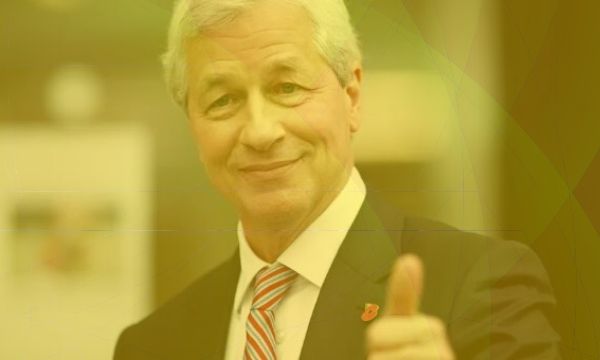

The CEO of one of America’s biggest banks hasn’t had anything nice to say about Bitcoin in the past. Back in 2017, JP Morgan Chase chief Jamie Dimon called Bitcoin a straight-up “fraud,” and a bubble that “won’t end well.” But now, during a CNBC interview at the World Economic Forum in Davos, Dimon says the growing U.S. national debt is the only financial bubble he sees.

To be fair to Jamie, Bitcoin and the entire cryptocurrency industry were at the height of the most parabolic bubble in history when he said he’d “fire in a second” any JPMorgan trader who went long bitcoin because “it’s against our rules and it’s stupid.” At the 2017 CNBC-Institutional Investor Delivering Alpha conference, Dimon said:

“It’s worse than tulip bulbs. It won’t end well. Someone is going to get killed. It’s just not a real thing, eventually, it will be closed.”

Jamie Dimon Comes Around on Crypto

That was in September 2017. Months later, the Bitcoin price catastrophically collapsed, and the altcoin market went down with it. There was blood in the streets. At the height of the bubble, there were media reports of people taking out mortgages on their houses to buy Bitcoin at what turned out to be its peak price. But only four months after he trashed the cryptocurrency, Jamie Dimon said he regretted calling it a fraud, and conceded, “Blockchain is real.”

And this week in Davos, Jamie Dimon sounded like an absolute crypto bull. When asked if he sees any bubbles in financial markets around the world, Dimon said, “only in sovereign debt.” Then he took a swipe at the Federal Reserve and other major central banks:

“Right now people think central banks around the world can do whatever they want. They can’t.”

He added an ominous warning that inflation “would be the big negative surprise.” He may not have been thinking about cryptocurrencies, but at this point, that’s rather unlikely. Crypto has obviously been on his mind lately.

Bitcoin Isn’t Tulips, But Fiat Has The Shelf Life of Cabbage

The sovereign debt bubble and inflationary fears are precisely what is attracting people to deflationary, decentralized currencies like Bitcoin (BTC). They want to be able to protect and grow their savings in a way that isn’t subject to manipulations by a central authority with its agenda.

At best, as with the Federal Reserve, that agenda is to incentivize people to get rid of their extra cash as fast as possible. They continually dilute the value of the dollars in your pocket, so you unhand them quickly for stocks, bonds, consumer goods, anything but those evaporating dollars. Venezuela’s practically worthless national currency is a prime example.

No wonder Bridgewater Associates’ Ray Dalio said, “Cash is trash” at Davos this week. These finance heavyweights won’t admit it, but they are some of crypto’s biggest boosters.

Featured image courtesy of Business Insider

The post appeared first on CryptoPotato