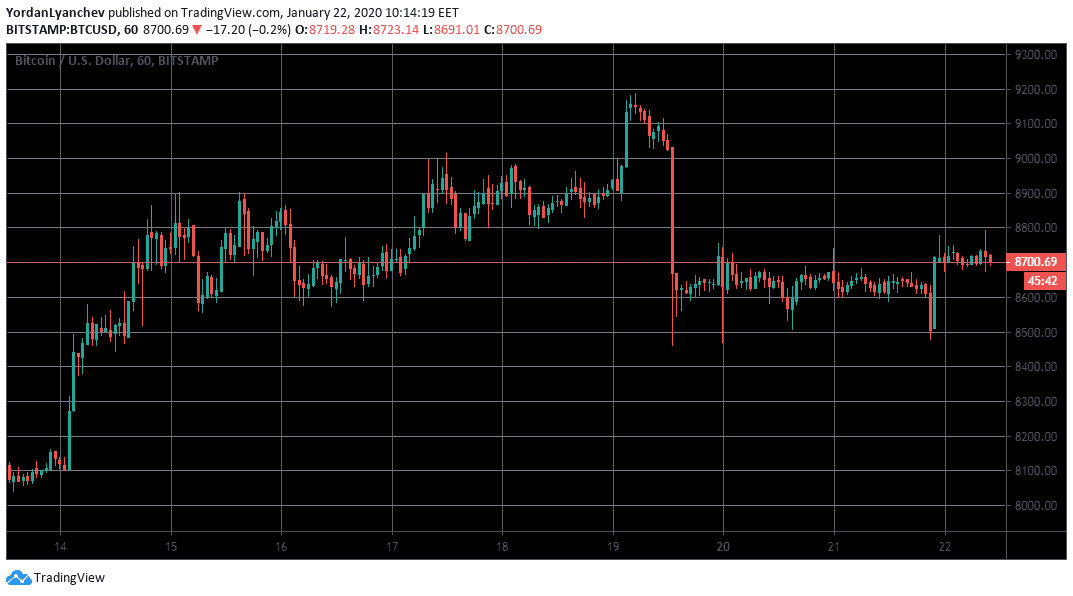

After last week’s surge to nearly $9,200 and the following retracement, Bitcoin has been trading mostly in a range between $8,500 and $8,750. Yesterday, it noted a quick dip to $8,480 on Bitstamp and immediately surged back to over $8,700, which is where it currently stands.

If Bitcoin’s bullish 2020 price movements are to continue, it has to break the first major resistance level of $8,730, which is also the 38.2% Fib level. If successful, $8,900 will follow, which is the Golden Fib of 61.8%.

Alternatively, $8,400 serves as a support line and further down is the $8,000 level, which is also a strong psychological point.

BTCUSD1h. Bitstamp. Source: TradingView

Even though it seems that Bitcoin has stabilized around $8,700, its dominance over the market has reduced to 65.7%, which is the lowest point in 2020. Combining this with the rising alternative coins, the community speculates on whether or not a new altcoin season is already in the making.

Ethereum (+1.41%) is just a shy of $170, while Bitcoin SV continues its remarkably positive year with another 4.6% gain to $319.

Binance completed the 10th burn of its native coin yesterday, and BNB rises with 4% today to $18.15. Litecoin also registers around a 4% gain and is close to $60.

Cryptocurrency Market. Source: coin360.com

Total Market Cap: $242 B | Bitcoin Market Cap: $159 B | Bitcoin Dominance: 65.7%

Major Crypto Headlines

Major Central Banks Announce Cooperation On Efforts Regarding Cryptocurrencies. The central banks of Britain, the Eurozone, Japan, Sweden, and Switzerland will reportedly create a dedicated group to discuss the eventual benefits of launching their own cryptocurrency.

At Davos: Billionaire Ray Dalio Says Bitcoin Fails The Purposes Of Money. Speaking at Davos, the famous U.S. investor Ray Dalio said that Bitcoin fails the two purposes of money because of its volatility. He also says that people should avoid fiat currencies, as “cash is trash.”

Another One Bites The Dust: SEC Brings Charges Against Another ICO. The Securities and Exchange Commission (SEC) has recently brought charges against another allegedly fraudulent ICO of unregistered digital asset securities. It appears that the U.S. market regulator is becoming much more stringent in this manner.

Significant Daily Gainers and Losers

Komodo (24.87%)

KMD is the most significant gainer in the last 24 hours against both USD and BTC, with a similar rise of around 24-25%. Komodo’s price is $0.76, and it trades that 8775 SAT.

The company recently updated its documentation for developers, which now consists of over 1000 pages of tutorials.

Golem (24%)

GNT’s impressive surge of 24% has returned it to the top 100 coins by market capitalization. Golem is now at over $0.04, and its increase of 23% against Bitcoin means that GNT/BTC trades at 473 SAT.

Golem will stream its first 2020 AMA later today, where it should announce the upcoming updates and developments from the team.

MCO (-6%)

In the predominantly positive market, MCO stands on the opposite side with a 6% decline since yesterday. It has dropped to $4.77 against the dollar and to 55000 SAT against the largest cryptocurrency.

Moreover, the recent negative price movement also means that MCO’s total market cap has decreased to around $75 M.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

Technical analysis tools by Coinigy.

The post appeared first on CryptoPotato