The Bitcoin third halving that occurred last week was a remarkable event for the Bitcoin community. However, while experts predicted that the event could be a price booster for the cryptocurrency in the long, miners are not very happy considering the effect of the halving on their revenue.

Bad Business For Miners?

One of the reasons why miners gracefully verify and process transactions on the Bitcoin network is the incentive they receive as block rewards. However, the system is designed to split those in half once every four years (210,000 blocks).

At exactly block number 630,000, which was mined on May 11, the block reward was reduced by 50% for the third time, from 12.5BTC to 6.25 BTC. Such reductions in revenue do not bode well for many businesses.

Before the event, Cryptopotato analyzed some of the dangers of post Bitcoin’s third halving, including the risk of seeing some miners shuttering their operations and increased on-chain transaction fees.

Bitcoin Transaction Fees Hit $5.16

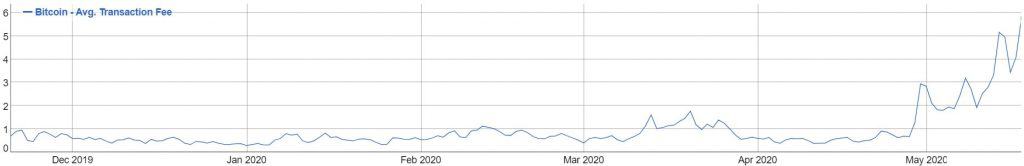

A week after the 2020 halving, transactions on the Bitcoin network have started rising just as analyzed, with the average fee hitting a new record in the past 11 months.

Data on BitInfoCharts shows that the average Bitcoin transaction fee raced to as high as $5.82 yesterday. This is the highest level since almost a year ago, in the early days of June 2019.

However, the chart suggests that the surge in the average fee started gradually since the dawn of 2020, but rose significantly about two weeks before the third halving, on April 28.

Doing the calculations, that’s more than 1,750% increase in the fees since 1, January (from $0.28 to $5.82). This period also matches the time when the hashrate of the Bitcoin network hit multiple all-time highs, as covered in previous reports.

At the time of writing, BitInfoCharts data suggests that the average cost is now at $5.82.

Although the current surge in transaction fee is only a fraction of the average cost in 2017, when the fees were as high as $58, the average crypto users may be unwilling to pay $4 for on-chain transactions.

That could force users into looking for a cheaper alternative like Ethereum, XRP, Litecoin, and other altcoins. Even if this does not happen now, it might happen later on as more halvings take place every four years, with the next excepted to occur in 2024 at block number 840,000.

Miners Trying Cover Shortage?

Earlier reports suggested that the cost of running a Bitcoin mining operation is expected to double, reaching up to $14,000 for mining a single block. The sudden rise in the fee of processing transactions on the Bitcoin network could be attributed to miners trying to make up for the shortage in revenue due to reduced rewards.

Since the halving, Bitcoin’s hashrate dropped by more than 30%, falling from around 136.098 million TH/s to 102.474 million TH/s, thus reducing the network’s security by a small extent.

The decrease in the hashrate means lesser computing power on the network, and could be caused by some miners who may have shut down their operations due to the halved revenue.

The post Bitcoin Halving Aftermath: BTC Transaction Fees On the Rise As Miners Seek Higher Incentives appeared first on CryptoPotato.

The post appeared first on CryptoPotato