When volatility is low and the market sentiment is neutral, copy trading may be the best bet for retail traders. Social trading platforms have been around for a while, however, they are even more relevant now.

Consider this – Finance Illustrated recently released a list of the top traders on the social trading platform, eToro. These traders have everything from crypto to tech stocks and retail giants in their portfolio. Unlike a conventional 80/20 portfolio, however, these traders have allocated up to 5% of their funds to top cryptocurrencies like Bitcoin, Ethereum, and Binance Coin.

In fact, almost 30% of the top traders’ portfolios have allocations distributed across Bitcoin and these two altcoins.

Let’s check out a few examples, shall we?

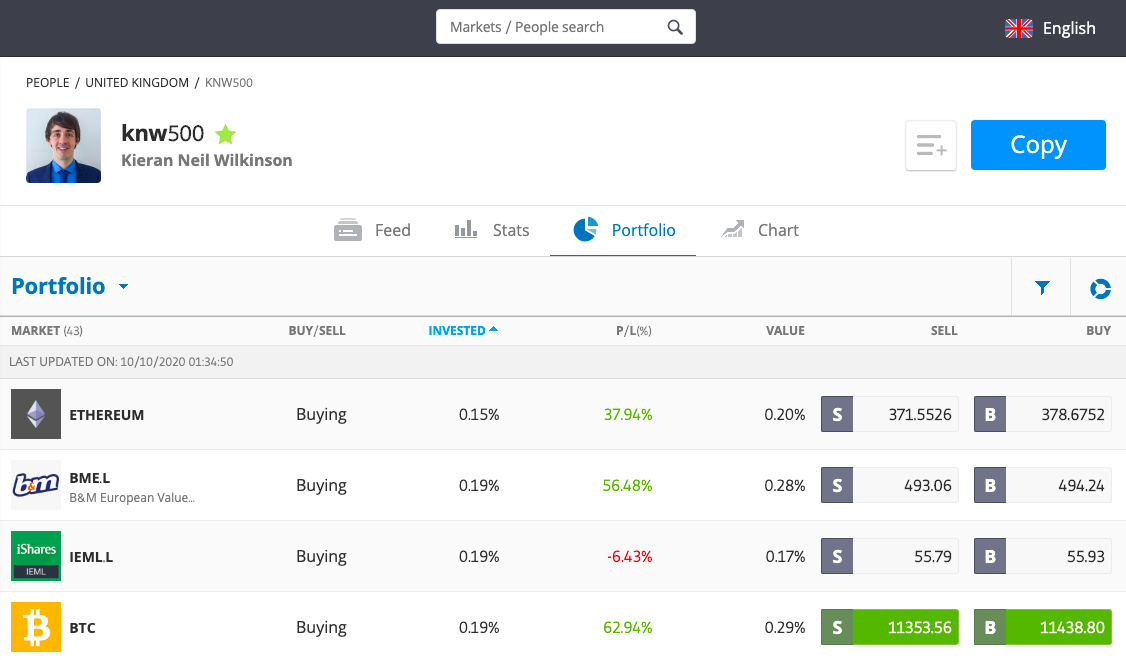

Portfolio of Fund Manager Kieran || Source: eToro

FundManagerZech is among the top-13 traders on the platform and has 17k followers. In the aforementioned portfolio, the fund manager has invested 5.22% of his funds in Binance Coin and 2.32% in Ethereum. Ethereum, with a PNL of 171%, is the biggest contributor to his ROI and a portfolio with a mix of tech stocks and Ethereum is profitable 73% of the time, based on data from eToro.

Portfolio of Fund Manager Kieran || Source: eToro

On the contrary, Fund Manager Kieran has allocated 0.15% to Ethereum and 0.19% to Bitcoin. However, the PNL is 62.96% for Bitcoin and 37.94% for Ethereum. The percentage of funds invested in cryptocurrencies may be low due to the risk exposure, however, less than 1% of the invested funds are driving 60% of ROI and this is more rewarding than the conventional 80/20.

What’s interesting in these two portfolios is that these traders have bought Bitcoin at a $10.5-$11k level. While they have booked profits on their previous trades, now they are open to buying at the present level. These well-performing traders have chosen to incorporate BTC, ETH, or BNB constituting 1-5% in their portfolios. These findings aren’t the first or only findings. And, they certainly won’t be the last ones.

Consider this – Investment from institutions has poured in this YTD. While FOMO kicks in for institutions, this is beneficial to the retail trader as the market capitalization of cryptocurrencies is climbing steadily. This translates to higher trade volume and liquidity on spot and derivatives exchanges.

The total inflow to cryptocurrencies stands at $9.15 billion too. Though this pales in comparison to the inflows before a bull run, this may increase activity on exchanges in stablecoin markets, subsequently increasing trade in Bitcoin.

Though traders in the crypto-market may be putting DeFi over Bitcoin right now because it’s the hottest trend, top traders differ. DeFi or other altcoins don’t even feature in their portfolios. BTC, ETH, and BNB are largely the top 3 choices and this may possibly signal a bullish development in their price.

The post appeared first on AMBCrypto