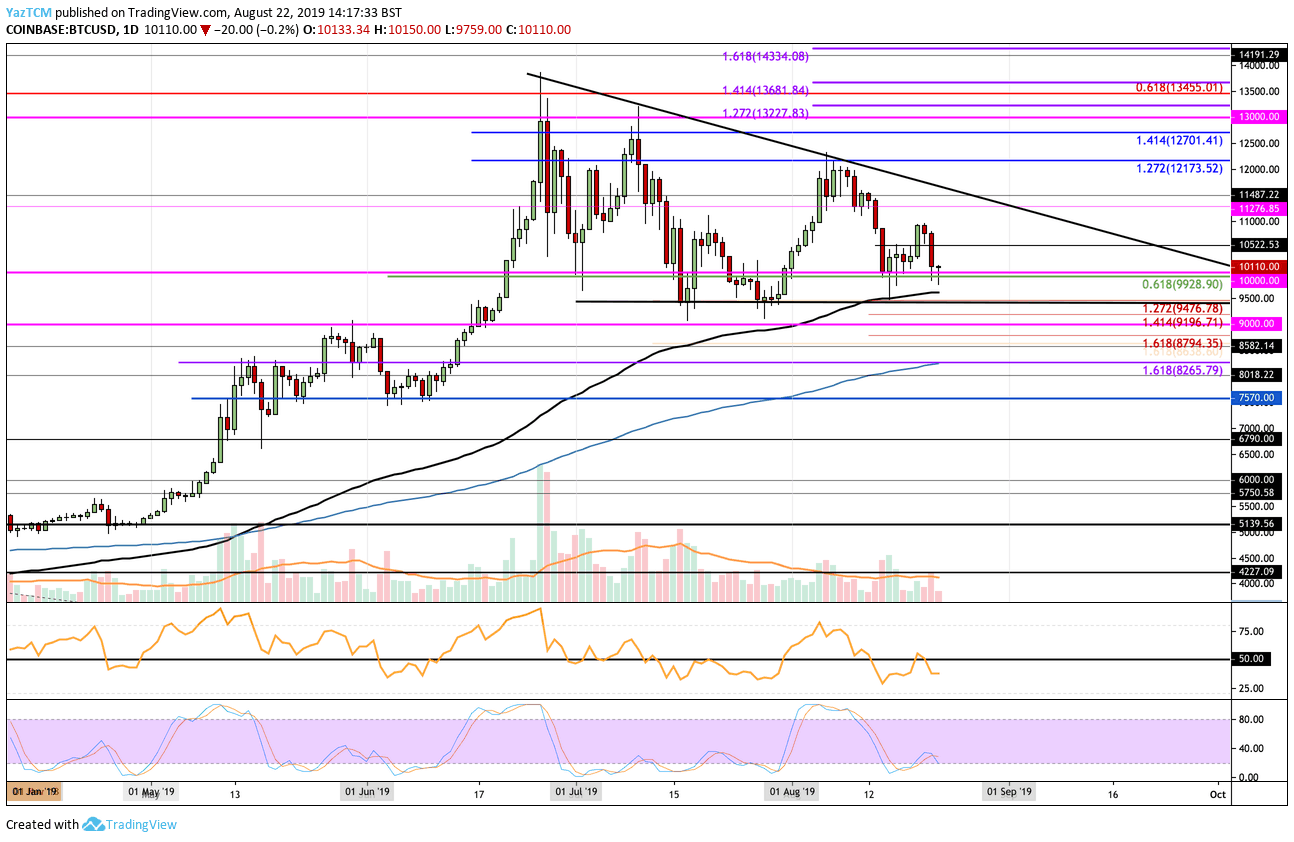

Bitcoin has been on a rollercoaster over the past few days, after rebounding at $10,000 only to reach the resistance at $10,800 and rolling over to return down to $10,000, where it traders now.

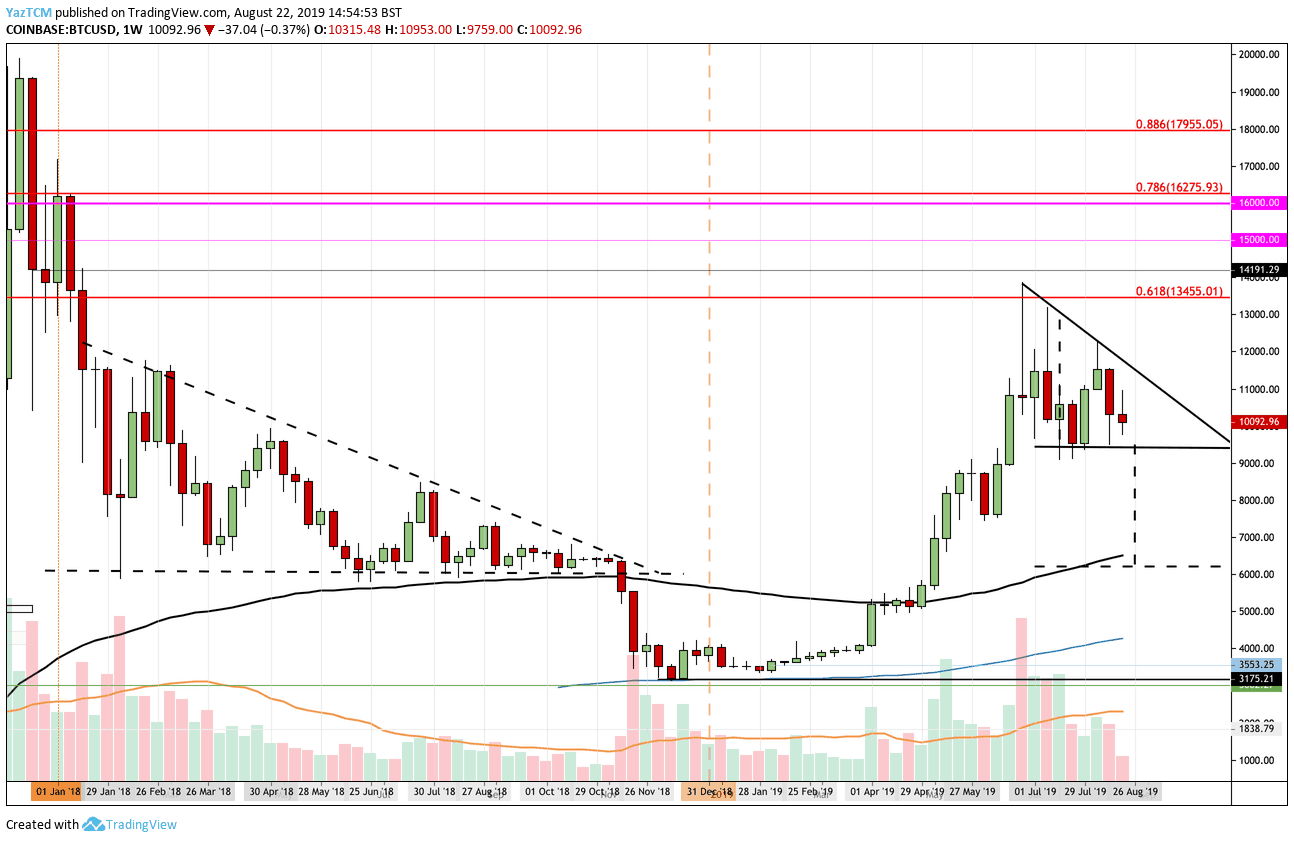

Looking at the Bitcoin weekly chart, we can see that the coin might be forming a descending triangle pattern. The interesting thing to note is that this pattern is remarkably similar to the massive descending triangle seen during most of 2018. The last was finally broken during the middle of November 2018, ignited the gigantic drop from $6,000 to 2018-low at $3,120.

Two Similar Triangles: Different Size

Analyzing the weekly chart above, we can see that Bitcoin has been trading within the triangle over the past few months now. The Bitcoin price had surged from April through June 2019 but had failed to break above the Fibonacci retracement level at the $13,500.

As a reminder, the breakdown of the 2018 triangle resulted in Bitcoin price dropping roughly 45%. Similarly, in the current descending triangle, a breakdown of the bottom of the triangle would technically predict a target of approximately $6,100 (measured as the pole of the triangle) which is roughly a 36% price drop. On the other hand, if the bulls can defend the lower boundary of the triangle and push higher to break above the upper boundary eventually, this pattern will likely to become invalidated.

Bitcoin Short-Term Bearish, But Long-Term (Still) Bullish

Analyzing the daily chart above, we can see that the base of the triangle is marked at the $9,400 region. Bitcoin is currently trading at the $10,000 support level as the buyers battle to remain above. However, it does look to me like the sellers will break beneath to possibly test the lower boundary of the triangle. Before it can reach the lower boundary, the bears will need to break beneath the support at $9,928 which is provided by a .618 Fibonacci Retracement level.

If the sellers can continue to break beneath this, they will also have to contend the support at the 100 day EMA which is just slightly below at the $9,630 level.

The lower boundary is further bolstered by a short term downside 1.272 Fibonacci Extension level being located at the same price. If the sellers do break beneath the support at the lower boundary, we can expect immediate further support to be located at $9,196 (downside 1.414 Fib Extension), $9,000 and $8,794.

The technical indicators are all favoring the bearish case at this moment in time as the RSI trades beneath the 50 level, which indicates that the sellers are in control over the market momentum. However, if the bulls can defend the lower boundary of this triangle, this may be enough to bring the RSI back above the 50 level to help turn the market bullish once again.

However, keeping in mind Bitcoin going back to $6,100 will still keep Bitcoin bullish when looking on the longer-term analysis. As long as Bitcoin stays above the $3000 – $4000 price area, the market is still on the uptrend for the longer time frame.

Overall, Bitcoin has had seen a great bull-run during 2019 after being able to rise from beneath $4,000 to over $13,800.

Be the first to know about our price analysis, crypto news and trading tips: Follow us on Telegram or subscribe to our weekly newsletter.

More news for you:

The post appeared first on CryptoPotato