Fear dominates the Bitcoin and crypto markets, but growth and adoption continues unabated.

According to the Crypto Fear & Greed Index, which gauges the general market sentiment by analyzing and aggregating multiple data points into a single number on a scale of 0 to 100, whereby 0 signifies extreme fear and 100 extreme greed, the prevailing sentiment of the crypto markets in the past six months has been mostly “fearful” — continually oscillating in the range of 20 and 40.

Judging by the available data, the community’s overwhelmingly negative outlook on the industry seems largely irrational — almost as if the bearish sentiment is entirely effectuated by unmet, unrealistic expectations and repressed feelings of grief for the (what now seems unattainable) all-time high.

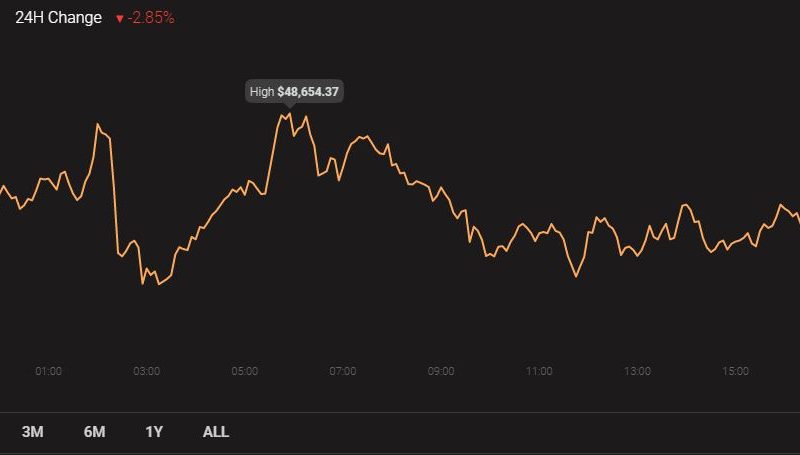

The negative outlook seems unjustified because, despite the downturn in Q2 of 2019, most of the large-cap crypto-assets actually finished the year significantly up in terms of price. Bitcoin’s price, for example, increased by 90% by the end of the year, while Ethereum is down only 6%.

The latest research recently published by Coin Metrics paints an entirely different picture of the state of crypto than the one inferred by the price charts or the fear and greed index.

Volatility, which has traditionally been pointed out as one of crypto’s biggest downsides, is declining across the board. At the end of 2019, the 30-day volatility (the measure of the 30-day standard deviation of log daily returns) was 2.6% for Bitcoin and 3.3% for Ethereum.

Crypto adoption is also on the rise, with the figures looking better than what most would expect. Even though it’s hard to pinpoint the exact number of crypto users, we can make a pretty good estimate by looking at the number of active blockchain addresses and the number of addresses with a balance of at least $10.

According to the Coin Metrics’ “State of the Network” report, active addresses increased for most of the major crypto-assets over the past year. Bitcoin marked an increase of 16%, BCH 90%, and LTC 12%, while USDT_ETH, LINK, and XTZ saw the biggest growth of the year with 44-fold, 6-fold, and 2-fold increases, respectively

The number of addresses with a balance of at least $10 can be used as a rough approximation of the total number of small or “retail” holders of an asset. Similar to active addresses, this figure is also on the rise for most of the large-cap crypto-assets on the market. Bitcoin and Ethereum remain the dominant crypto-assets in terms of retail holders: Bitcoin, which has 4-times as many addresses with a balance of at least $10 than Ethereum marked an increase of 40% in 2019, while Ethereum, which has more than double any other asset on the market, saw an increase of 20%.

The number of big “whale” investors is also on the rise and, similar to their taste in smaller retail investors, BTC and ETH are also their two favorite bags to hold. BTC finished the year with over 11,000 and ETH with over 1,800 addresses with a balance of at least $1M, and no other asset finished with more than 700.

The significant increase in economic activity for most major crypto-assets also tells a bullish story. Increases in transactions, transfers, and adjusted transfer value can be seen all across the board. The most striking statistic of all is USDT_ETH’s incredible 59-fold increase in transaction count during the course of a single year.

The health and security of a particular cryptocurrency network are in large part dependent, if not entirely correlated, with the health of the mining industry surrounding it. Miners are in it for the money, which means that as long as there’s money to be made from mining, miners will keep increasing the amount of computing power devoted to securing the network, which then equates to more secure networks.

Note here, of course, that this is quite a reductionist assessment and that issues such as the health and security of a particular cryptocurrency network are vastly more nuanced — with the degree of decentralization and geographical dispersion of miners playing a significant role, among many other factors.

On that front, things are looking stellar. Bitcoin, which is otherwise the market leader in terms of cumulative hash rate, marked a yearly hash rate increase of over 130%. The incentives are also looking strong, with miner revenue (transaction fees plus newly issued supply) seeing an increase of 78% for Bitcoin, 26% for Bitcoin Cash and 190% for Tezos.

As should be expected due to upcoming plans to switch to a proof-of-stake-based algorithm in 2020, Ethereum saw a decline in both hash rate and miner revenue over the course of the past year.

Despite the overwhelmingly negative sentiment, 2019 was still a good year for crypto. The decrease in volatility and the rise in prices, adoption, miner revenue, and hash rate are all bullish signs heading into 2020.

This year on the crypto menu we have the Bitcoin halving, Ethereum’s upgrade to proof-of-stake, the potential launch of the first regulated crypto bank, and the potential roll-out of China’s CBDC. It’s going to be a feast!

The post appeared first on CryptoBriefing