When Satoshi Nakamoto sat down to write the whitepaper of Bitcoin, he (or she) prepared precisely for today’s coronavirus situation.

The idea of Bitcoin was born after the latest devastating real-estate financial of 2008. All experts were eyeing this day. However, over the past weeks, Bitcoin is attaching its value to the global markets. This, instead of branding itself as a real safe-haven asset.

Yesterday, following President Trump’s announcement, including halting the flights to Europe for a whole month, Wall Street futures immediately plummeted in response to the new financial impacts following such fatal decisions.

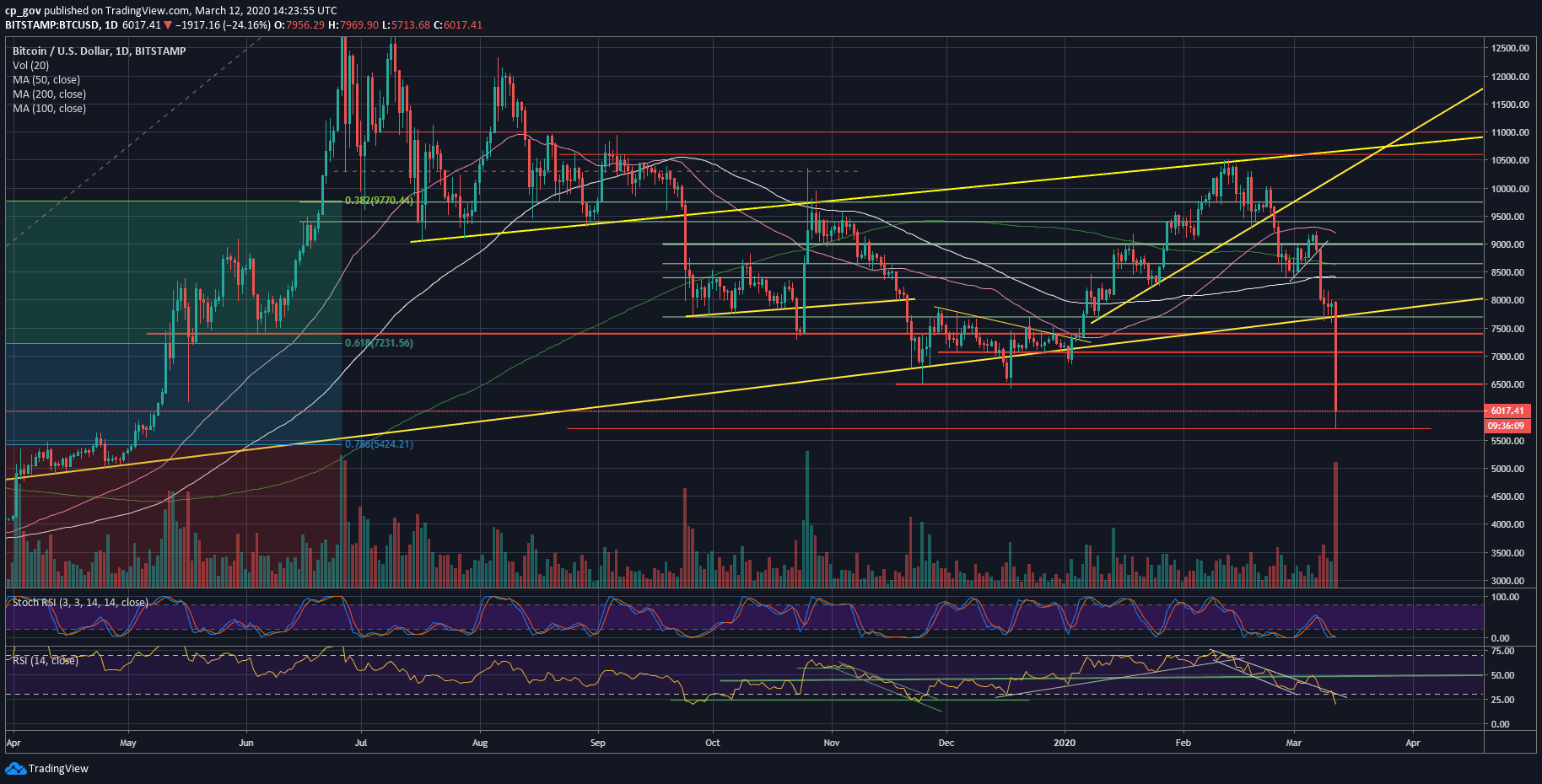

Not surprisingly, Bitcoin continued its correlation and made a rapid $400 price decline to retest the $7600 long-term support, which was discussed here yesterday.

UPDATE March 12, 14:30 UTC: Following a catastrophic collapse of more than $1500, Bitcoin marks $5700 as the daily bottom. Since then, the coin recovered a bit and now trading around the $6,000 mark.

Altcoins Suffer Even More

As of writing these lines, the $7600 level, along with the ascending trend-line from 2015, is broken. Since then, Bitcoin quickly dropped another $300, and now $7300 is the current daily low (it can be changed as you’re reading these lines). A weekly close below the long-term line, or $7600, will likely worsen Bitcoin’s situation.

The crypto panic expands to the altcoins, whereas the Bitcoin dominance index surged to 65.6%. Ethereum (ETH) seeing almost 30% daily price decline, as of now. Tezos (XTZ) and Chainlink (LINK) are both down approximately 35% on the daily.

Total Market Cap: $168 billion

Bitcoin Market Cap: $110 billion

BTC Dominance Index: 65.4%

*Data by CoinGecko

Key Levels To Watch & Next Possible Targets

– Support/Resistance levels: Bitcoin is trading around the $6000 confluence zone. The first level of support is $5700, which is the current new yearly low, as well as the lowest since May 2019.

Further below is $5500 and $5400 (the 78.6% Fib retracement level), and $5000.

All indicators are in the oversold territory, so we might see a correction to retest and confirm support turned resistance levels: The first level will be $6300, then $6500 (the low from the end of 2019), $6800, $7000, $7230 (the Golden Fibonacci retracement level following the June 2019 bull-run), and lastly $7600 from the above mentioned ascending trend-line.

– The RSI Indicator: The RSI is back inside the descending wedge pattern. The momentum indicator recently marked its lowest value since November 2018 (!).

The Stochastic RSI oscillator is about to make a crossover in the oversold territory. This might lead to some correction.

– Trading volume: The sellers are definitely here. Over the past days, the cumulative volume is massive.

BTC/USD BitStamp 1-Day Chart (UPDATED)

The post Bitcoin Broke Down The Critical Support Line From 2015: What’s Next? BTC Price Analysis (UPDATED) appeared first on CryptoPotato.

The post appeared first on CryptoPotato