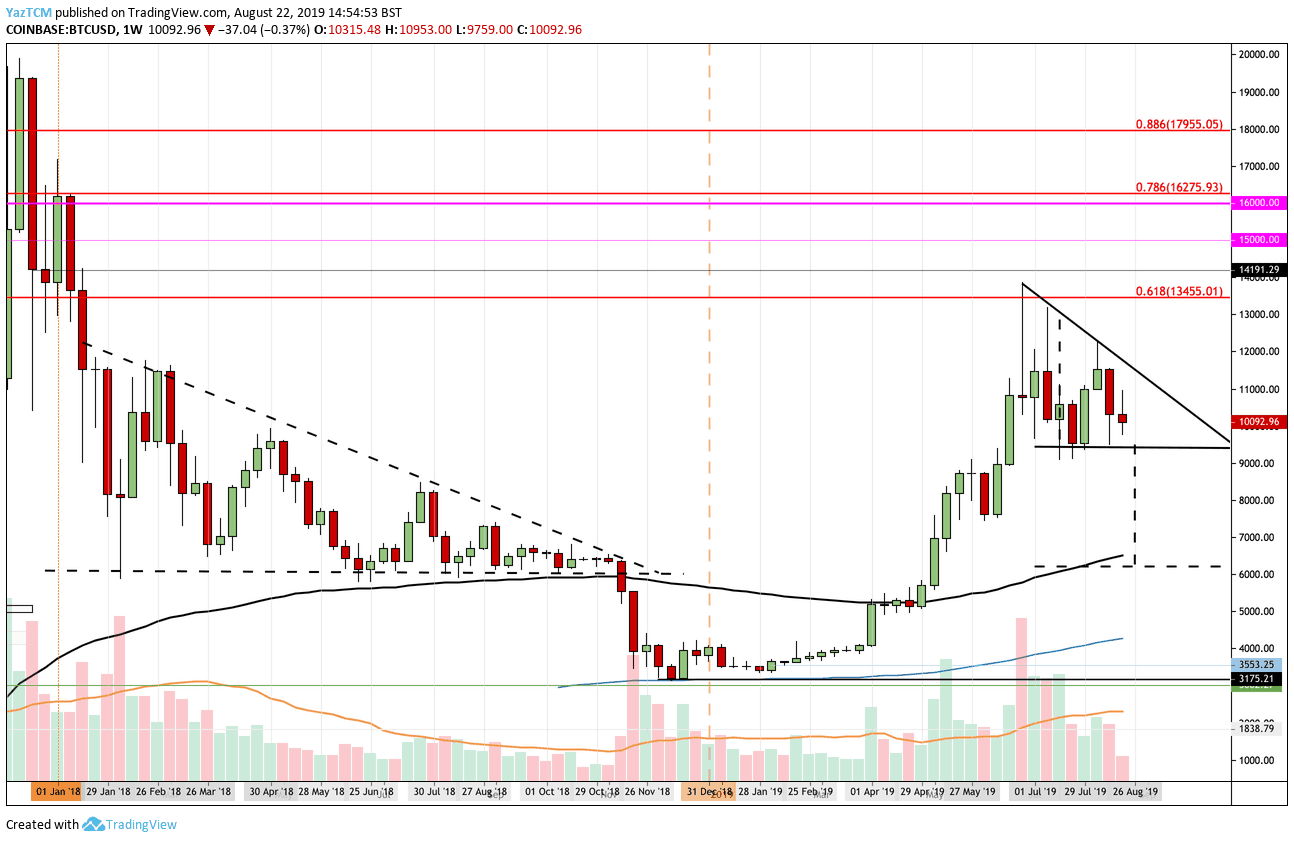

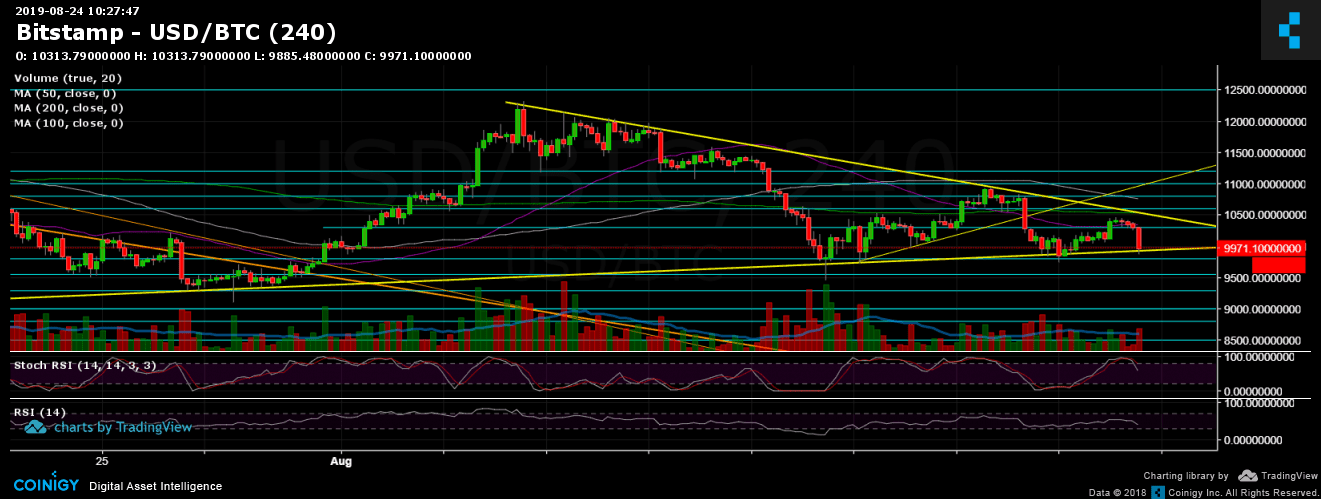

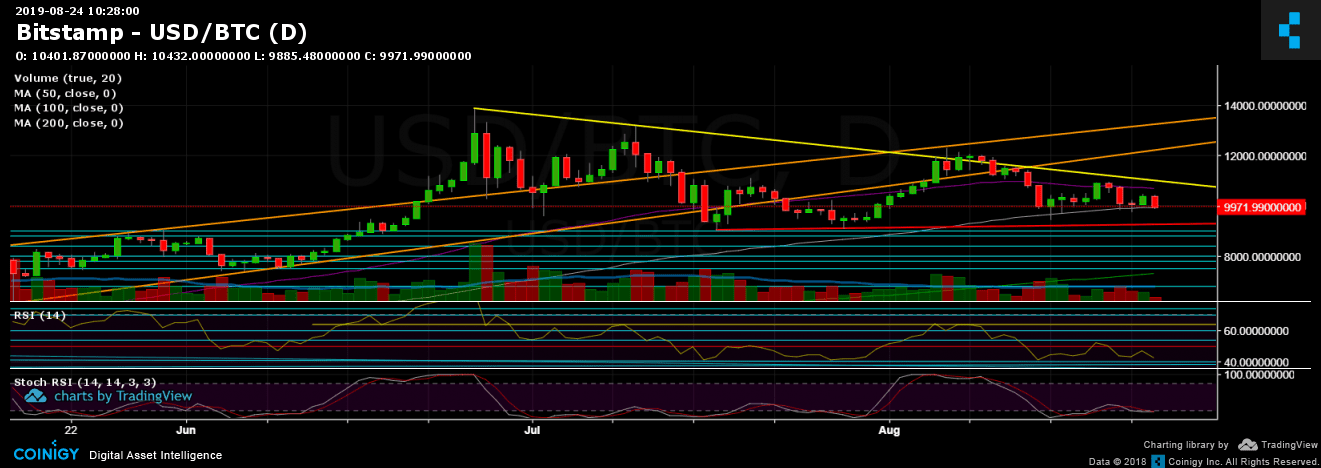

Over the past ten days of trading, we had seen Bitcoin trading inside a very tight price range between ~$9400 and ~$10,800 (which contains the 50-days moving average line, marked purple on the following chart).

The above range is also forming a horizontal triangle pattern where its apex is getting very close – it seems like a matter of days. However, usually this type of structure doesn’t ‘wait’ until it reaches the apex so that the breakout could take place at any given moment.

During the recent hours, the Bitcoin price had lost approximately $400, down to the bottom boundary of the triangle pattern, along with the $10,000 support area.

Can Bitcoin hold one more time? So far, seven attempts of the line got supported. As we know, the more times the support is being tested, the higher the chances of a breakdown.

Despite the consolidation in the price of BTC, some altcoins are showing strength, which remind the craziness of an altcoin season. However, considering the current massive gains, the prices of the altcoins are far away from their all-time highs.

Total Market Cap: $261 billion

Bitcoin Market Cap: $179 billion

BTC Dominance Index: 68.3%

*Data by CoinGecko

Key Levels to Watch

– Support/Resistance:

Following the recent $400 hours’ plunge, Bitcoin is now facing the critical support level between $9800 and $10,000, along with the bottom boundary of the triangle. Looking on the 1-day chart, we can also see that Bitcoin is holding up upon the 100-days moving average line (marked in white), which lies around $9900.

A break-down of the triangle is likely to produce an ugly red candle to the downside: the next support levels are at $9600 (weak), $9400 and then the $9000 – $9200 range. Further below are $8800 and $8500.

From the bullish side, the next level of resistance now lies at $10,300 and the triangle’s descending trend-line (which is roughly around $10,400). Further above is the 50-days moving average line ($10,700 – $10,800), before reaching again to the unbreakable $11,000 region.

– Daily chart’s RSI: The RSI is also on a decision point – breaking down from the 42 level means breaking down of the previous low, in its way to a lower low. Overall the RSI indicator doesn’t look very bullish, following the breakdown of the 50 RSI area.

– Trading Volume: Looking at the last consecutive three trading days (not including today), we can identify a decreasing amount of volume. This is another sign for a coming up strong price move. Overall, the amount of volume over the past week is relatively low.

BTC/USD BitStamp 4-Hour Chart

BTC/USD BitStamp 1-Day Chart

More news for you:

The post appeared first on CryptoPotato