The largest cryptocurrency, Bitcoin finally witnessed great volatility sneaking into the market, after months of remaining dormant. This upwards volatility helped the coin’s price to rise by 18% in a day, which eventually pushed the price above $10k. The peak registered during the rally was $11,417, whereas the price has reduced to $10,735, at press time. This gusto moved the interest higher in the BTC derivatives market.

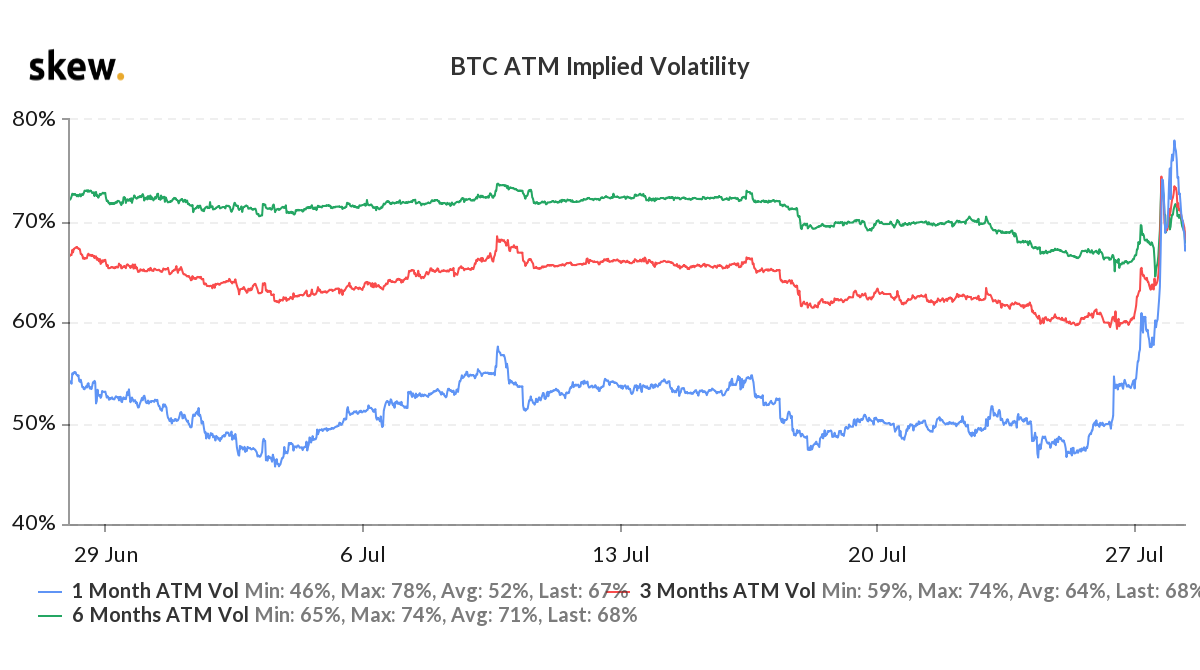

According to data reported by Skew, the open interest in the BTC options market had reached an ATH of $1.853 billion, with Deribit leading with $1.5 billion. As the demand for options increased in the market and began trading with a peak volume of $772 million, the Implied volatility also increased. The 1-month IV laid under 55% on 26 July, which was pushed to 77% as the demand for options increased and may have resulted in high-priced options premium. This may also mean that the market may witness a more volatile behavior going forward.

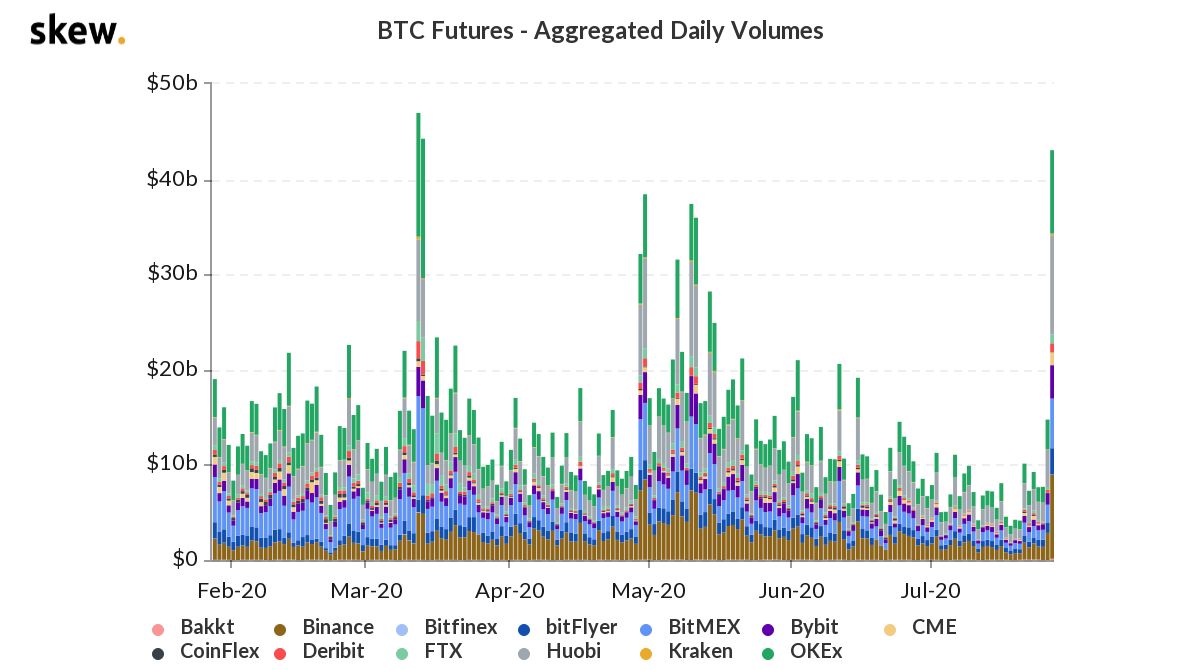

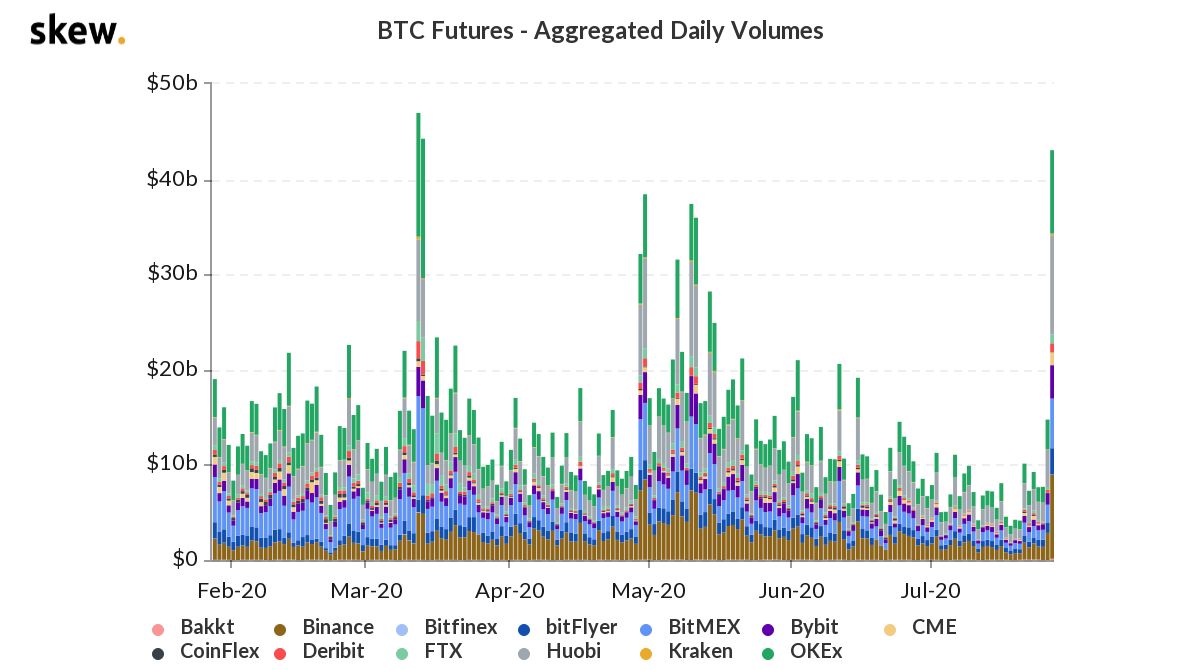

While the Futures market also witnessed great interest from the traders after slumbering in the past few months. Apart from mainstream BTC derivatives platform contributing majorly to the daily volumes, CME and Bakkt also rallied with great appetite. This implied that despite undergoing a tough market in the past few months, the institutional investors were not far away from the market and jumped right in. The CME and Bakkt futures reported record volumes yesterday with $1.3 billion and $132 million.

Source: Skew

The trading volume aligned with that of the Black Thursday event, suggesting a highly active futures market.

However, as the derivatives traders moved to realize profits from the latest Bitcoin action, the lack of momentum for the futures puts this rally under the spotlight. According to data by Deribit, the greed was dangerous in the near-term options, and as per Alternative.me, the sentiment of the market has become ‘Extreme Greed’.

Source: Alternative.me

Greed was prevalent in the market even before, but the rally pushed it a level higher. This sudden boost can be the late impact of the news regarding US banks offering custody to crypto users and the fact that the market has indicated that profits may not last long as BTC had already begun a minor correction.

The post appeared first on AMBCrypto