So far, 2020 has been a remarkably positive year for Bitcoin. Not only has the price of Bitcoin increased by 30%, but the Global Bitcoin Futures market open interest has noted a massive 60% growth as well.

In the meantime, BitMEX and OKEx are still the most widely-used Bitcoin margin trading exchanges, with over 50% of the market share.

Bitcoin Futures Market 2020 Surge

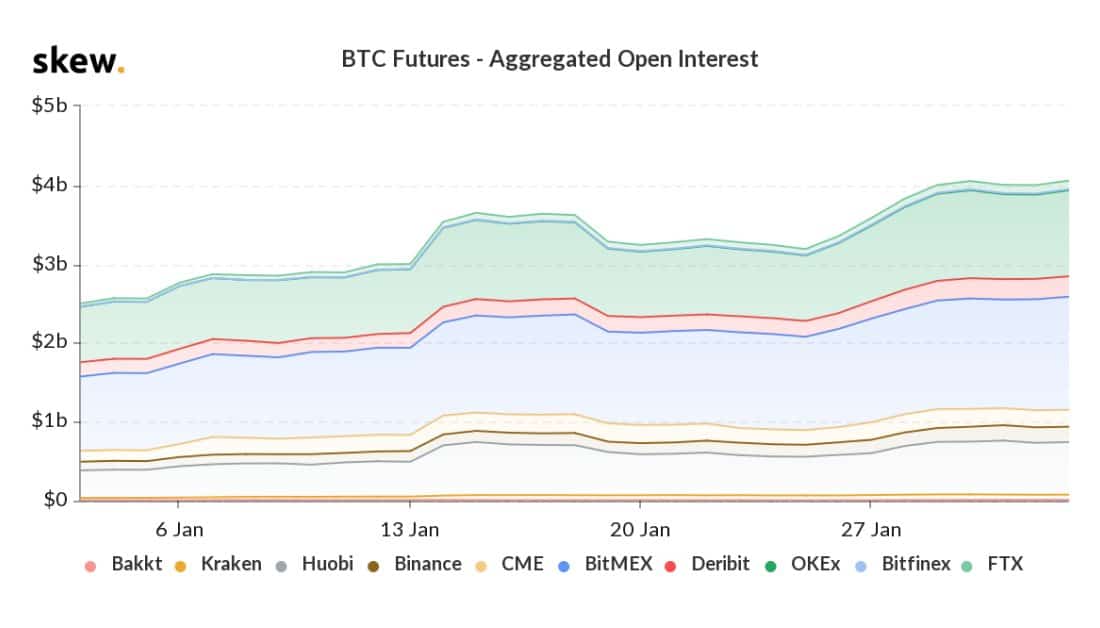

According to the monitoring resource Skew, the global Bitcoin Futures open interest is continuously increasing. In fact, solely in January 2020, it had recorded a significant surge of over 60%, as the aggregated open interest had exceeded $4 billion.

Bitcoin Futures Volume. Source: skew.com

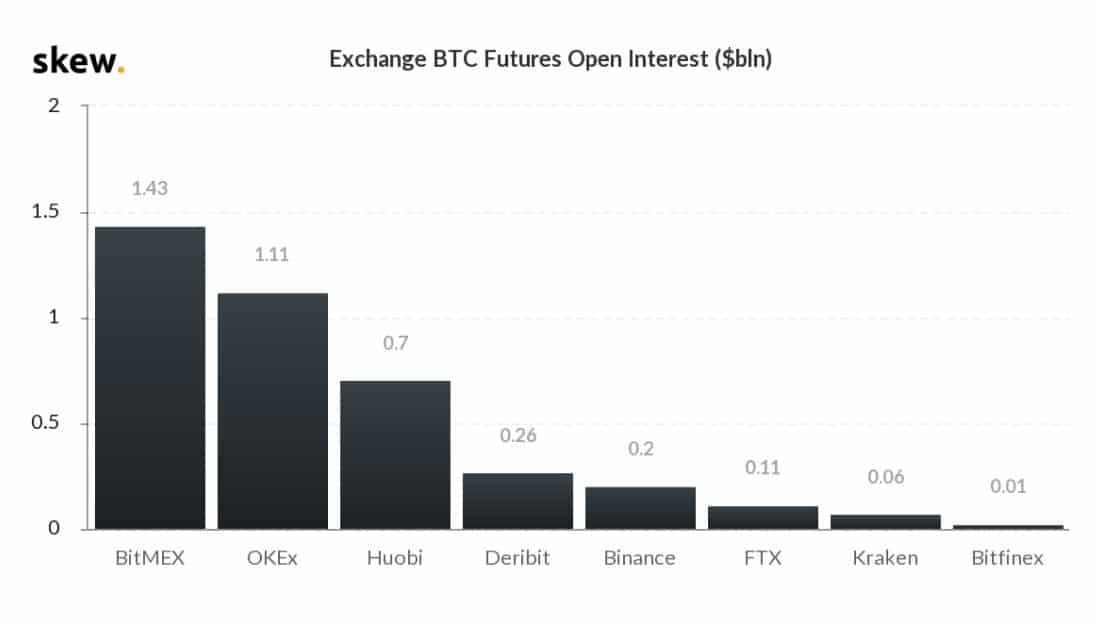

As it appears, the majority of the open interest volume comes from the two giant Bitcoin margin trading exchanges – BitMEX and OKEx have delivered respectively $1.43 billion and $1.11 billion.

Trading Volume On Bitcoin Margin Trading Exchanges. Source: skew.com

As Cryptopotato informed a few days ago, BitMEX’s cold wallet balance has grown with over 15,000 Bitcoins, which is approximately $140 million. This comes following a few months of a continuous decline in the amount of BitMEX cold storage.

Besides, BitMEX CEO Arthur Hayes recently declared on another impressive milestone reached by his company. According to him, “XBT/USD swap just crossed $2 Trillion in total volume traded since it launched in 2016.”

Binance Futures Steadily Behind

Binance Futures is among the youngest margin trading exchanges as it launched during the third quarter of 2019. Even though it still has to go a long way to catch the giants in means of trading volume, it’s on the right track.

According to Aaron Gang, the Director of Binance Futures, noted earlier today that the open interest had almost doubled, from $137 to $271 million, which presumes a faster growth rate than the industry average. This represents an 85% Month over Month (MoM) volume increase. According to the recent Binance report, 75% of the trades feature the Bitcoin-USDT contract.

Binance Futures is rapidly adding cryptocurrencies, and as of writing these lines, the leveraged platform supports up to 75x contracts for most major altcoins, including Ethereum, Ripple, Bitcoin Cash, Dash, and Monero.

Halving and Corona

While it’s difficult to point out one particular reason behind the massive increase in the Bitcoin futures trading volume, one upcoming event might come to mind – the Bitcoin Halving. Scheduled to take place in less than 100 days, and due to the unique way of how Bitcoin is set up, it raises the total attention towards the largest cryptocurrency.

Another plausible reason could be the recent political issues between the US and Iran, and of course, the emerging financial concerns following the newly discovered coronavirus.

The post appeared first on CryptoPotato