After incurring significant losses earlier this week, the Bitcoin and Ethereum prices managed to hold support this Thursday as stock markets jumped Wednesday afternoon briefly amid the Fed raising interest rates by 75 basis points to fight inflation. The last time interest rates were as high as they are right now was two years ago when the pandemic began, signaling a tremendous effort by the Fed to curb inflation and ease looming recession fears.

Bitcoin and Ethereum Price Incurs Significant Losses This Week

Despite holding support today, Bitcoin (BTC) and Ethereum (ETH) are still down over 30% this past week, as the global cryptocurrency market remains below the $1 trillion level, with a current market capitalization of $912 billion.

As Bitcoin has been following the stock markets price action this year, it is no surprise that the bloodshed has momentarily stopped today, as stock markets jumped late last night after the Fed announced a historic move to increase interest rates further to fight inflation.

On Wednesday, the S&P 500 jumped by 2% from a low of $3,748 to $3,822, NASDAQ jumped 2.7% from a low of $146 to $151, and the Dow Jones saw gains of over 2.4%, rising from a low of $30,277 to $30,996.

The brief stock market recovery is due to the decisive action by the Fed as a response to the recently released Consumer Price Index data, which signaled inflation isn’t quite slowing down as expected. High gas prices, and increasing mortgage rates, are all stark signs for the economy, and investors are pulling cash out of their investments as a result.

We can expect the stock market to continue its bearish action until CPI numbers and other indicators signal a slowing down of inflation and a recovering economy. Yet another indicator for a bullish reversal would be the decrease in gas prices, which somehow continue climbing to record highs.

Celsius Drama and Stablecoin Depeg Causing Additional Stress to Crypto Economy

The recent debacle with Celsius, a leading venture capital-backed lending platform, recently disabled withdrawals for all customers, causing market panic. While individuals were most affected by the platform’s actions, the leading stablecoin, USDT, was depegged briefly from its $1 when it was revealed that it has a significant position in Celsius.

Luckily, current reports indicate that USDT was able to liquidate its Celsius position with no losses, narrowly avoiding a similar catastrophe to the likes of Terra Luna.

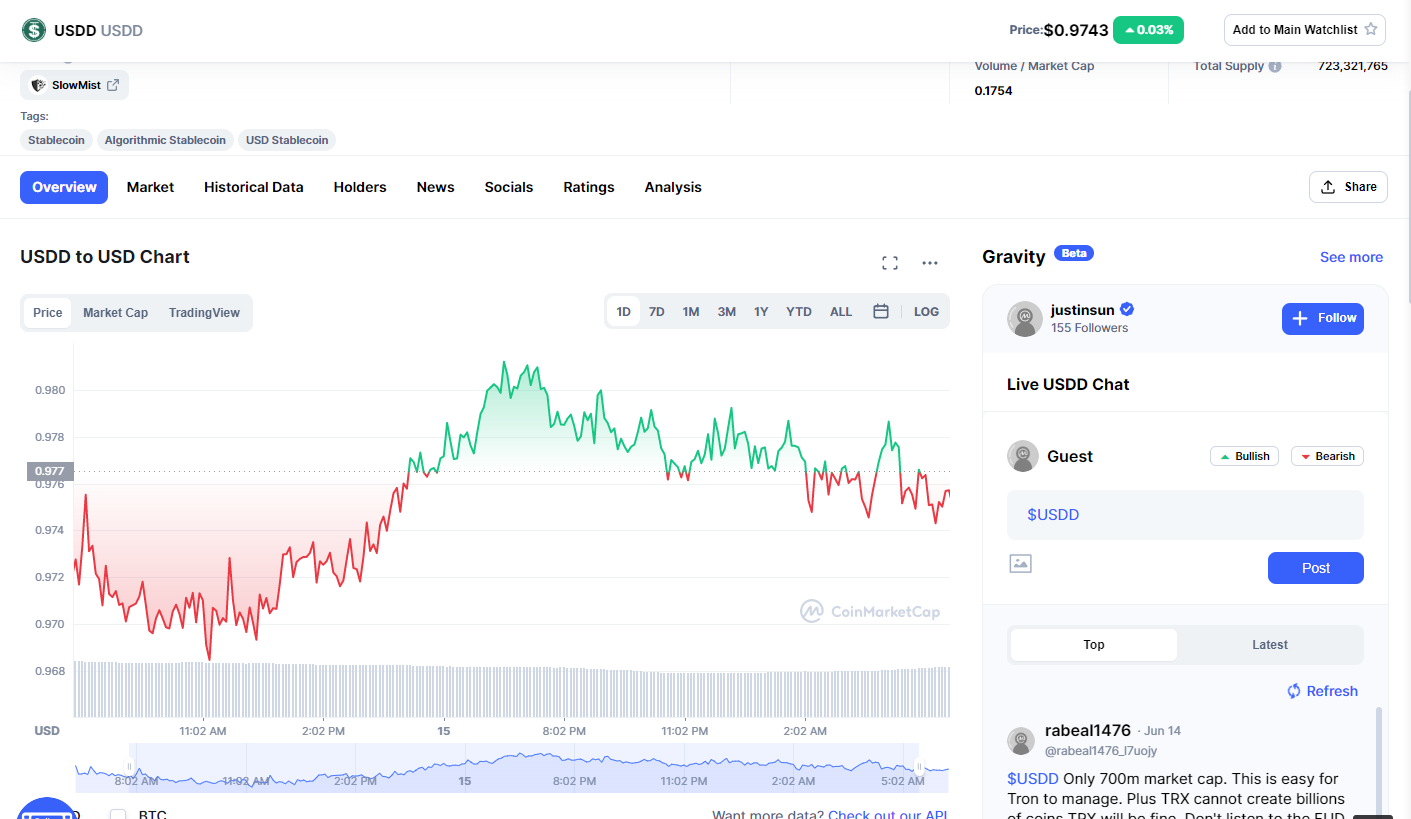

Another algorithmic stablecoin struggling this week was Tron’s USDD, which depegged as low as $0.96 on Wednesday.

Tron’s founder, Justin Sun, communicated to the community his actions of deploying billions in capital to defend the peg, which helped USDD recover to $0.98. However, things are still shaky as USDD is currently trading at $0.9747; whether the current level will hold is yet to be seen.

The Terra Luna, Celsius, USDT, and USDD uncertainty is causing substantial pressure on the crypto economy and is causing investors to lose confidence not only in cryptocurrencies but also in blockchain technology. If crypto is to survive this bear market, the industry needs to avoid scandals like Terra Luna from happening again, at least this year.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any service.

Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, and Metaverse news!

Image Source: tolkachev/123RF

The post appeared first on The Merkle