The resurgence of the crypto rally has attracted the attention of traditional investors and market makers, as the alt season sets in. Bitcoin has been relishing during this period as the coin reported a 41% return since the beginning of 2020, while the second-largest crypto, Ethereum marked triple digits yield of 115%. According to Binance.US CEO, the climbing market might have also reacted to the positive news about Grayscale becoming a Securities and Exchange Commission [SEC] reporting company along with SEC commissioner’s proposal.

In an interview with CNBC, Catherine Coley stated that regulators were also getting behind the technology and added:

“…you see grayscale as you mentioned get that clearance through from regulators. You also saw Hester Peirce put forward her proposal for increase regulations around allowing for new activities to take place with kind of a three-year benchmark. Seeing these changes is really important to see the evolution take place and America takes charge.”

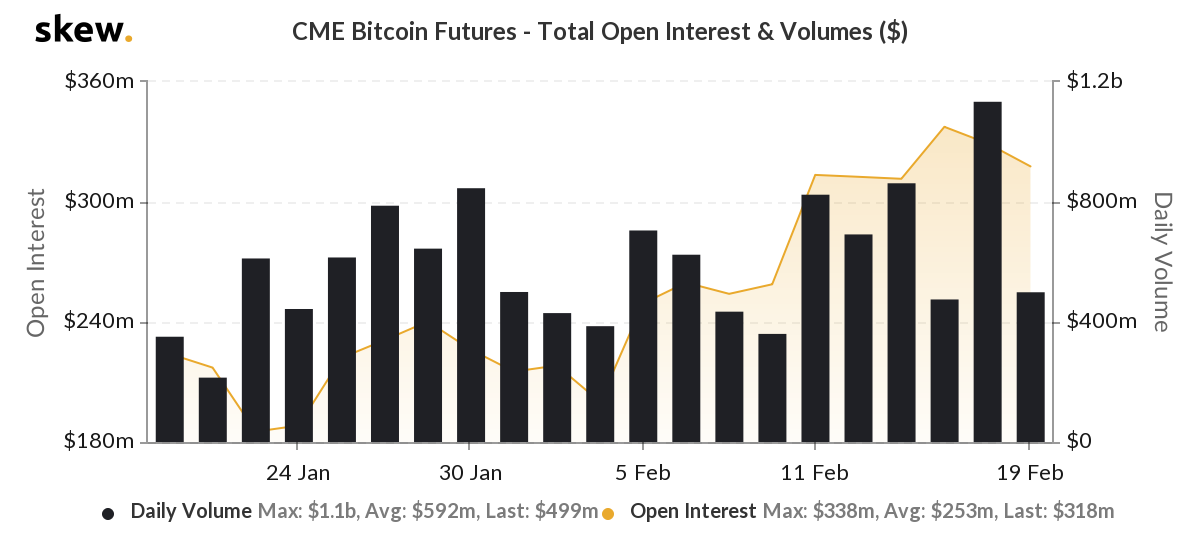

However, as the market rallied mainly to the tunes of Bitcoin, many believe the excitement before bitcoin halving contributed to the surge. The market has been seeing an influx of various derivatives products, with open interest on the CME reaching its highest mark yet, also contributing to the Bitcoin hype.

Source: Skew

The largest digital asset has been bestowed the title of being a ‘Store of Value’ as people consider it to be a flight to safety or sovereignty, claimed Coley. Comparing the use-case of different cryptocurrencies, Bitcoin could be a go-to option for certain purposes, in comparison to XRP.

The CEO added:

“That’s going to be a different case and scenario for XRP, which is really going to be useful for cross-border transactions, instantaneous settlements, and moving funds cross-border.”

As the use cases of a Bitcoin differ from Ethereum or XRP, an “all tides rise” effort may be visible when the king coin surges.

The post appeared first on AMBCrypto