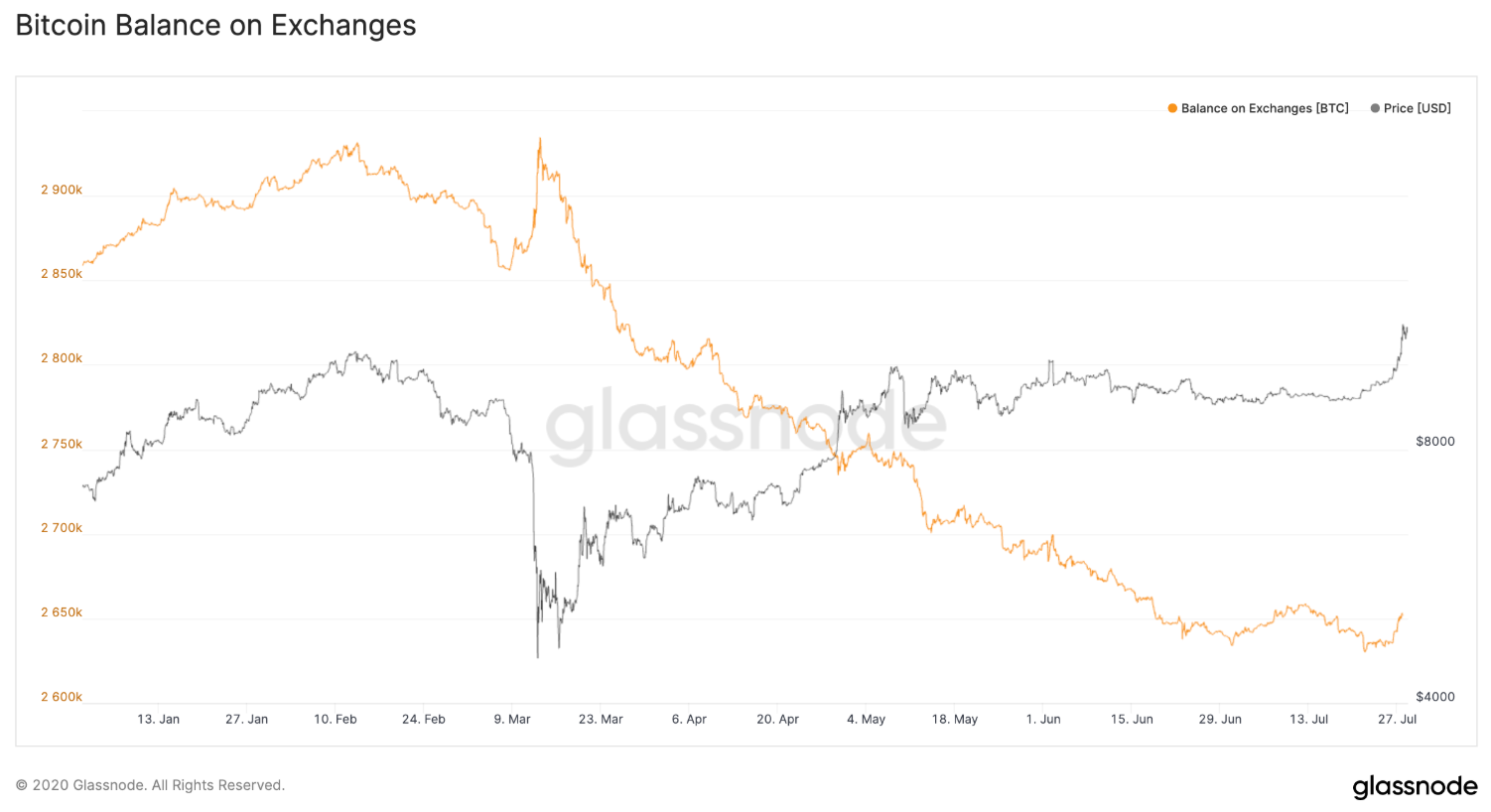

It has been a year of trends for Bitcoin and one of the most well-documented ones is the trend of more Bitcoin leaving exchanges than entering it. Since the start of the year, more specifically since March, over 92,000 BTC has moved out of exchanges.

A recent report had suggested that some amount of Bitcoin were starting to come back into the exchanges but recent data from Glassnode suggested that the Bitcoin balance on platforms was still stable.

Source: Glassnode

According to the Glassnode’s tweet, Bitcoin’s current price explosion did not have a significant effect in terms of large-scale deposits of funds into exchanges. It said,

“So far, the Bitcoin balance on exchanges remains stable – at around 14.5% of the circulating BTC supply.”

Recent reports also cited that Bitcoin reached an 18-monthly low in terms of BTC balances on exchanges and recently, Shapeshift exchange released its self-custody app, where the users do not have to share their private keys with any third party domain.

However, the situation is most likely to undergo a trend reversal over the next few months.

Why did Bitcoin exit exchanges in the first place?

Although there wasn’t any clear cut reason, many suggested that a sentiment of distrust attached to exchanges ran like wildfire after the March Crash. Binance and Coinbase incurred less exiting Bitcoins but other exchanges faced major wrath, especially BitMEX.

However, it is important to remember that Bitcoin alongside the larger financial market was facing an economic collapse amidst the pandemic. With global lockdown a reality, many speculated that it was safer to keep Bitcoin under self-custody rather than with exchanges.

With the financial ecosystem improving, it is possible that users saw the benefit of storing Bitcoins in exchanges again.

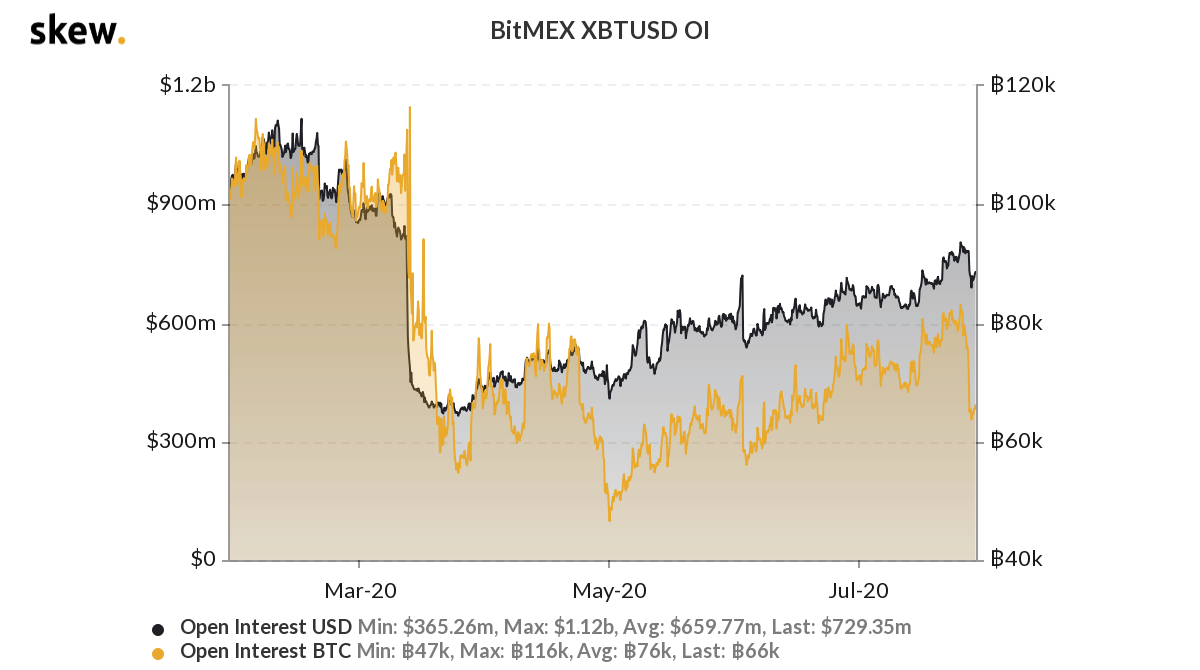

Source: Skew

With BitMEX’s Open-Interest improving over the past week, the largest derivatives platform image was recovering as well, which meant that users were ready to let go of the past.

Therefore, it seems like a matter of time before Bitcoins are swarming back into the exchanges, with the general sentiment becoming strongly positive over the past month.

The post appeared first on AMBCrypto