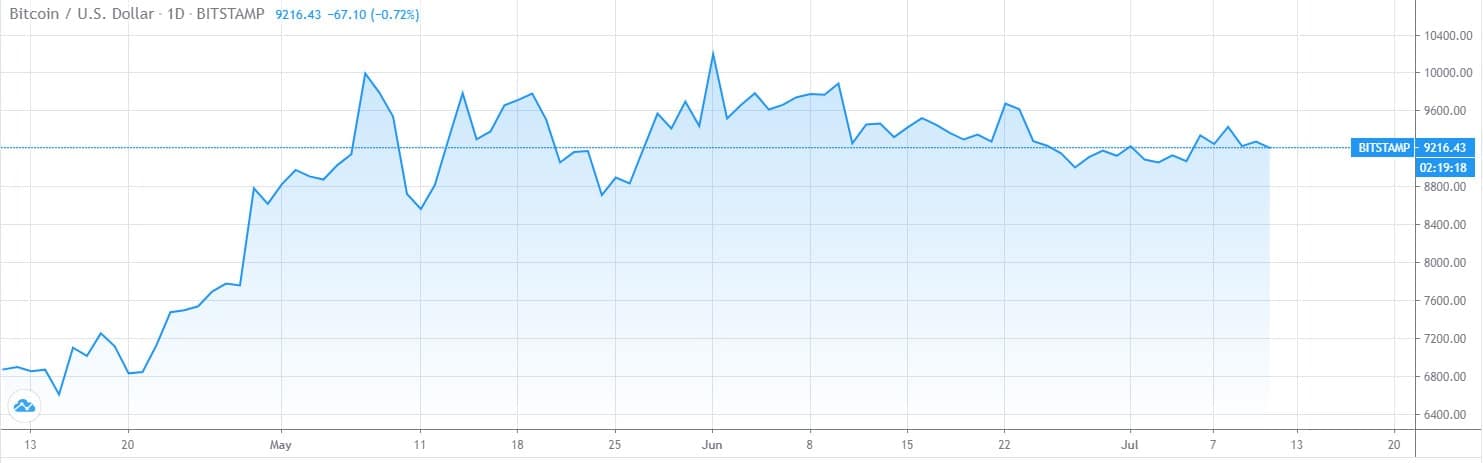

Bitcoin prices followed stock markets down on Friday, sliding to an intraday low of $9,050; however, the primary cryptocurrency was able to recover in order to reclaim $9,300 over the past day but failed to break resistance there, sliding again to around $9,200 during most of Saturday.

The move has kept BTC within its range-bound channel as the consolidation, which began in early May, resumes. Trading volumes and volatility is dwindling, which could signal a more massive move ahead.

Bitcoin Dominance At Critical Point

Volatility is not the only element that is decreasing. Bitcoin’s dominance has also dropped to a twevle-month low, reaching 62.5%. In early May, dominance was close to 70%, and the timeframe coincides with the DeFi boom, that began around then.

The last time the Bitcoin Dominance was as low as today’s was approximately a year ago, according to Coinmarketcap.

Crypto analyst CryptoFibonacci has identified a significant confluence area for BTC dominance. A major trend line could be broken down if dominance falls any further.

$BTC Daily Dominance Chart.

Will be interesting see what happens in the next few days or now.#BTC pic.twitter.com/UeIafO1AVO

— CryptoFibonacci (@CryptoFib) July 11, 2020

A fellow analyst was not confident that the dominance ratio would return to previous highs, adding;

“I don’t think we’ll ever see $BTC over 70% maybe not even 65%. Way too many up and coming winning ALTS, the competition is getting next level.”

Messari researcher, Jack Purdy, pointed out that Bitcoin has done absolutely nothing two months after the halving, before adding that this was no different to the previous 2016 halving event.

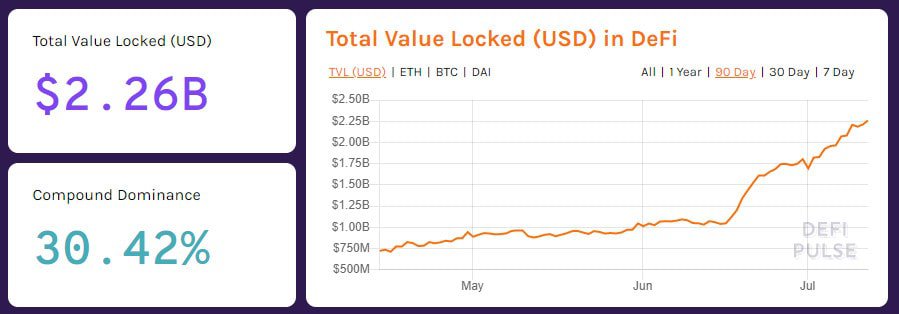

DeFi Driving Altseason

BTC’s market share has been eroded by the explosion in DeFi tokens over the past two months. Total value locked (TVL) across all decentralized finance markets has hit another all-time high today of $2.26 billion. Still, the speed at which crypto collateral has flooded into the space is even more remarkable.

In less than a month, DeFi TVL has surged 114% as over a billion U.S. Dollars’ worth of crypto has been pumped into the smart contract-based lending and borrowing ecosystem. By contrast, crypto markets have only managed a meager 1.5% gain in terms of total market capitalization over the same period.

DeFi tokens are in the driving seat at the moment, kick-starting what could be the beginnings of a long-awaited alt-season once again. Compound Finance catalyzed the momentum with its COMP token launch in mid-June, and since then, a raft of DeFi based tokens have had their own moon shots.

In addition to COMP, massive moves have been seen at Balancer (BAL), Kyber Network (KNC), Aave (LEND), Synthetix (SNX), Elrond (ERD), 0x (ZRX), Ren (REN), and Bancor (BNT).

The common factor between them all is DeFi. Hence, it comes as a surprise that the blockchain of the majority of the DeFi tokens, Ethereum, has yet to benefit and has been as inactive as Bitcoin over the past month or two.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato