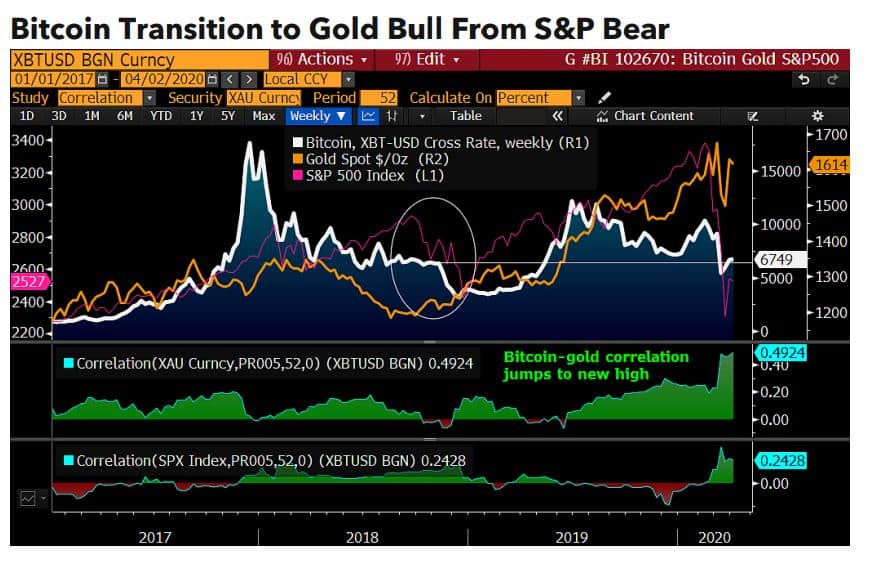

Bitcoin is reducing its correlation with the stock market, and is transitioning towards gold’s performance, a recent Bloomberg report claimed. Amid the current COVID-19 crisis, both assets will outperform equities and emerge as the most substantial gainers.

Bitcoin To Join Gold

The unexpected outbreak of the COVID-19 pandemic jolted world economies and financial markets. The cryptocurrency space was not exempt from adverse price developments. However, a recent Bloomberg document outlined that the primary digital asset is declining in terms of volatility and is preparing to become a more stable asset amid the coronavirus crisis:

“This year will confirm Bitcoin’s transition from a risk-on speculative asset to the crypto market’s version of gold, in our view. From a volatility perspective, declines in Bitcoin’s reading and the rise for the stock market’s shifts performance favor toward the crypto asset.”

Per the paper, the most recent stock market movements are pushing Bitcoin to “divorce” its correlation with equities and, instead, to join gold. Evaluation in the report “depicts the 52-week correlation of Bitcoin to gold jumping to the highest in our database since 2010.” It also added that BTC’s relationship with gold “is about twice that of equities.”

Therefore, the benchmark cryptocurrency’s maturation processes toward a store-of-value mechanism akin to gold should continue, the report concluded.

Bitcoin And Gold To Emerge The Strongest From COVID-19

In attempts to fight the economic aftermath prompted by the coronavirus, world central banks and governments began printing excessive amounts of money and rushed them into the markets. The report also touched upon these drastic measures and predicted that BTC and gold are prone to gain the most out of the situation:

“Bitcoin and gold also stand to be primary beneficiaries of the unprecedented monetary stimulus that’s accompanied by a mean-reverting stock market.”

Making a compelling prediction regarding gold’s price by the end of the year, the paper determined that it will break the previous all-time high and breach $1,900. In a Bank of America report on gold’s performance, the giant institution stated that the precious metal could even reach $3,000 next year.

Bitcoin, on the other hand, utilized the current COVID-19 situation to distinct itself from other cryptocurrencies, the report reasoned. According to the Bloomberg Galaxy Crypto Index, which measures the performance of digital assets by combining various indicators, BTC’s ratio is recovering from a dip below its “upward-sloping 52-week moving average”, while other coins are declining.

The post Bitcoin and Gold To Increase The Most Amid the COVID-19 Pandemic, Report Says appeared first on CryptoPotato.

The post appeared first on CryptoPotato