- A new individual claims he is Satoshi in risible PR stunt

- Liquidity analysis pegs Bitcoin’s market dominance beyond 90%

- Japanese Amazon launches cryptocurrency wallet and exchange

- Original faketoshi, Craig Wright loses Kleiman lawsuit

Yes, as we can all see, the price of bitcoin dropped over $550 in a matter of hours on August 28th to see a low of $9,613 BTC/USD after being $10,269 earlier in the day. But, aside from the real time action, let’s recap the last week of bitcoin and cryptocurrency news stories and map out a timeline of what transpired for those who may have missed any important headlines.

Another Satoshi Wannabe Emerges With Sob Story And New Project to Shill

Before getting stuck into this story, it would be remiss not to make it unequivocally clear that this is a story that I would much rather not cover, were it not for the publicity and conspicuity it has been afforded in mainstream media.

With the most notorious claim to the moniker, courtesy of Craig Wright, falling apart at the seams in the middle of a Florida courtroom, it would seem many a wannabe Satoshi is now emboldened to step into the breach with some pretty ridiculous backstories.

Satoshi Nakamoto Renaissance Holdings, which claims to be a new blockchain company, hired the services of Ivy McLemore, a New York based PR agency, to reveal the identity of Satoshi Nakamoto.

A three-part reveal was published last week over the course of three days by the PR firm and it has left many in the crypto community fuming and wondering just how much more blatantly false and downright preposterous these claims are going to get and what it’s going to take to stop the faketoshi farce.

The individual claiming to be Satoshi was revealed by many online to be Bilal Khalid from Pakistan, by looking up the registration for another website he owned, even before he himself came around to revealing his identity in the third installment of his three-part reveal on the website.

Most of the efforts at debunking the claims focused on the use of basic word press, multiple edits and poor choice of words, but all that is really of any relevance is whether he is able to sign a message from Satoshi’s address, which predictably he cannot.

As narrated to Ivy McLemore, Bilal talks about the origins of the Bitcoin idea as everyone knows it, the cryptography mailing list et all., and then explains the provenance of the Bitcoin name as stemming from a disgraced, defunct Pakistani bank, Bank of CredIT and COmmerce INternational (BCCI).

He shows proof of registering a domain named after BCCI in 2008, talks about being paranoid over his identity, says his pseudonym was inspired by Chaldean numerology, thanks Hal Finney and explains how he solved the Byzantine General’s Problem.

In parts two and three, he narrates his life story, which comes across as a cookie-cutter sob story – about how being denied banking services in the UK inspired him to create a currency independent of banks, losing access to his email addresses and his 980,000 bitcoins.

Bilal Khalid, who adopted the alias James Caan in the UK, claims that he mined his bitcoins using a remote computer, which he then transferred to his Fujitsu laptop and then to an Acer laptop. Being of the habit of “never leaving data that was recoverable on any remote PC or laptop,” he then wiped all the data from old devices.

As luck would have it, the Acer stopped working the very next day. He sent it to Acer support, who diagnosed a corrupt hard drive and replaced it. Thus, Satoshi lost his 980,000 bitcoins.

In all of this tedious yarn, where exactly is there any semblance of proof to adduce this individual’s claim to being the creator of Bitcoin?

Ignore the story, but does the reveal consist of any verifiable information at all that only Satoshi and maybe a few early contributors, someone like Andresen, would be privy to?

Everything in the reveal, besides the individual’s life story, is publicly available information. The best thing you could say about this wannabe’s claim is that it can justifiably be argued to warrant a B-grade disaster fiction movie.

Ivy McLemore doesn’t seem like a serious PR firm but if it has any designs on being one someday, it should have simply said to Bilal, “Cool story, bro. But do you have any actual proof?”

Is Bitcoin More Dominant Than What Market Cap Indicates?

We tend to measure Bitcoin’s dominance by calculating the share of its market cap against the combined market cap of all cryptocurrencies but how reliable is the method?

Arcane Research published an analysis last week based on volume and liquidity of the various markets to show that Bitcoin’s actual dominance might be a lot higher than what market cap data suggest. The study claims that the market cap measure is deeply flawed and underestimates the relative strength of Bitcoin.

The argument put forth is that the market cap does not reckon for liquidity, which is the ability to execute large orders in a market without slippage and a tight spread between ask and bid prices. A good indicator of liquidity is volume and the study uses volume to measure the relative dominance of different currencies.

Using this method, which excludes stablecoins as a fiat alternative, thus not being true cryptocurrencies, Bitcoin’s dominance is estimated to be over 90%.

By using volume data only from the top 10 exchanges, which are largely regulated and reputed to not indulge in wash trading, Bitcoin’s dominance using the volume-weighted method is a staggering 92.4%.

Japanese Central Bank “in love” With Blockchain Technology

As inventors of fiber-optic communication, microprocessor, laptop and camera phones, among a myriad other technologies, Japan is widely regarded as the most progressive country in the world for developing and adopting revolutionary technologies. Obviously, you wouldn’t expect Japan to stifle blockchain innovation in the country.

Last week, an executive from Bank of Japan (BOJ) revealed that the country’s central bank is “in love” the technology behind virtual currencies and has no fear of capital outflows through new forms of money, “Because of fear of capital outflows, China regards all financial assets as enemies. But we are not worried about capital outflows. We are in love with the technology behind it (virtual currency) and interacting with the technical community.”

The country’s largest e-commerce platform, Rakuten, often dubbed “Japanese Amazon”, released a wallet last week, first for android devices and a few days later for iOS devices. Along with the wallet service, the app also provides feeless spot trading service for crypto assets.

Rakuten Wallet’s parent company, Rakuten Group, had been seeking regulatory clearance since March and has now obtained license to allow trading of three crypto assets – Bitcoin, Ethereum and Bitcoin Cash.

Customers of Rakuten will be able to deposit Japanese yen to their account and exchange it to any of the three crypto assets using the smartphone app. To encourage users to adopt crypto payments, no fee is charged on crypto to crypto transactions.

This is a major development in Japan, the equivalent of Amazon integrating crypto payments in the US, and shows how progressive Japan continues to set the benchmark for adoption of revolutionary technologies.

Craig Wright Is Found Guilty of Perjury to No One’s Surprise

Since we’re talking faketoshis this week, we might as well round it up with the Kleiman lawsuit involving Craig Wright.

Ira Kleiman, who is the brother of Wright’s erstwhile business partner, late Dave Kleiman, litigated Wright in February 2018 over embezzlement of 1.1 million bitcoins which were mined and jointly held by Wright and Dave Kleiman.

The lawsuit, which has rumbled on for 18 months, seems to have been all but settled. Reports emerged on Monday from courtroom eyewitnesses that the judge had ruled the case in favour of the Kleiman estate.

Wright was found guilty of perjury, falsifying documents and in contempt of court by Judge Bruce E. Reinhart, who rejected all of Wright’s testimony. It was also found that “Tulip Trust”, which was the trust created for holding the coins the pair had mined between 2009 and 2011, does not exist.

In his final ruling, Judge Reinhart awarded the Kleiman trust 50% of intellectual property rights and 50% of bitcoins mined before Dave Kleiman’s passing.

At least, Wright won’t be able to sue anyone that calls him a fraud for libel while he busies himself trying to cough up the 550,000 bitcoins which he likely never mined.

In the immortal words of Walter Scott, “Oh, what a tangled web we weave, when first we practice to deceive!”

Trading Insights

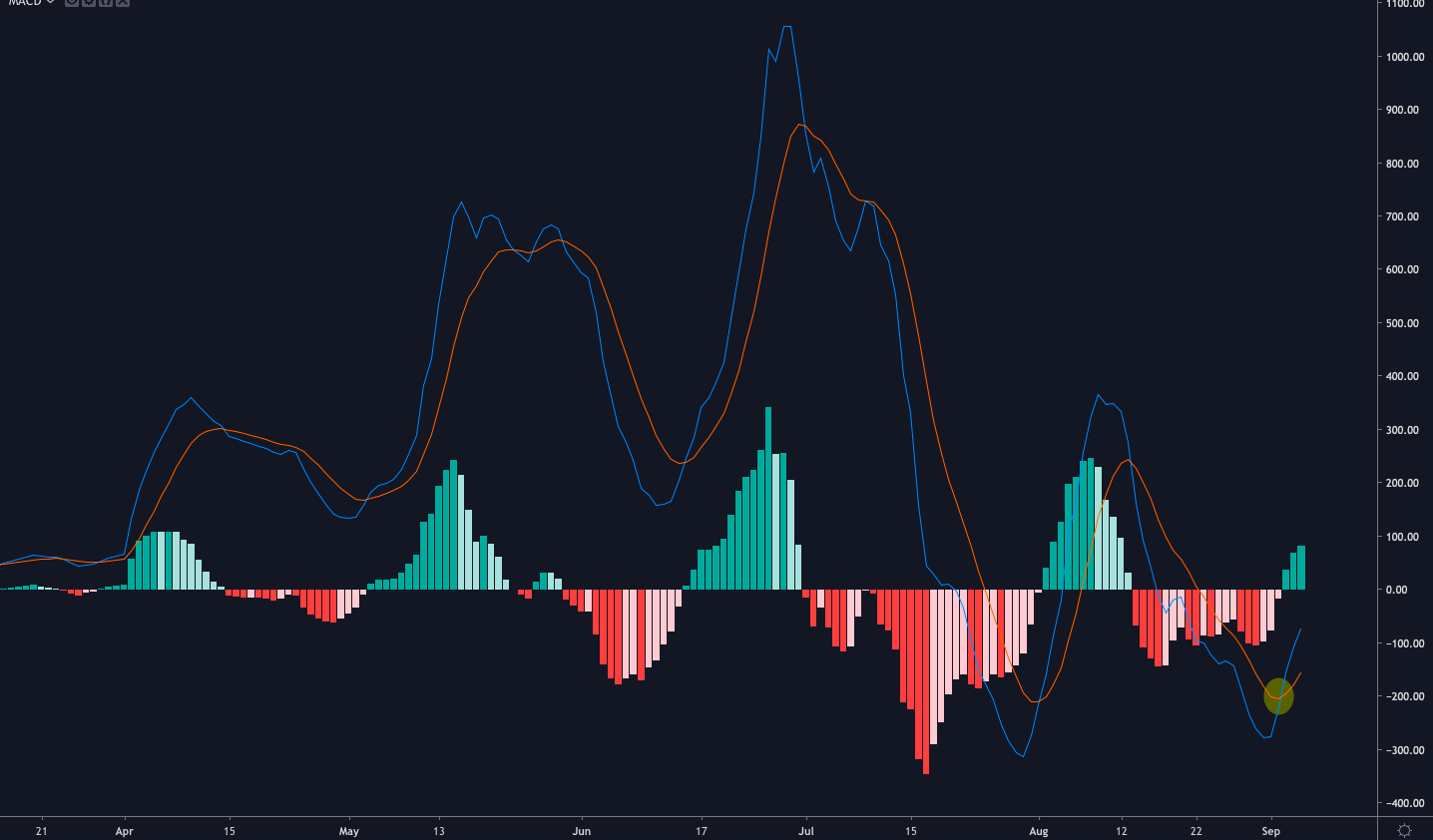

It would be fair to suggest that August has been a pretty mundane month with a lot of sideways movement and relatively little volatility. That may not be a bad thing.

Bitcoin has already spent more days above 10000 than it did back in Dec ’17 to Jan ’18, which shows that it is comfortable at this level and doesn’t feel out of place. A necessary spell of consolidation following a steep upsurge is characteristic of a healthy, mature market.

Last week’s trading closed in red in a short body which indicates that sell pressure has relented once again at the key Fibonacci ratio of .38. This level, near 9400 has proven to be a formidable layer of support throughout the month. The resistance to break still remains 10800.

The weekly chart is showing bearish tendencies on multiple fronts for the first time in nearly six months. Although RSI remains healthy in the bull market zone, there are rumblings which indicate a slide could be imminent. Whether or not it comes to pass, 9400 still remains the support zone to defend for the time being.

Weekly MACD saw bearish convergence this week, with ADX holding high and DI likewise evincing bearish convergence.

On the Daily chart, which has been largely bearish since last week, RSI has formed an ominous M-top formation just above lower bull cycle level of 40.

After showing some signs of mounting a revival, Ethereum has gone back to treading water, struggling to break above 0.019 BTC. Ethereum Classic (ETC) was the best performer among leading altcoins last week, gaining nearly 30%, rising from 55k sats to 70k sats.

Last Week Today: Bitcoin and Cryptocurrency Weekly Digest for August 19-26

The post appeared first on Crypto Asset Home