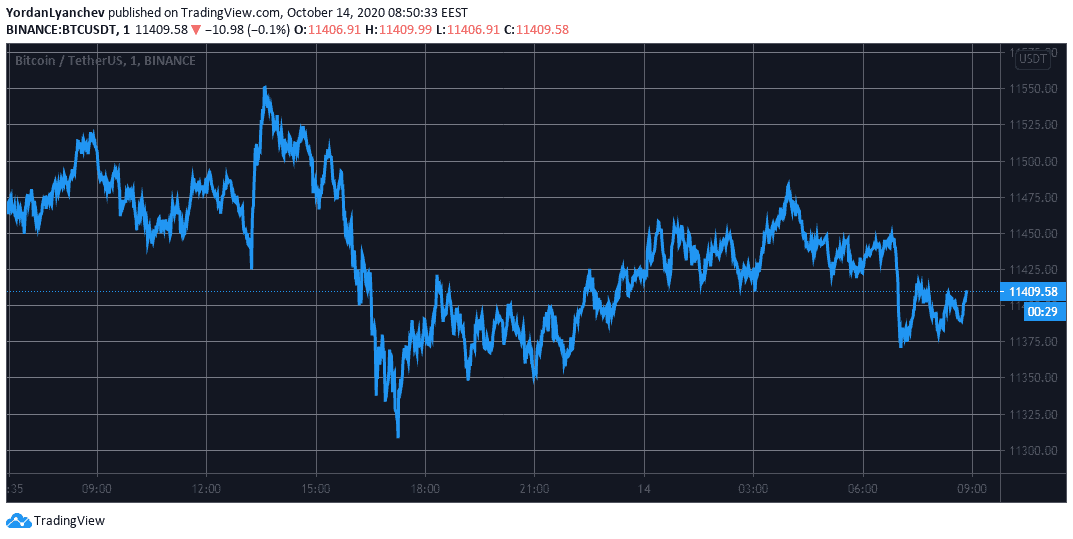

After spiking to a new monthly high of about $11,700, Bitcoin has retraced slightly in the past 24 hours and sits at $11,400. Most altcoins have followed suit by charting minor losses.

Bitcoin Drops To $11,400

As CryptoPotato reported yesterday, Bitcoin was heading upwards and reached a new 5-week high above $11,720. In the following hours, the primary cryptocurrency couldn’t sustain its run and hovered around $11,500.

BTC initiated another leg up to $11,560 (on Binance) but then lost about $350 in just a few hourly candles. As such, Bitcoin charted its intraday low of $11,310.

Although the cryptocurrency has recovered from this steep decline, BTC is still about 1% down on a 24-hour scale. Bitcoin currently sits around $11,400. Interestingly enough, this happened despite President Trump calling for additional economic stimulus.

The recent increased correlation between Bitcoin and Wall Street could be the reason behind the latest price drop. The three most prominent US stock indexes all closed yesterday’s trading session in the red. The Nasdaq Composite dipped by 0.1%, the Dow Jones Industrial Average by 0.55%, and the S&P 500 by 0.63%.

Altcoins Slightly In Red, BCH Back To #5

Most larger-cap alternative coins have also charted minor losses since yesterday. Ethereum has dropped by 1% and fights to stay above $380.

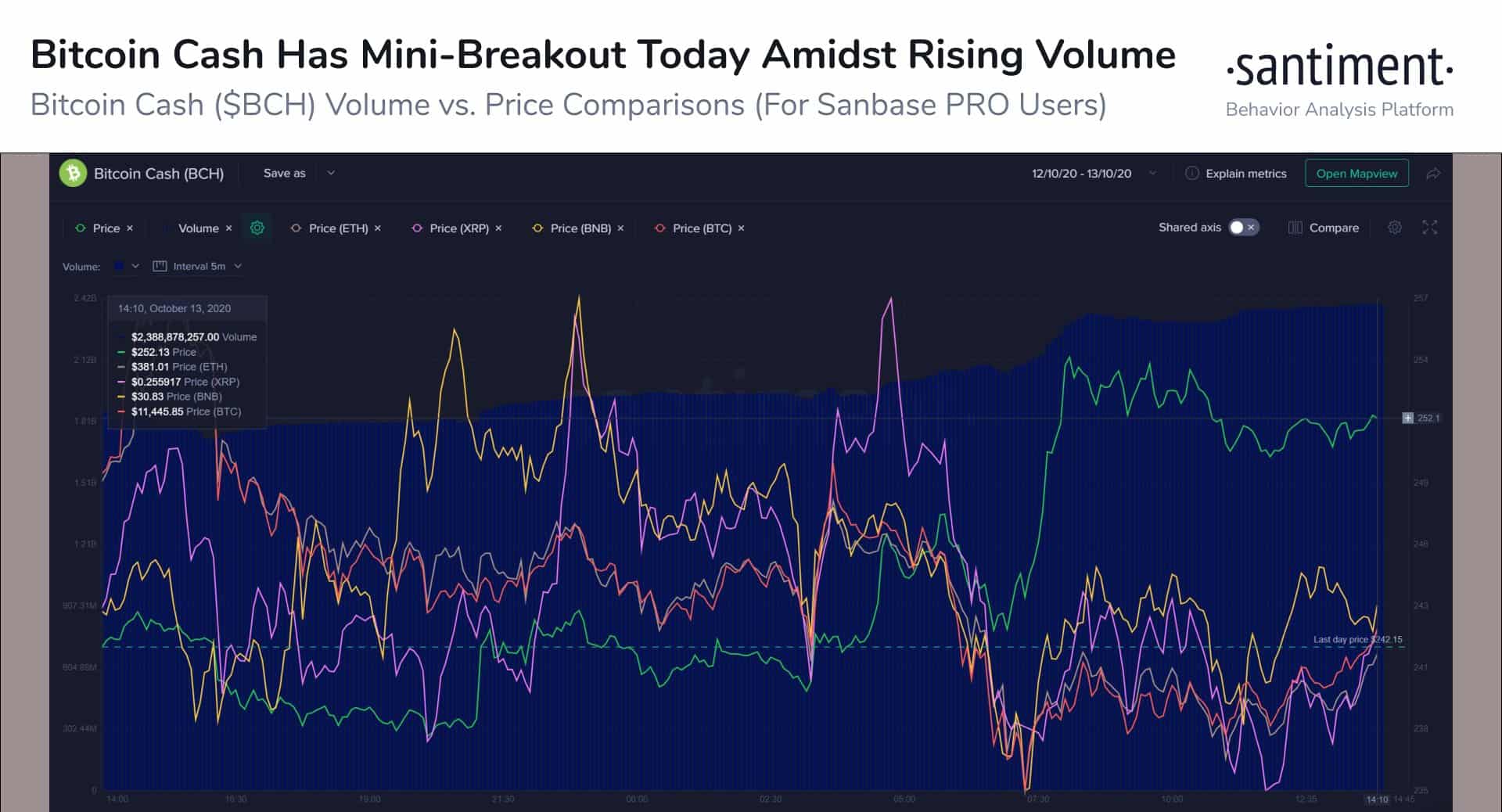

Polkadot (-1.7%), Binance Coin (-2%), Chainlink (-2.4%), and Cardano (-2.3%) are also in the red from the top 10. In contrast, Bitcoin Cash has jumped by over 5% to above $250. As a result, BCH has reclaimed the 5th position from BNB only a day after losing it.

According to data from the analytics company Santiment, BCH has enjoyed a steady inflow of trading volume and has reached “near one-month high levels.”

Further losses are evident from lower and mid-cap altcoins. PumaPay leads this adverse trend with an 11% decline. Band Protocol (-9%), UMA (-5%), Crypto.com Coin (-4.5%), and Yearn.Finance (-4%) are next.

Nevertheless, several altcoins have surged in value as well. ABBC Coin has spiked by 16%. Reserve Rights (9%), Hyperion (8%), Quant (8%), and 0x (7%) follow.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato