Bitcoin suffered a major loss within hours on 19 February, which dragged its price back under the $10k resistance. The largest asset has been having a crest and trough-like movements with $10k as the mean point. On 19 February, the coin noted an overall fall of 6.28% during which the price of BTC slashed from $10,214.98 to $9,573.74.

Source: BTC/USD on TradingView

According to Binance’s CEO, Changpeng Zhao there exists a psychological barrier at round numbers, like currently at $10k price. Due to this barrier, there are fluctuations in the price.

CZ, who appeared in an interview with BlockTV, talked about the factors contributing to price. He also presented arguments for why he believes the king coin is not priced in for the halving.

CZ added:

“The halving should have a couple of different impacts. Historically we have seen the halving impact price positively. Historic event does not necessarily predict future events, so don’t take that too literally.”

Zhao expressed that psychological levels had more to play in defining the price of BTC. The halving will reduce the supply of BTC, but conversely, the adopters of the cryptocurrency are increasing every day, thus theoretically it should impact the price positively.

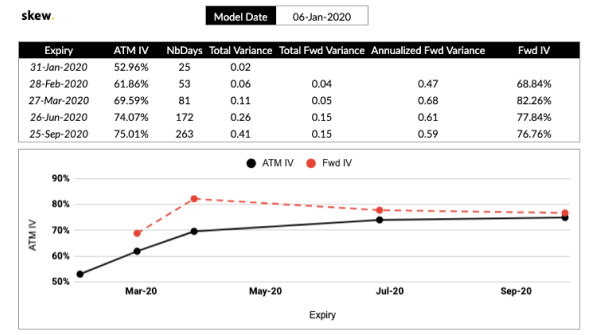

However, there have been regular debates over Bitcoin halving as the market keeps changing its form. Data provider Skew hinted towards a lack of ‘kink’ or drastic changes in the volatility of Bitcoin. In order to identify this ‘kink’, the investors consider focusing on the asset’s implied volatility term structure through the Options market.

Skew had stated:

“The BTC options market tells us an interesting story: there is no kink in the implied volatility term structure for the relevant expiry (Jun20). This means the options market does NOT anticipate any increased volatility around that time!”

Source: Skew

The kink corresponded to the March 2020 expiry, that indicated heightened relative volatility during that period, and not in Q2 2020. However, this wasn’t true in the case of alleged increased volatility expectations for the halving. In such a scenario, either the BTC Options market believed that the halving is priced in, or the Options market in itself is “very inefficient.”

The post appeared first on AMBCrypto