Bitcoin began its 2020 journey with a 3.16% pump that pushed its price from $7,233.87 to $7,495, with its market cap at $132.62 billion. With Bitcoin’s halving scheduled for May 2020, there have been many predicting that Bitcoin will avenge its fall as the price rallies. However, irrespective of whether the BTC halving is priced-in or not, there will be some volatility in the spot price around the halving date.

Market data provider, Skew markets, posted a Twitter thread recently, stating,

“There have been voices claiming that whether or not the halving is already priced in, we should expect some volatility in the spot price around the upcoming halving date as the market adjusts to the sharp decrease is the natural supply from miners.”

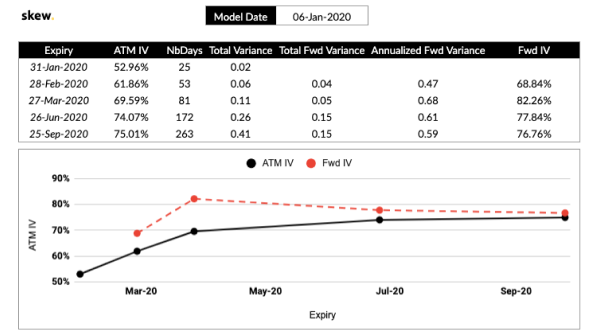

In order to identify any ‘kink’ or drastic changes in the volatility of an asset, investors consider focusing on the asset’s implied volatility term structure through the Options market. However, while Bitcoin’s implied volatility reflects changes in its price, it does not reflect much in the future. This suggests that Bitcoin might already be halved in.

Skew also noted,

“The BTC options market tells us an interesting story: there is no kink in the implied volatility term structure for the relevant expiry (Jun20). This means the options market does NOT anticipate any increased volatility around that time!”

Source: Twitter

According to the attached chart, the kink corresponds to the March 2020 expiry, which means that the market may witness heightened relative volatility during that period, and not in Q2 of 2020. However, this does not hold true in the context of alleged increased volatility expectations for the halving.

“One would expect to see a higher forward volatility for Q2 2020 vs the rest of the forward vol curve if the options market actually anticipated turmoil for this event.”

With the aforementioned observations, two scenarios could be true. Either the BTC Options market believed that the halving is priced in, or the “BTC Options market is itself very inefficient.”

The post appeared first on AMBCrypto