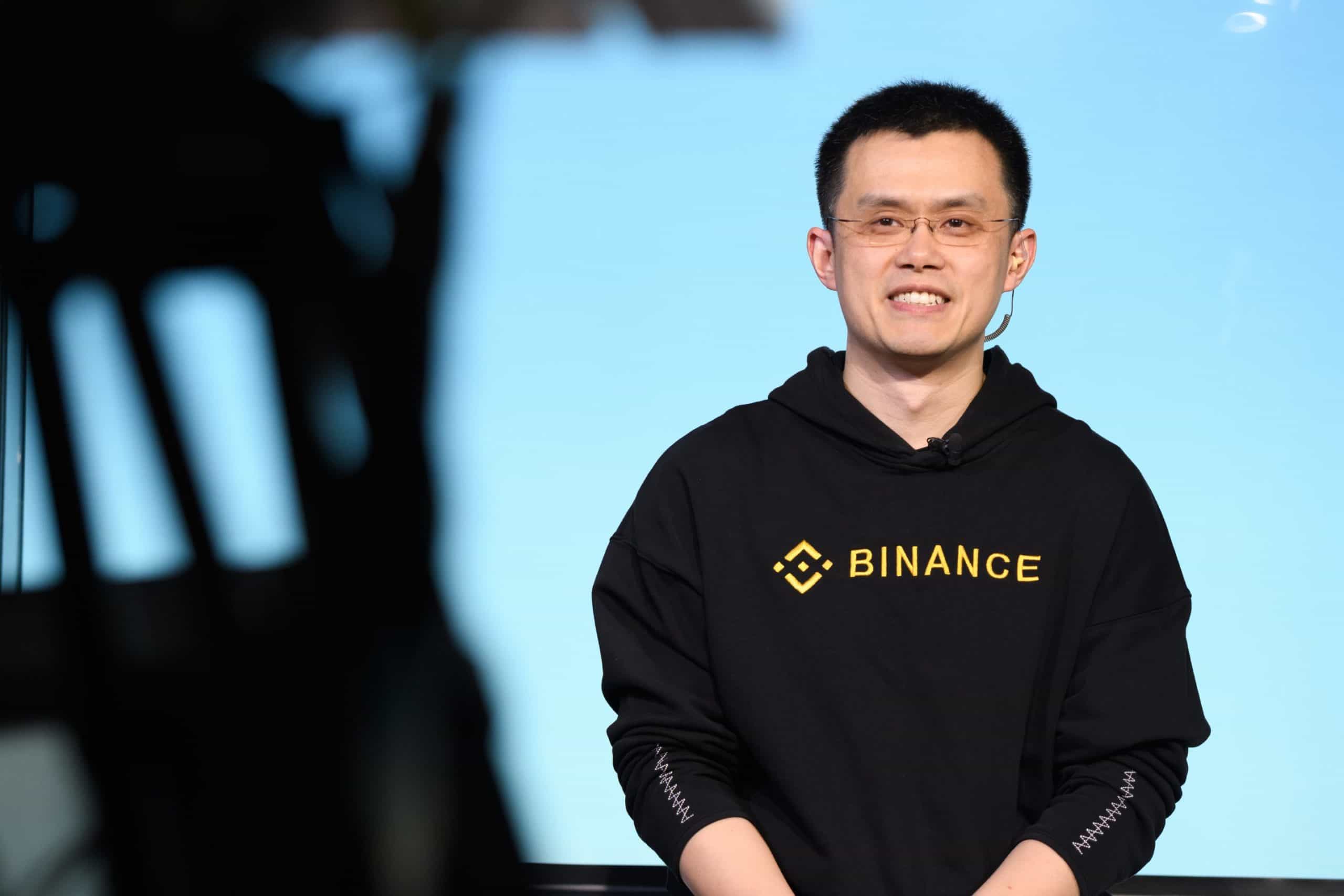

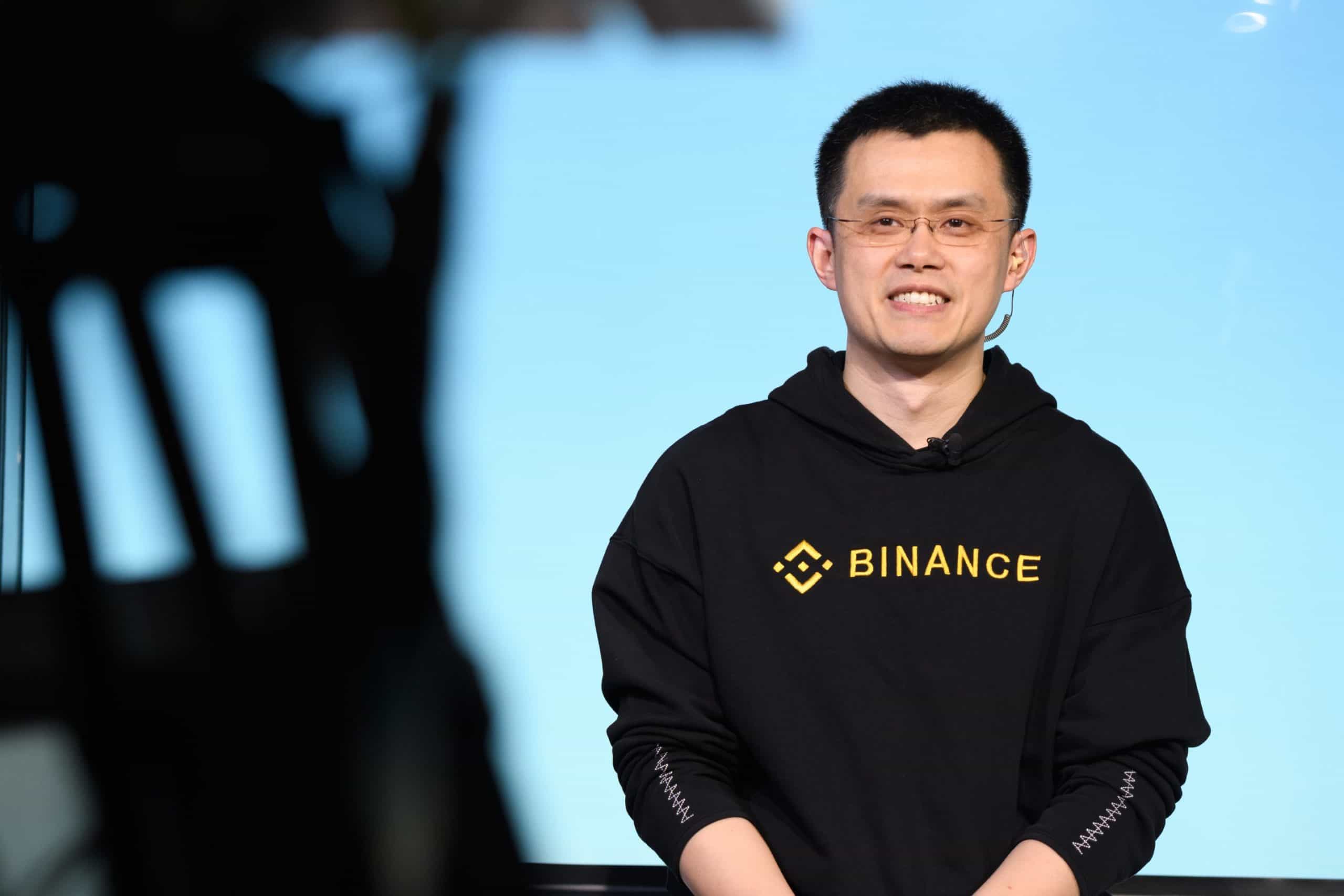

Binance’s CEO, CZ, had an ask-me-anything (AMA) session on Twitter and answered community questions, mostly related to the FTX fallout and how he thinks the industry will move forward.

In essence, CZ believes that this is a cleansing event that will eventually turn out to be a good thing. However, he still believes there will be contagion, even though he hinted that the worst might be over, at least in relation to the FTX fallout.

Short-term it is painful, but I think this is ultimately good for the industry in the long term. Blockchain technology is not going away. The industry is not going away.

One of the more interesting questions was from a user who made an argument that Binance investing in FTX gave legitimacy to the now-bankrupt exchange, which led many people to use it. He asked if CZ will consider refunding those who lost money.

Binance Shouldn’t Be Responsible for Every User’s Loss

Answering the above, CZ made it clear that there’s a fine line when it comes to responsibility and that, especially when it comes to FTX, it should be shared to some extent.

However, he made sure to say that most of the blame should fall on SBF for his fraudulent and criminal actions. Speaking on the Binance investment in FTX, he said:

ADVERTISEMENT

First of all, we exited as other investors came in. We invested quite early, and we exited quite early. Both events are very public, we didn’t hide anything. We had $500 million worth of FTT and we still hold a large part of it.

FTX users choose to use FTX on their behalf. I don’t want to create a situation where if anything bad happens to the industry, Binance has to pay for it. I want to do what’s fair, and I don’t think that’s fair to our users.

When bad things happen, if you only blame other people, you will never be successful. When the FTX issue happened, many people had their responsibilities. For example, regulators can’t prevent everything. If they want to, they will still be a bad actor.

At the same time, all of us who invested in FTX made a mistake and many of the investors were professional. Why didn’t we dsicover this problem earlier? We could look into that, but should they compensate everyone? Probably not.

Binance and Withdrawals: Business as Usual

Another question that CZ addressed was if Binance saw any massive increase in the withdrawals following the FTX collapse.

Business as usual.

We published our cold wallet addresses a few days ago. There are many third-party platforms that track them very carefully. There’s no news about siignificant withdrawals from those addresses. you guys can see that on Binance, it’s business as usual. We do see a slight increase in withdrawals, but whenever prices drop, we see this. It’s very in line with price drawowns. We haven’t seen anything out of the ordinary.

On the Question of Reserves, BUSD and BNB

Once again, CZ reiterated the importance of differentiating between the entities that issue the BUSD stablecoin. It’s not issued by Binance. It’s issued by Paxos.

When asked, the exec explained that even if something happens to Binance, users will be able to redeem their BUSD for fiat at Paxos.

He also explained that Binance doesn’t convert funds for their customers – whatever they choose to store, that’s what the exchange stores. Therefore, if all they want to buy is BUSD, that’s the only cryptocurrency they would store, he said.

What Lies Ahead?

Being careful in his wording, CZ said that he thinks the biggest hit of this cascade is through. He said that when something like this happens, it’s usually the biggest actor that falls first, and what follows is a series of smaller actors.

He said that there will be some cascading contagion effects nonetheless and that “other players with money on FTX could cause trouble.”

He also said that the BNB ecosystem is less affected and that, in regard to their portfolio companies, nobody has cried out for help yet. At the end of the day, he believes this will blow over, and “people may or may not even remember it.”

He reiterated that stronger and legitimate industry participants will become even stronger and that, ultimately, this will turn out to have a positive cleansing effect in the long term, albeit painful in the short term.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.

The post appeared first on CryptoPotato