Another leg up took Bitcoin to a fresh yearly high of over $14,500. Most alternative coins were left behind, and BTC’s dominance over the market has further expanded to nearly 65%.

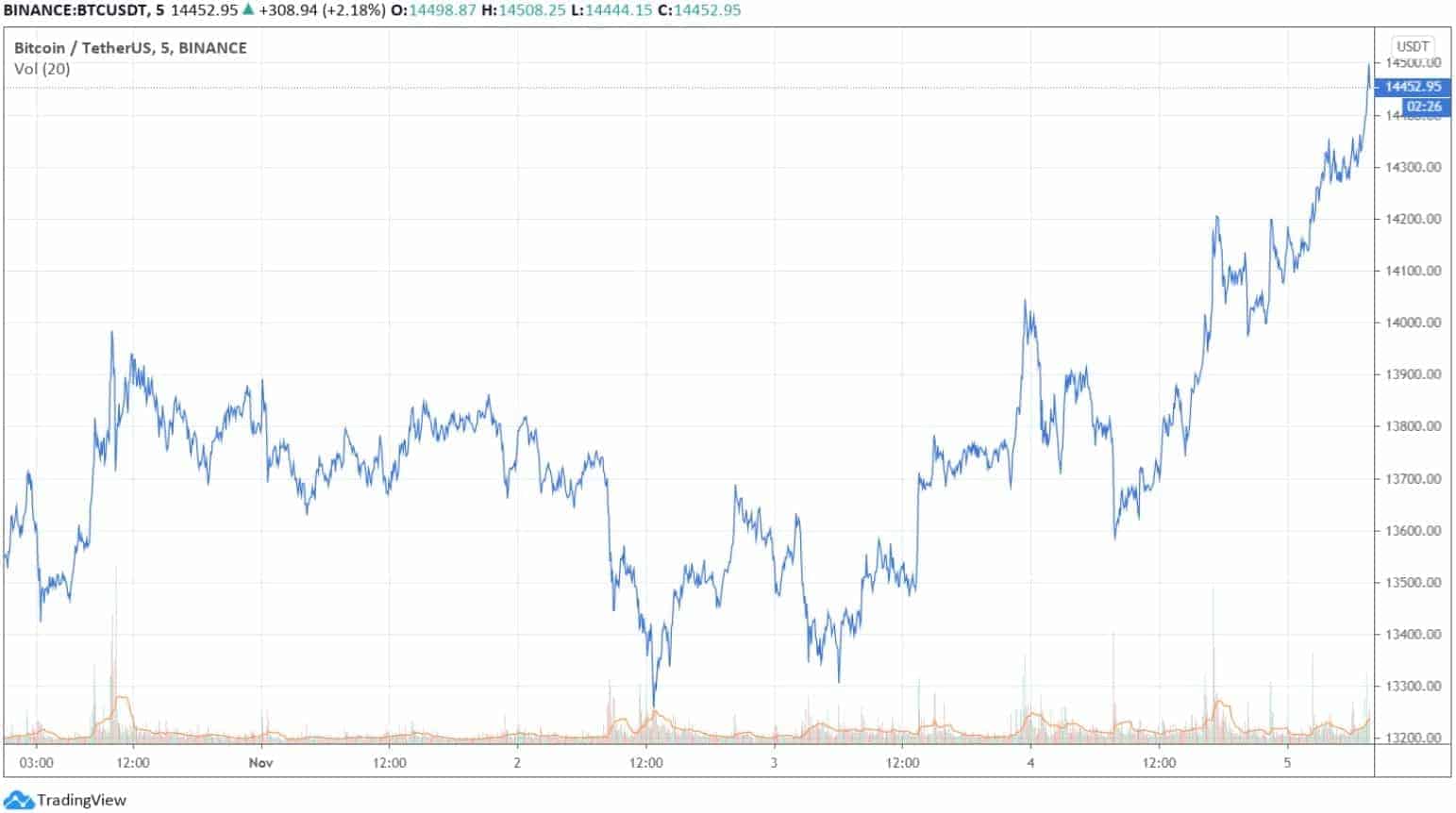

Bitcoin Peaks Yet Again To $14,350

It’s safe to say that the primary cryptocurrency has enjoyed the past several weeks. Bitcoin marked consecutive yearly highs in October and finally broke above the 2019 high last Saturday. At the time, BTC registered a fresh 1,000-day high of $14,100.

The digital asset struggled with maintaining its price tag above it in the following days, until yesterday. It’s still unclear if the US elections directly impacted the price, but Bitcoin jumped back to above $14,000.

Nevertheless, another rejection followed, and BTC met its intraday low of $13,550. Although the situation seemed unfavorable, Bitcoin tends to prove people wrong, and that’s precisely what transpired just hours ago.

For the third time in less than a week, BTC spiked above $14,000. However, this time it didn’t fall immediately. Instead, it kept on rising and painted another YTD high above $14,500 (on Binance). This is now the new highest price tag BTC has seen since January 2018.

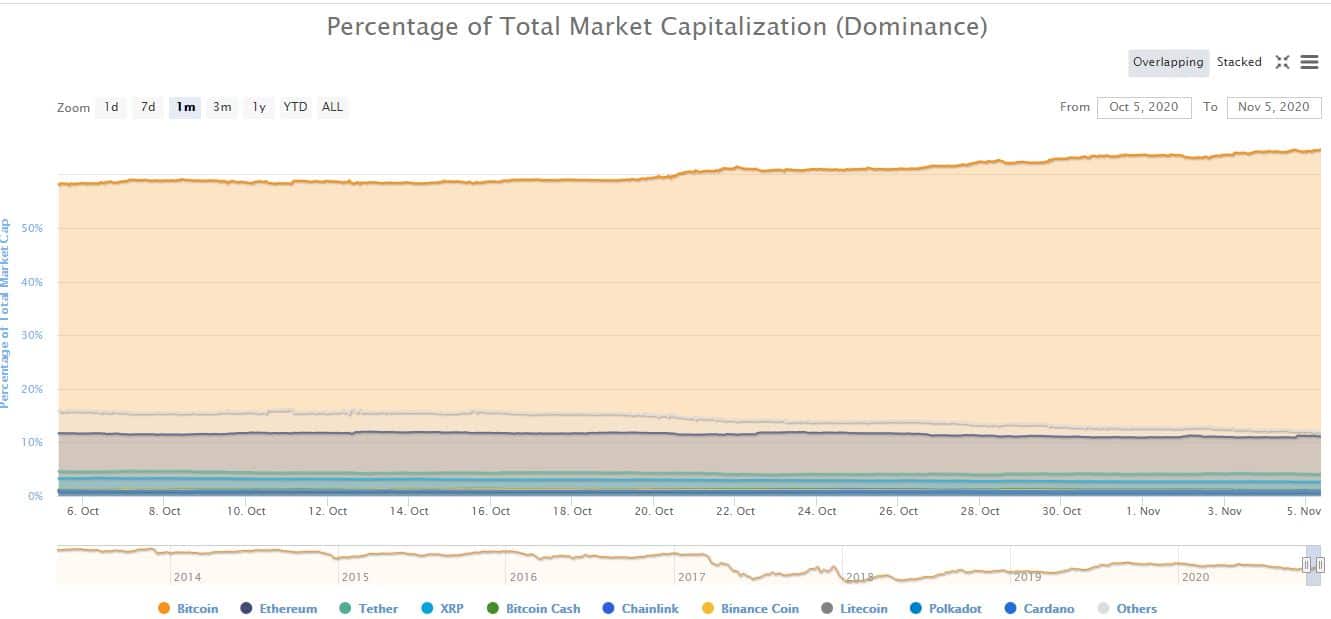

BTC Dominance On The Rise

Most alternative coins have failed in pursuing their leader. Ethereum is among the few exceptions. ETH has pumped back above $400 after a 5.1% increase. The positive price development could be largely attributed to the Ethereum 2.0 deposit contract’s launch, announced by Vitalik Buterin yesterday.

Binance Coin (4.3%) and Litecoin (4.8%) have also gained value against the dollar. A lot of the remaining cryptocurrencies have also charted slight increases, though not as significant as that of BTC.

Consequently, the metric measuring Bitcoin’s relative share of the total market cap, namely the BTC dominance, has continued its gradual increase and now sits at above 64.8%. It’s worth noting that less than a month ago, it was down to 58.2%. This 6.6% surge in three weeks has taken the BTC dominance to its highest level since June 2020.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato