Registering poor daily returns, both Ontology and Maker’s valuation were down by almost 3% since yesterday. This happened despite, Bitcoin recording appreciable gains on its daily charts.

Given a strong price correlation with Bitcoin Cash (BCH), Bitcoin’s price rise indeed helped in warding off a strong selling pressure for BCH.

The digital asset was poised for an upward rally over the upcoming trading sessions, with BCH bulls aiming for a key resistance level.

Bitcoin Cash [BCH]

Rising along the trendline, the brief sell-off recorded in the Bitcoin Cash market at press time was soon over. In a quick reversal, after the digital asset witnessed a pullback in prices, BCH bulls aimed to move past the $263.009 resistance level.

Looking at the Relative Strength Index, the RSI noted a neutral view amid mixed signals of buying and selling pressures.

Further, the Aroon Indicator displayed a bearish setup, with the Aroon down (blue) above the Aroon Up (Orange), although hints of weakness in the selling pressure were also visible.

Under this scenario BCH bulls could further rise above, to regain control at the $268.25 level of resistance over the next few trading sessions.

Ontology [ONT]

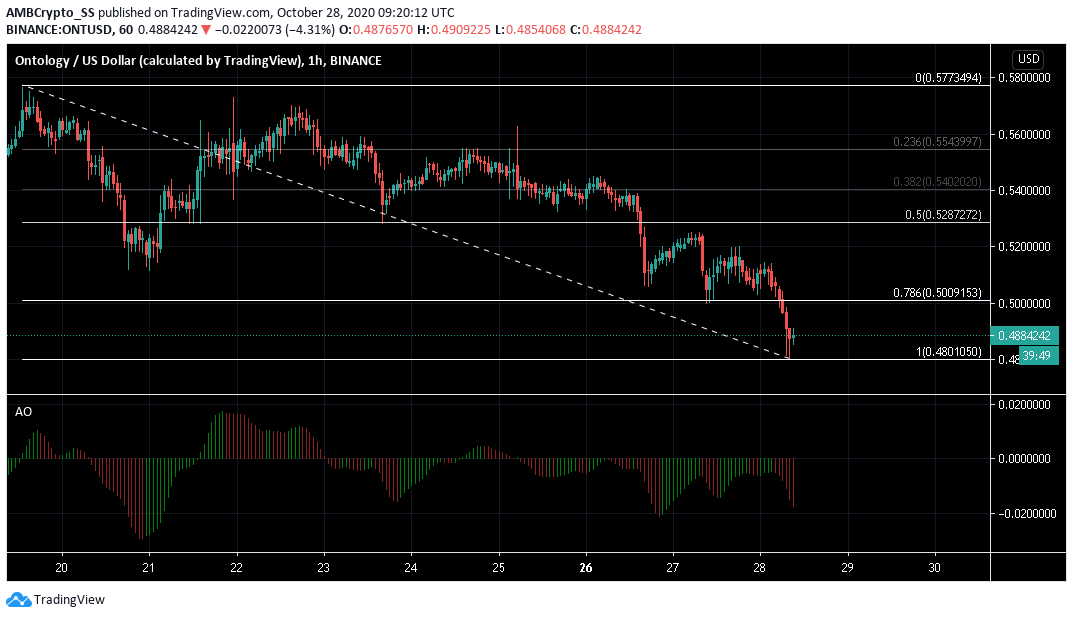

At the time of writing, Ontology was trading at $0.488 after having noted another wave of selling pressure as it fell back at the 100% retracement zone marked by the Fibonacci retracement tool.

An early indication of this sell-off was picked up by the Awesome Oscillator (AO), while the price was still hovering near the $0.488 pivot level.

In fact, the AO’s high bearishness with red closing below the zero line, pointed to a possible price decline under the $0.480 support level over the next few days.

Maker [MKR]

Noting a move to the downside a 1.5% loss since yesterday was recorded in the Maker market. The digital asset at press time, was trading at $565.14

In fact, the cryptocurrency despite an overall uptrend dived beneath its morning lows and could be seen retesting the immediate support level soon. The MACD line registered a bearish crossover too, diving below the Signal line on the charts.

The high levels of volatility, signaled by the widening Bollinger bands, also seemed to side with the bears.

As the digital asset attempts to regain some positive momentum over the next few days, short term price actions, given the existing selling pressure could keep prices near the $556.15 level of support.

The post appeared first on AMBCrypto