Binance is the world’s largest cryptocurrency exchange by means of daily trading volumes. In the few short years since its launch, the venue went on to become a leading company in the industry.

In fact, launching coins up for trade on the exchange has created the so-called “Binance Effect.” In short, when a cryptocurrency is selected and launched for trading on the platform, its price usually undergoes a substantial surge.

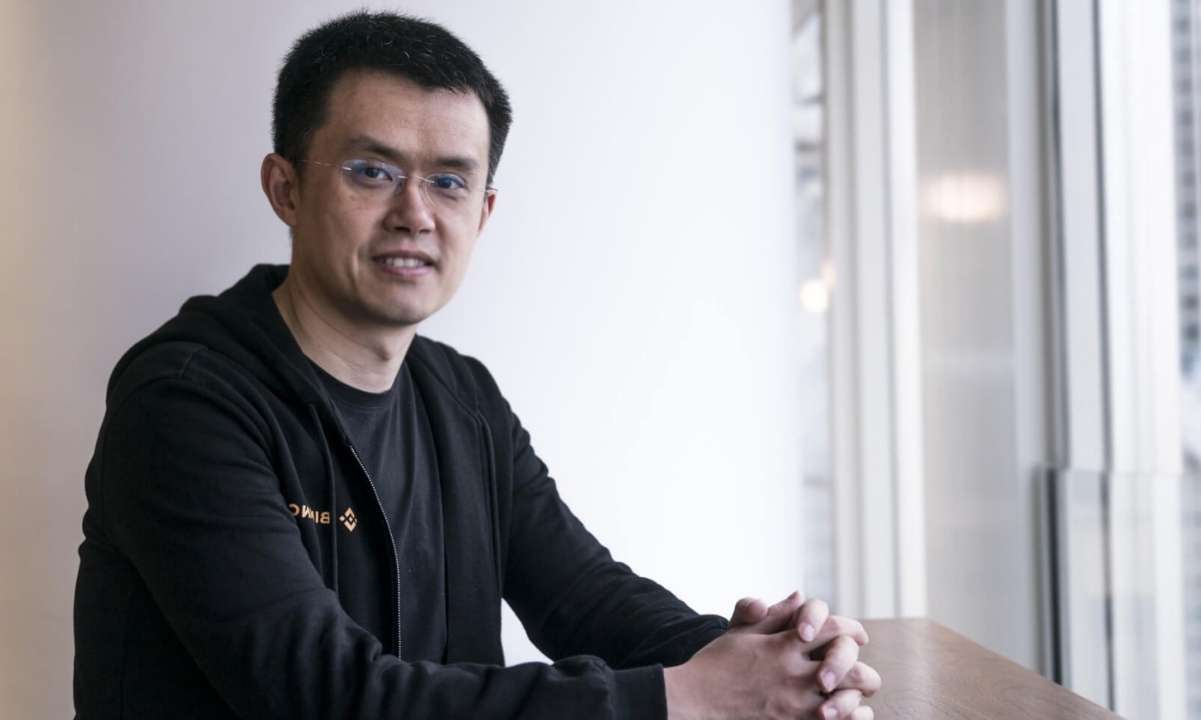

Now, the CEO of Binance, Changpeng Zhao, has hinted that it may start delisting low-volume coins.

Low-Volume Coins May Kiss Binance Goodbye

In an interesting Twitter thread, a popular cryptocurrency analyst and trader RookieXBT suggested delisting all coins on Binance that “do less than 10 BTC of daily volume.”

Expectedly or not, the CEO of the exchange engaged in the thread, providing a hint that they might consider doing so.

“I think it is a good idea. If you are on Binance and still have no volume, then…” – Said CZ, perhaps hinting that there’s something inherently wrong with coins listed on Binance and failing to generate big daily volume.

Naturally, there are two sides to this debate. Some users think that the merits of a coin shouldn’t be valued based on the volumes it generates on cryptocurrency exchanges. People argue that they hold a coin for the long-term and don’t really care about the daily volume.

This is most definitely true. The inherent merits of a cryptocurrency are most definitely not associated with it being listed on a certain exchange, be it Binance. So, a logical question pops – why would someone care if the coin is listed or not, presuming they are “in it for the technology”? And this is where things take a twist.

The Other Side of the Story

At this point, it becomes rather clear that this particular narrative doesn’t stand on solid ground because people are obviously concerned about the price, perhaps even more so than the technology itself.

If an investor is holding a cryptocurrency for the long run, it being listed on Binance shouldn’t make a difference. But that’s usually not the case – people are rarely “in it for the technology” despite what they might claim.

The main concern is that if Binance decides to delist low-volume cryptocurrencies en-masse, this might cause a larger upset in the market because of the “Binance Effect.”

As we mentioned before, when a cryptocurrency is listed on Binance, it usually goes through a substantial increase. However, the opposite is also true. Last year, the exchange delisted Bitcoin SV, and it tanked more than 10% on the news. That’s just one example.

In any case, there’s no formal confirmation, and it remains interesting to see whether the exchange will really start delisting coins based on low volumes.

Featured image courtesy of Medium

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato