of Service [ToS], stated that its services cannot be availed by US residents.

This switch was done so that US-residents would shift to Binance.US from Binance.com. Restrictions were evident on the short-term, but CZ was fine playing the ‘long-game’ in this endeavor,

There will be a few restrictions on https://t.co/9rMMAmtCxH accompanying this. But some short term pains may be necessary for long term gains. And we always work hard to turn every short term pain into a long term gain. https://t.co/gl1M1cwPYB

— CZ Binance (@cz_binance) June 14, 2019

In just a few months of active operations Yi He described the performance of Binance.US as “stunning.”

On the Margin

Margin trading was soon introduced on July 11, with the exchange providing a x3 leverage to begin with. However, KYC will have to be adhered to, in addition to two-factor authentication [2FA]. The cryptocurrencies that were allowed to be traded on margin were Bitcoin, Ethereum, XRP, Binance Coin, Tron and USDT.

That’s my Picture!

In August, yet another breach threatened the integrity of the exchange, this time targeting data, not funds. On August 7, Zhao stated that the “KYC leak,” was FUD, which was elaborated upon in an official statement, which read,

“We would like to inform you that an unidentified individual has threatened and harassed us, demanding 300 BTC in exchange for withholding 10,000 photos that bear similarity to Binance KYC data.”

Name the Stars

Going on the theme of stablecoins and star-signs, Binance unveiled a stablecoins project, weeks after Facebook’s Libra stablecoin was announced. Following Libra’s and Gemini’s astronomical footsteps, Binance rolled out Venus.

While Libra primed to be a stablecoin backed by fiat and government deposits, Venus claimed to be a “open blockchain project,” to build “alliances and partnerships with governments, [and] corporations,” so that “localised stablecoin,” could be developed. With the trend of global-stablecoins developing, Binance decided on dipping its toes in the cross-border payment network for “secure operations of new stablecoins.”

Look to the Future

With Futures trading ramping-up both on the regulated and unregulated side, Binance decided to finally throw its hat in the ring. Following a hint from CZ during an AMA, in September, the exchange announced the launch of two Futures Testnet Platforms – Futures A and Futures B. This trading competition took place between September 3 to September 8, with users choosing their preferred platform.

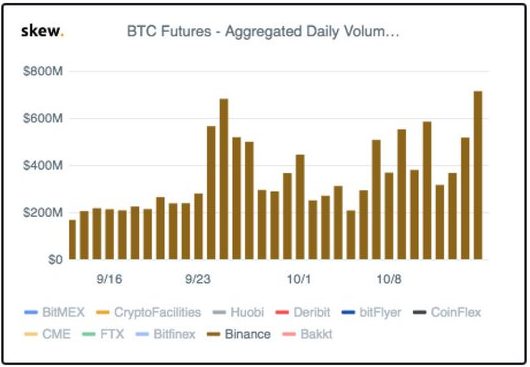

During the initial invite-only trading phase, the Futures platform saw over $150 million in daily trading volume in BTC/USDT Futures. Fast-forward to mid-October, and the derivatives platform saw over $700 million in daily volume, a new ATH, at the time. Skew markets noted,

Source: Skew Markets, Twitter

A few days after the surge in volume, Binance upped the leverage on their BTC/USDT contracts to 125x using a “sophisticated risk engine and liquidation model,” for leveraged trading.

India on the Map

In November, Binance took another scalp off the cryptocurrency market, by acquiring Indian cryptocurrency exchange WazirX. Seen as a major breakthrough, owing to the gravity of the market-players and the market itself, this acquisition was met with excitement throughout the community.

Many crypto-exchanges in India have shut-up-shop owing to the anti-crypto regulatory atmosphere, but some persisted. From Binance’s point of view this acquisition gave them direct entry into the Indian market, with its growing young-population, and also saw them include the Indian rupee [INR] on their fiat-to-crypto on-ramps. Yi He referred to India as a “strategic market for Binance.”

Binance will not merely stop their Indian-push with WazirX, they plan on bringing in Indian talents for their other projects as well. Li told AMBCrypto,

“India has many excellent tech talents; we’ve seen many Indian tech developers in Silicon Valley, and hopefully there will be more Indian talents joining Binance in the future.”

Challenges and Competitors

Cryptocurrency exchanges are never in the clear, security, regulations or credibility, present constant challenges. Yi He stated that one of the key issues of the exchange is “communication.”

With growth and development the systems of “transparent communication,” is often stifled and has led to “unnecessary troubles.” Simplicity is key, she said,

“We still hope to keep our efficiency in communication, instead of using some ambiguous diplomatic languages.”

On the competition front, both spot and futures considered, Yi He highlighted Bitfinex, Poloniex, and BitMEX as key competitors due to their “contributions to growing and educating the industry.”

Finishing Touch

Under one umbrella, Binance has managed to include a traditional exchange, futures platform, token-issuances, margin trading, a native coin, and a stablecoin project. The structure for 2020 is set, and Binance has laid the foundation.

Binance has set out to BUIDL in 2019 and BUIDL they did.

The post appeared first on AMBCrypto