The three digital assets, Bitcoin Cash, IOTA, and Basic Attention Token continued to stay in the red zone for the day’s trading session.

With over 6% in losses since yesterday, strong selling pressures could last longer in the Basic Attention Token and IOTA market.

Bitcoin Cash on the other hand, also witnessing a sell-off, dipped only slightly, while also displaying strength along its immediate support level.

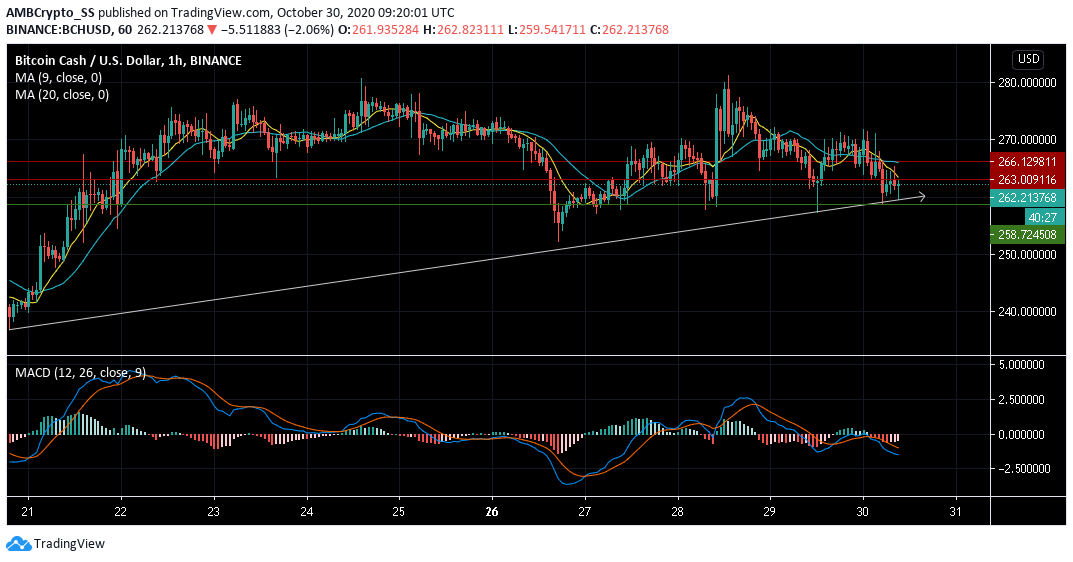

Bitcoin Cash [BCH]

Bitcoin Cash had been maintaining a level above the $258.72 support since 22 October, as it rose above from an ascending channel in a bullish move over the past one week. This made the $258.72 mark a strong level of support

Despite a 1.5% loss since yesterday BCH price continued to stay above this level, with the upward trendline also acting as a strong support level.

Having said this, the digital asset still maintained an overall bearish outlook for the short-term period, as it dived below both its moving averages. Further indicating bearishness, the 9 SMA (yellow) plunged beneath the 20 SMA (cyan).

Well into the bearish territory the MACD too suggested a selling sentiment for the short-term period. However, given the reasons for the strong support level, the possibility of a further downtrend, without a resurgence of a strong market-wide sell-off, remains bleak.

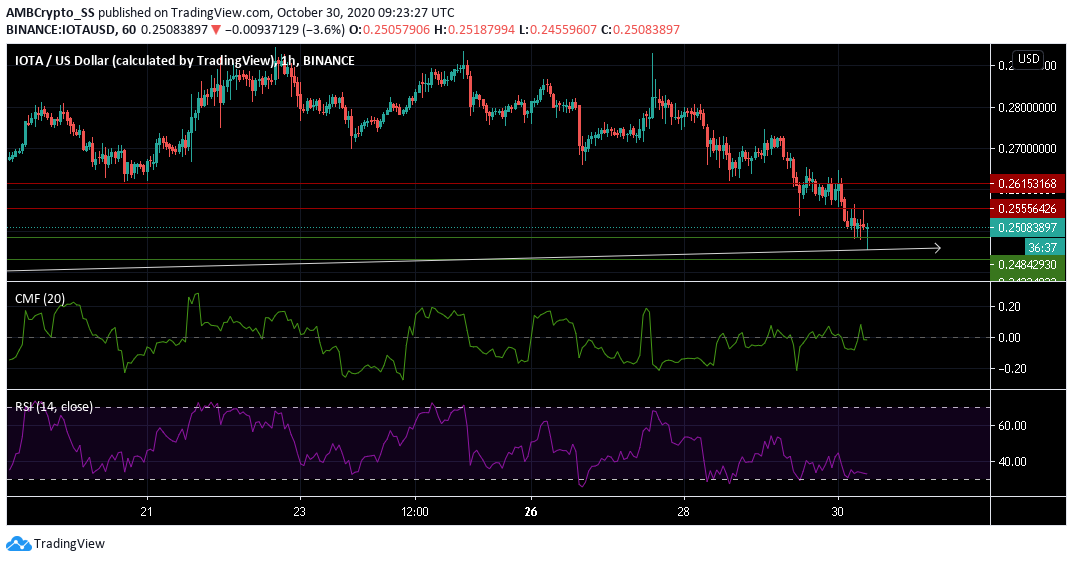

IOTA

IOTA was down by almost 7% since yesterday and was trading at $0.250 at press time.

Over the past few days, with the capital flowing out of the IOTA market as outlined by the significant drop of the Chaikin Money Flow Indicator below the zero line, a clear bearish strength was thus being witnessed.

However, at press time, CMF remained neutral as it stayed close to the zero level. The Relative Strength Index also turned south, hovering just above the oversold territory. This indicated a growing presence of selling pressure.

Given the bearish setup, a price action towards the next support at $0.243 remains a possibility over the next few trading sessions.

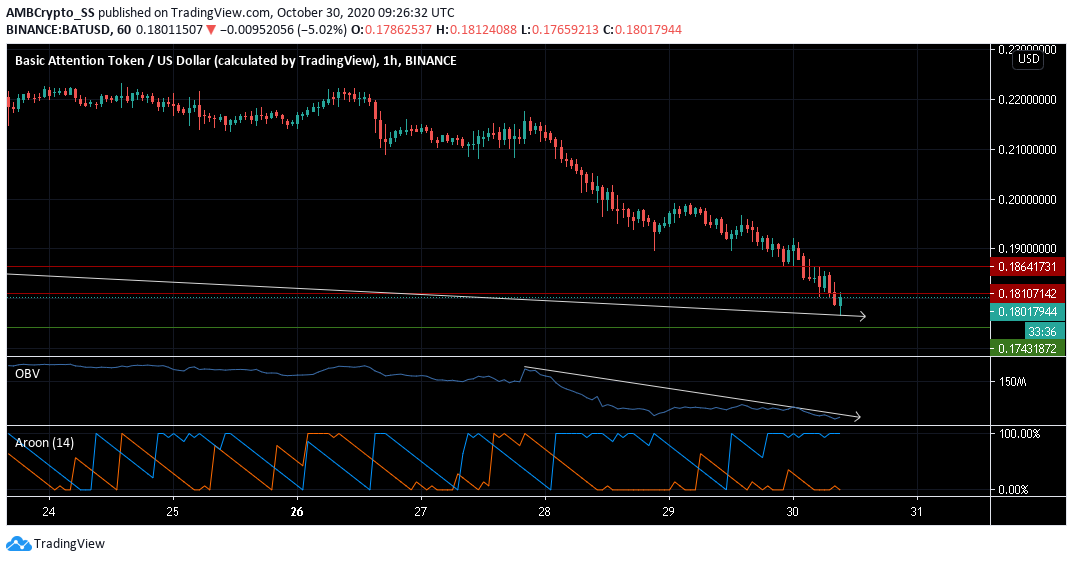

Basic Attention Token [BAT]

The Aroon Indicator gave a strong sell signal, with the Aroon down (Blue) rising above the Aroon Up (orange).

The event coincided with Basic Attention Token diving below two of its support turned resistance levels at $ 0.186 and thereafter the $0.181 levels.

A fall in the buying volume as noted by the OBV technical indicator, also ruled out any price reversal possibility, due to a lack of immediate buying strength.

In fact, the recent 8% dip over the last 24 hours in Basic Attention Token hinted towards the short- term period being controlled by the bears. This left room for a further downside towards the next support at the $0.174 level.

The post appeared first on AMBCrypto