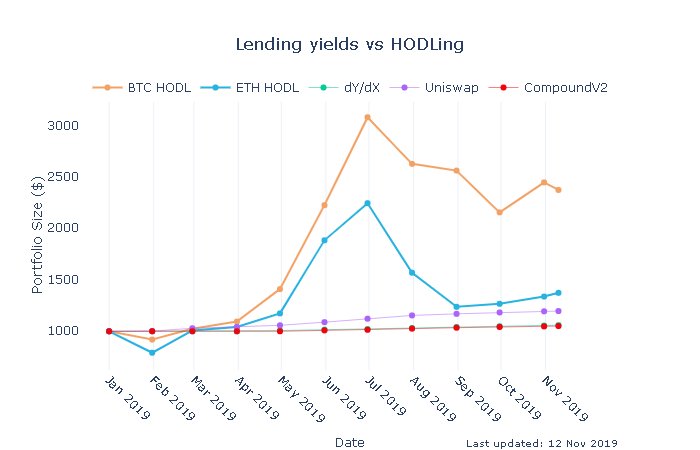

Bitcoin had its hands full dealing with the bearish market, while DeFi gained popularity and provided significant earnings in mainstream finance. However, according to the report provided by Token Analyst, hodling Bitcoin [BTC] or Ethereum [ETH] garnered more revenue compared to crypto lending.

The report highlighted the difference in returns offered by investing $1,000 at the beginning of 2019 in crypto and crypto lendings. The first example of hodling was:

“if you put $1000 into BTC on Jan 2019 and held until July 2019, you would have had a 211% return on investment!”

Source: Token Analyst

The 211% return on investment was higher than the returns incurred by becoming a liquidity provider on dY/dX or CompoundV2 that provide returns in the form of interest accrued. According to Token Analyst, if a user invested a sum of $1000 in Uniswap and compounded up until July 2019, they will receive a return of merely 11%. The scenario was not very distinct if the users would have invested in dY/dX or CompoundV2.

However, the report noted that “risk” adjusted results might reflect a different picture, due to relatively less volatile results promised by DeFi yield. According to DeFi schemes noted a boost recently as it managed to hold $650 million.

@AboutDefi tweeted:

“There is now over 650 million (USD) locked in #DeFi. ”

Source: DeFi Pulse

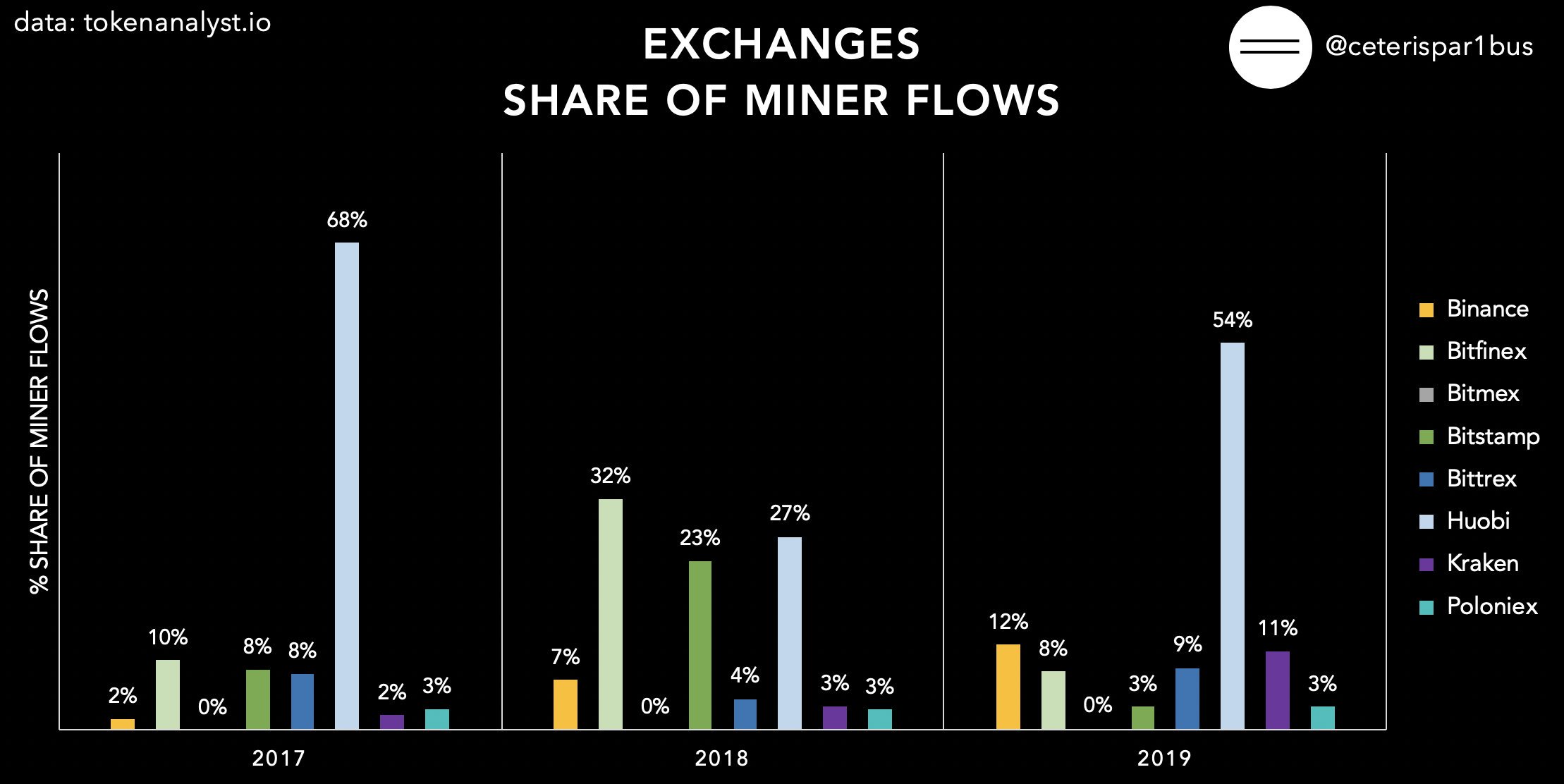

Apart from yields, the report highlighted Binance and Kraken have both increased share ~10% since 2017, with Huobi maintaining its lead. The move towards OTC trades has gained momentum in 2019.

Source: Token Analyst

The report also noted that only 3% of BTC mined in 2019 was sold directly on exchanges, while Over The Counter [OTC] trades took over.

The post appeared first on AMBCrypto