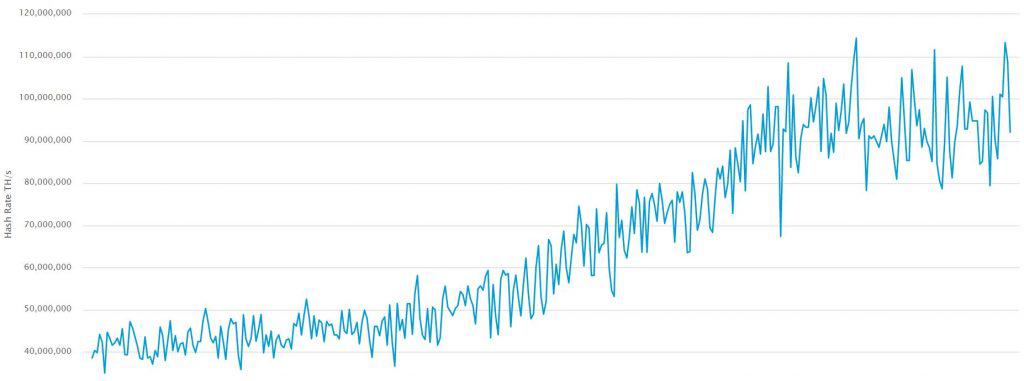

Data shows that Bitcoin’s hashrate has just hit a new all-time high of 111 EH/s, which represents a 170.73% increase since January 1, 2019.

Bitcoin Hashrate. Source: Blockchain.com

Hash rate measures the amount of computing power used by miners to generate new blocks every 10 minutes, keeping the Bitcoin network running at all times, a process known as mining.

The increasing hashrate could suggest that the network is getting more robust and secure, as the chance for a potential attack on it would require a lot more effort.

A Bitcoin Price Rally Ahead?

Bitcoin mining is an expensive endeavor. However, the growing hash rate coupled with the entrance of more players into the market indicates that miners are confident and optimistic about the potential of Bitcoin’s price in the long run. This could also be a signal that mining remains, for the time being, profitable.

Hashrate is usually a trailing indicator and it doesn’t necessarily correlate with Bitcoin’s price. However, it does show the enthusiasm of the market, as Chris Derose from the Counterparty Foundation puts it. According to him, it “shows where the enthusiasm is on the network on people investing in getting in, at least at some level.”

Blockbid’s David Sapper also shared the same view noting that an “increased hash rate means people are here for the long-term because they’re happy to just accumulate what they have, potentially even run at a loss.”

China Dominating the Bitcoin Mining Market

Despite a bumpy year for bitcoin price, 2019 was quite profitable for miners as data from Coinshare earlier this month revealed that miners globally generated a total revenue of $5.4 billion this year.

However, China is dominating the Bitcoin mining network, with almost 66% of bitcoin hashrate coming from the country. This is possible because mining giants like Bitmain and Canaan, that generate a lot of the bitcoin hashrate, are based in China.

You might also like:

The post appeared first on CryptoPotato