In the past 24 hours, Binance has set a new record as the market sentiment shifts and Bitcoin (BTC) the world’s largest digital asset, hit its all-time high.

Binance’s $8.3 billion Open Positions

Amid this bullish market sentiment, the on-chain analytics firm CryptoQuant shared a post on X (Previously Twitter) that the net open interest (OI) on Binance the world’s largest cryptocurrency has skyrocketed by 12.24% and reached an all-time high of $8.3 billion.

Additionally, the overall derivative exchanges have reached an all-time high of $23.3 billion. This suggests that Binance alone is contributing a significant 35% of all global future positions. Meanwhile, monitoring only Binance’s on-chain data can give thorough insights into market trends and traders’ sentiment.

Risk of Open Interest and Market Volatility

Despite Binance’s and overall derivative exchanges’ new achievements, the risk of volatility in the market could potentially rise. In a report on CryptoQuant a crypto analyst noted,

“A sudden increase in Open Interest (anything above 3% within 24 hours is significant) often hints at upcoming liquidations in the futures market.”

The analyst noted that whenever open interest increases it suggests that lots of long and short positions are open in the market and have not yet been closed. If volatility in the market rises the pressure on these open positions may increase if volatility moves against them, resulting in either traders closing their positions or facing liquidation to prevent further losses.

The notable positions opened in the market over the past 24 hours suggest a potential liquidation in the coming days.

Currently, Bitcoin is trading near $75,900 and has experienced a price surge of over 9% over the past 24 hours. This notable surge has liquidated $393.25 million in short positions.

Major Liquidation Levels

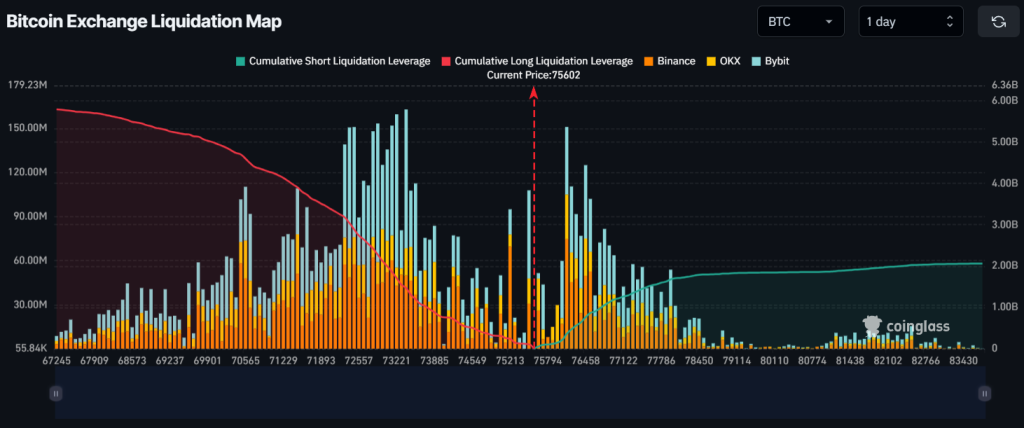

As of now, the major liquidation levels are at $73,387 on the lower side and $76,126 on the upper side, with traders over-leveraged at these levels, according to Coinglass data.

If the sentiment remains unchanged and the price rises to the $76,126 level, nearly $358.73 million of short positions will be liquidated. Conversely, if the sentiment shifts and the price declines to the $73,387 level, approximately $1.5 billion worth of long positions will be liquidated.

This liquidation data shows that bulls are currently very active and believe the asset price won’t fall below the $73,400 level.

The post appeared first on Coinpedia