The Bitcoin market after moving to its yearly-high of $13,864 had fallen under $13k on 28 October and has since bounced back. As Bitcoin traded at $13.2k, at press time, the outcome from the approaching BTC options expiry remains undecided.

Source: BTC/USD on TradingView

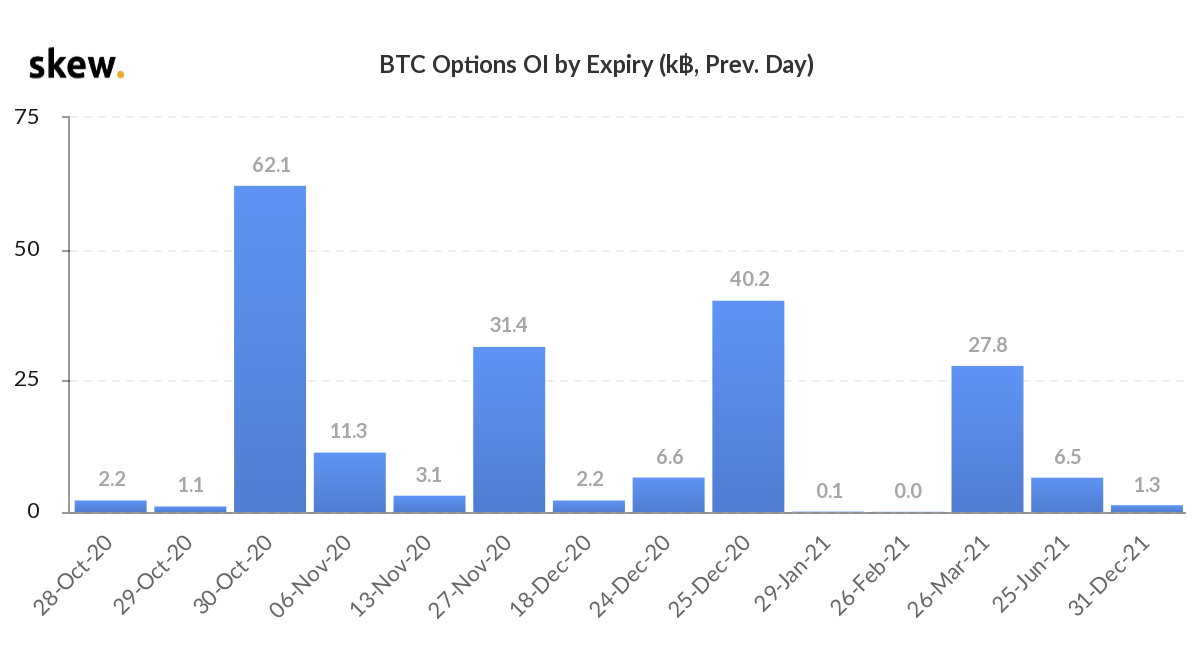

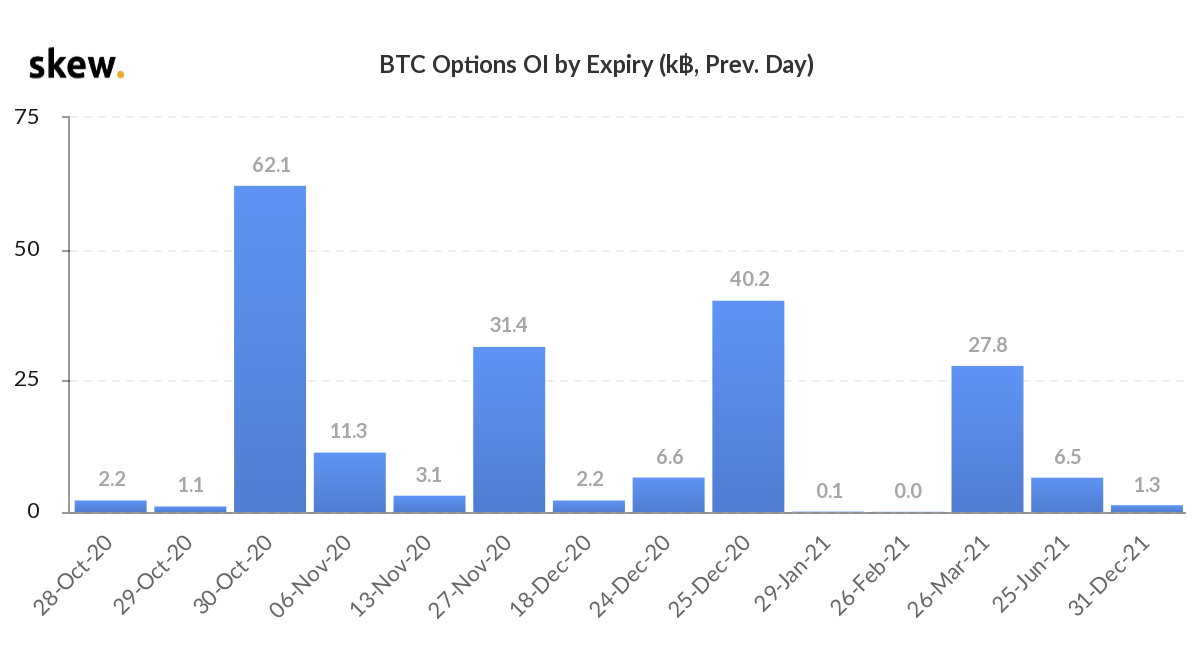

According to data provider Skew, over 62k Bitcoin options are set to expire on Friday and worry has seeped into the market once again. The Bitcoin market has remained volatile over the past couple of weeks. Even though many were seeing a strong bullish sign of take-off, the digital asset has slumped close to $13k.

Source: Skew

Open Interest had returned to the Bitcoin options as it marked an ATH on skew on 27 October close to $3.583 million. This was a result of the positive sentiments evolving in the market and provided an opportunity for traders to hedge and lock-in profits from the existing price levels. However, with price dropping before the expiry could put the traders into an uncertain spot if they weren’t already.

Deribit insights shared this uncertainty among traders related to the upcoming expiry. Deribit has been one of the largest platforms for Bitcoin options and has been noting its term structure sloping upwards, this was an indication of long term yields being higher than the short term yields.

According to Deribit, like the stock market, even the BTC market had priced in the potential volatility in the election week of 30 October until 6 November. This increased volatility is expected to continue until the end of this quarter. With Deribit’s 7% of the expiry open interest fixated on the $13k strike, the events leading to the expiry may determine the direction of Bitcoin’s next move.

However, more often these speculations about the future and options contract expiry have not resulted in a notable event. Like the one witnessed on 25 September wherein 87k worth of BTC options were set to expire. This expiration did not affect the spot value of the digital asset. Thus, even though the market indicated full strength despite a collapsing value, traders may want to keep a watch on the external events that may cause a spike in volatility in the Bitcoin market to protect themselves.

The post appeared first on AMBCrypto