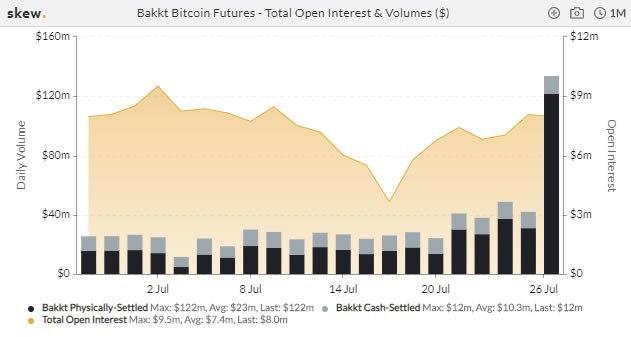

The Intercontinental Exchange (ICE) backed Bakkt has just reported its largest single-day volumes for physically settled monthly Bitcoin futures contracts. On Monday, the figure hit a new record, trouncing the previous one.

“Our Bakkt Bitcoin Futures reached a new record high of 11,509 contracts traded today – an increase of 85% from our last record-setting day,” – Bakkt tweeted.

Physically-settled contracts are paid out in BTC as opposed to cash-settled ones that get delivered in USD.

Futures on Fire

According to data from Skew analytics, Monday’s surge was one of the largest ever seen on the institutional investment platform hitting $122 million, up from a monthly average of $23 million.

Bakkt is a relatively small player in the world of crypto-asset futures with major exchanges such as Huobi, Binance, and OKEx, taking the lion’s share of the volume.

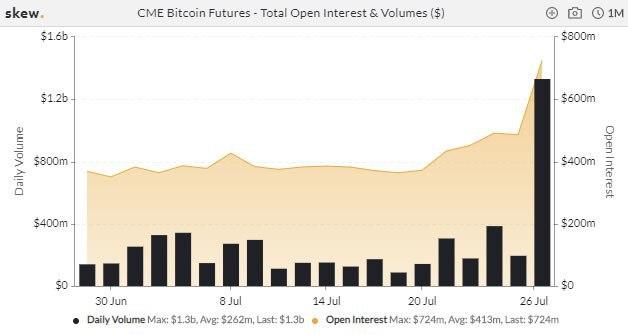

Skew also reported that CME futures also surged on Monday as Bitcoin prices broke out of their rangebound channel. The Chicago Mercantile Exchange is one of the largest institutional investment platforms in the world. Daily volume topped $1.3 billion while open interest, which is a measure of the total number of outstanding derivative contracts that have not been settled, also soared to $724 million.

The analytics provider also reported that Ethereum futures were experiencing an uptick as prices finally awaken. Again, the major crypto exchanges dominate the markets with digital asset derivatives.

Bitcoin Price Update

The move has been correlated with Bitcoin’s breaking of longer-term resistance and powering to its highest price to date this year.

In late trading on Monday, BTC prices topped out at just over $11,400. The move has eclipsed the previous high in February of $10,500 and has returned the king of crypto to its highest level since mid-August 2019. The next hurdle in terms of resistance is to top $12,300 though a correction is likely after such a rapid move.

Over the past few hours, BTC has pulled back to settle below $11,000, though analysts are starting to turn bullish with their predictions as the longer-term trend line has now been broken.

For those of you, who prefer log-scale charts:

the resistance line has been broken anyway.

The price should hold above it though, otherwise no lambos… #bitcoin $BTC $BTCUSD pic.twitter.com/z7PMrDKHrp— CryptoHamster (@CryptoHamsterIO) July 28, 2020

Further bullish momentum from both Bitcoin and Ethereum, which is about to see the launch of the final ETH 2.0 public testnet, is likely to drive action for institutional futures contracts markets.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited – first 200 sign-ups & exclusive to CryptoPotato).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato