2019 has been crucial to the emergence of the crypto-derivatives market. Many industry experts believe that this sector would soon replicate “positive figures exhibited by the traditional market” as crypto-derivatives become more and more popular with institutional traders and investors continue to jump into the bandwagon.

For a long time, the derivatives space was dominated by players like BitMEX. However, exchanges such as the Malta-based crypto-giant, Binance, have also gained a consistent foothold over the past year. According to Binance Research’s latest report titled, ‘December Markets Overview‘ published on 3 January 2020, Binance Futures have recorded consistent growth.

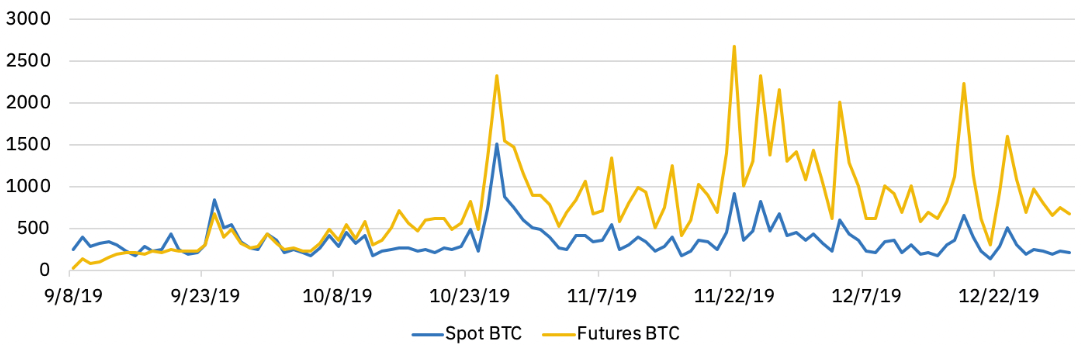

Source: Binance Research | Volume of Binance BTC/USDT perpetual futures contract and spot market [in USDT million]

The report stated that the volume on BTC/USDT perpetual contracts was higher than the total spot volume across all pairs on Binance.com’s platform for the most part of the year.

The first major spike for both spot as well as Futures volume was noted in October 2019. This was during the same time when Bitcoin witnessed a sharp surge in its price from a low of around $7.4k to $9.6k within 48 hours. The next major high for BTC/USDT perpetual Futures volume was seen in November, a high which coincided with a short-lived price rebound. BTC spot volume, on the other hand, did not post a significant figure, despite a few minor surges since October.

The latest high in BTC/USDT Futures was occasioned with the king coin’s price rally from $6.6k on 19 December to $7.5k on 23 December.

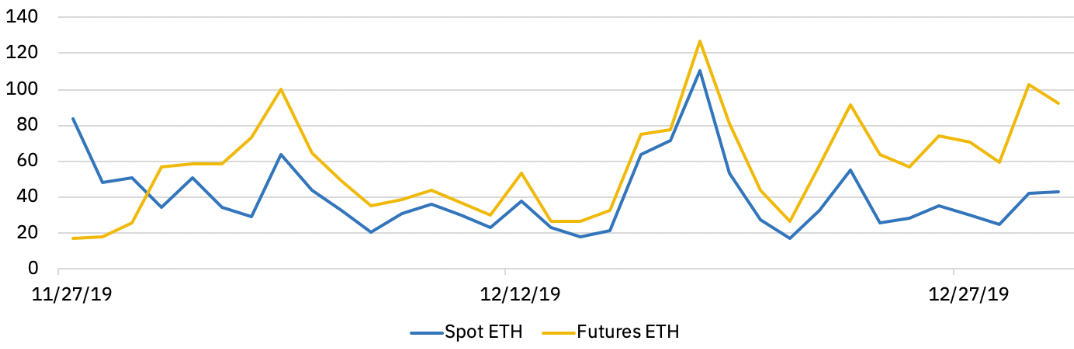

Source: Binance Research | Volume of Binance ETH/USDT perpetual futures contract and spot market [in USDT million]

Binance had launched ETH/USDT perpetual Futures contracts in November last year with up to 50x leverage and since then, a similar trend has been noted for ETH as well. The Futures volume was recorded to be higher than the spot volume. The report elaborated,

“ETH/USDT perpetual contract markets displayed a median daily volume of $58.7 million while the spot market exhibited $32.9 million daily volume.”

The post appeared first on AMBCrypto