Binance continued its growth this year by completing a strategic investment in the cryptocurrency derivatives exchange FTX. By working together and delivering mutually beneficial products, the community wonders if both companies can actually be disrupting the dominance established by other exchanges on the futures market.

Binance Invests In FTX

The largest cryptocurrency exchange by volume, Binance, announced yesterday its strategic investment in the crypto derivatives exchange FTX. Both companies will reportedly join forces to develop the cryptocurrency ecosystem further. According to the post, Binance has taken a long-term position in the FTX Token, while the derivatives exchange returns the favor by helping to build out the liquidity and institutional product offerings.

Binance’s CEO, Changpeng Zhao, said that he believes this partnership will help both companies and that FTX is on its way to becoming a larger player in the cryptocurrency derivatives market:

The FTX team has built an innovative crypto trading platform with stunning growth. With their backgrounds as professional traders, we see quite a bit ourselves in the FTX team and believe in their potential in becoming a major player in the crypto derivatives markets. We are pleased to have an excellent partner joining the Binance ecosystem and aim to grow the crypto market together. – Said Zhao.

A Threat To The Giants?

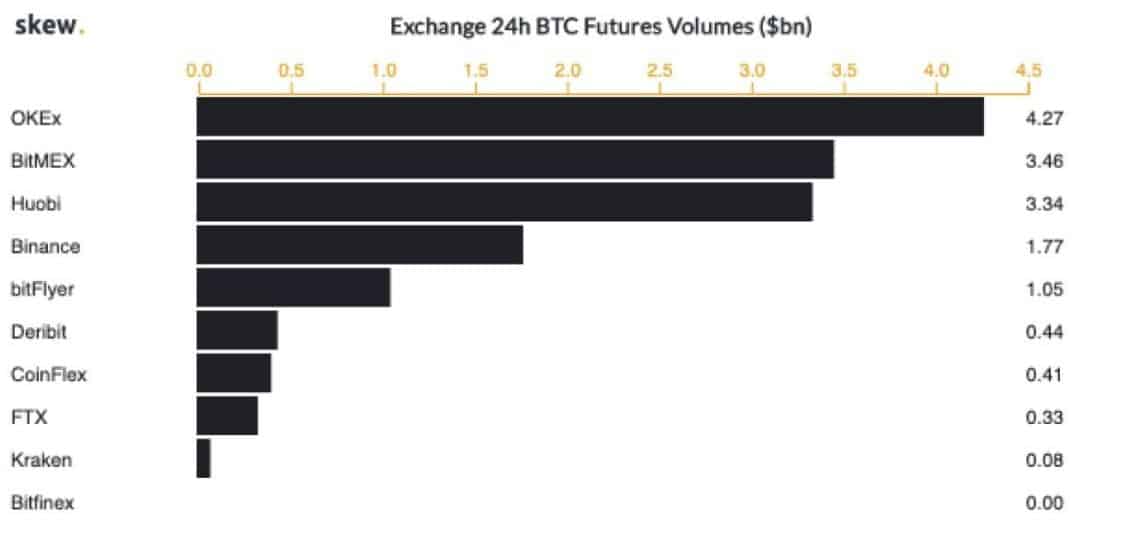

The last point that CZ brought is also what some of the community appears to be wondering about. Is it possible if, by working together, both companies can challenge the dominance from the largest cryptocurrency margin trading exchange like BitMEX, Huobi, and OKEx?

BTCFuturesVolume. Source: Skew

As it can be seen in the picture, the top three exchanges by daily trading volume from a few days ago are OKEx ($4.27 B), BitMEX ($3.46 B), and Huobi ($3.34 B). Binance’s volume reached $2.24 B, while FTX was close to $500 M, meaning that both companies seem like they have a long way to go even when we combine their volume.

However, it’s also worth noting Binance’s improvements over the last several months. As Cryptopotato reported in late October, Binance Futures noted its all-time high at the time of $850 million traded in a day, and a few weeks ago it recorded a new ATH at over $2.5 B. This shows a 3x multiplication within a few months, and the most recent partnership with FTX could deliver even more impressive results in the near future.

You might also like:

The post appeared first on CryptoPotato