The U.S-China trade war has left both nations’ economies in a state of distress, accelerating geopolitical tension. However, several analysts speculate that the ongoing trade war between two of the world’s largest economies has been beneficial to Bitcoin.

Bitcoin’s entry into the monetary world was during a period of economic recession and the coin’s resistance towards centralization has prompted prominent people from the cryptosphere to label the coin as a “safe haven” asset. Recently, the Federal Reserve cut interest rates and Bitcoin seemed unaffected by it as the price of the king coin moved up.

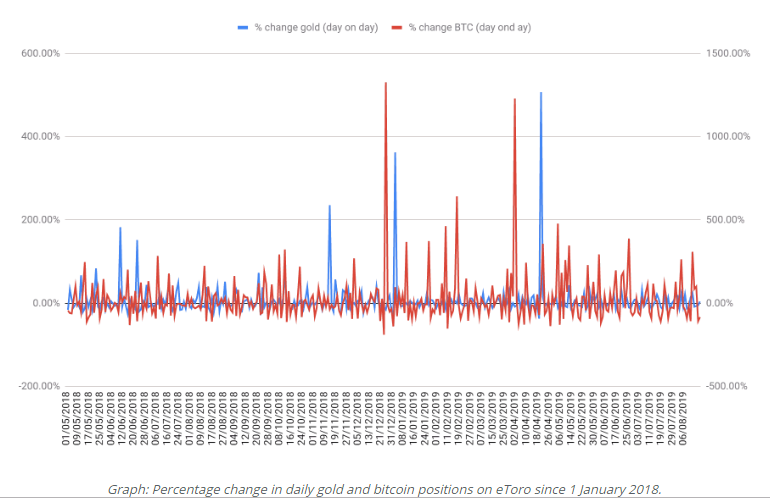

Bitcoin is often compared to gold because of their various similarities like their limited supply and deflationary nature. The original “safe haven” asset, gold has acted as a hedge for the longest time during financial crises, allowing investors to invest in the asset. According to recent data from trading platform, eToro, investors have been considering Bitcoin as a store of value, especially during new developments related to the US-China trade war.

Source: eToro

eToro’s UK analyst, Simon Peters, pointed out the several similarities between the two assets, but believes that the storage costs of gold posed as leverage to Bitcoin. The tariff-related announcements from both China and the USA have paved way for a lot of retail investors to become interested in the digital asset, he added.

In a recent interview, Yoni Assia, Founder and CEO of eToro, vaguely expressed his thoughts on the correlation between the price of Bitcoin and the ongoing trade war. He suggested that previous trade wars have increased the price of the coin. He added that only “bigger catastrophes” would lead to a significant surge in the price of the coin.

Speaking with AMBCrypto, eToro’s Senior Market Analyst, Mati Greenspan, had said that the correlation between the price of Bitcoin and the US-China trade war is “theory,” as it would be “extremely difficult” to actually prove the correlation. He had also said, ,

“More likely people speculating on a narrative that might be true, but the speculation itself regardless of the validity of the underlying theory can potentially impact the prices.”

Whatever the case may be, the fact that Bitcoin and the cryptocurrency market are in decent shape in troubling times is good news for many.

The post appeared first on AMBCrypto