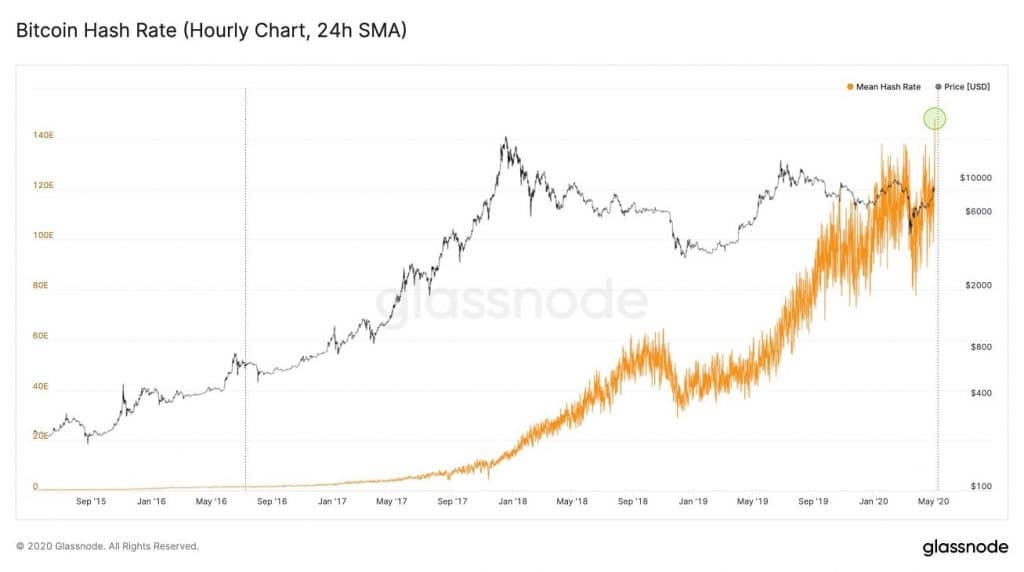

Bitcoin intelligence, data, and analytics firm Glassnode found the Bitcoin hash rate hit a new all-time high over the weekend, ten days before the Bitcoin halving event.

In other words, miners are putting more computational power into maintaining the Bitcoin network. Because miners must venture electricity and capital intensive computer processors to mine Bitcoin, the increase in hash rate is a bullish sign. It means miners are after the Bitcoin rewards they get from maintaining the network. And they’re venturing the resources to go after those rewards.

Is The Bitcoin Hash Rate Correlated With The Price?

In general, the Bitcoin price and the hash rate are not correlated. The price is what buyers and sellers agree to pay for one Bitcoin, and there are many factors – external and internal – affecting the price.

However, there is a relation between the two. While the price goes up, it’s more profitable to mine, which likely to cause more miners to turn on their mining equipment. The result is that the hash rate goes up.

As can be seen on the above five years chart, the hash rate recorded its previous high only months after Bitcoin hit its all-time high in 2017. The same thing happened in regards to the June 2019 high (at $13,880). Yet, as time goes by, the hash rate is increasing.

What Does The Bitcoin Hash Rate Mean?

The hash rate relates to the amount of computations computers on the network are making per second to solve hash problems. This is an integral part of the Bitcoin architecture. When Satoshi Nakamoto designed the world’s first cryptocurrency, he had to solve a basic problem.

How to get qualified nodes (or computers on a network, in this case, Bitcoin). Which is to say, how to get nodes that would maintain the system and have an incentive not to cheat. If the cryptocurrency was to be successful, there would be a massive financial incentive to cheat the system. That would corrupt it and make it worthless.

So the solution was to require nodes to solve hash functions, which requires an expenditure of processing power and electricity. This would mean miners have some skin in the game.

If they spent the money to mine Bitcoin, and then cheated, by say rewarding themselves more Bitcoin than allowed for solving a hash, the other nodes would reject their block, they would not get the Bitcoin reward, and they would lose the money they spent on the electricity. An elegant solution.

How Bitcoin Hashing Works

This cryptographic technique is how Internet servers have long prevented spam and distributed denial of service (DDoS) attacks. Say, for instance, you wanted to attack someone’s server from your computer and bring down their website.

You might have your computer make so many requests to their server that it’s overwhelmed and goes down. But if their server made your computer solve a cryptographic hash for each request, then your computer would go down trying to send enough requests to compromise their computer.

Or if you had a powerful enough computer, you’d still have to spend a lot on the electricity, making it costly to attack. But it’s no problem to send a legitimate number of requests and spend a second solving a hash problem. Now you’re a qualified node.

Bitcoin uses a hash function created by the U.S. National Security Agency (NSA) and published in 2001. It’s called SHA-256. It’s a computer program that takes any string of characters of any length and condenses them down into a 256-bit hash, a string of numbers.

If you feed it the First Amendment to the U.S. Constitution, it will spit out a unique hash for that specific string of characters. It will always output the same hash for the same input. But if you change just one letter of the input, the hash won’t slightly change, and it will change completely. So it’s a pseudo-randomizing function. This has all kinds of interesting and useful applications.

For Bitcoin, the implementation gives miners a hash, and they have to guess what the input was to create it. Because the hash function is pseudo-randomizing, the only way to find the input is to make millions of guesses and put each guess into SHA-256 to see if the hash comes out.

Eventually, a Bitcoin miner makes the right guess and unlocks the ability to place the next block of transactions on the blockchain, as well as create new Bitcoin to award to itself as payment for maintaining the network. The software is coded to adjust the difficulty level based on the network hash rate to target a pace of one new block mined every 10 minutes.

The post Bitcoin Hash Rate Hits All-Time High: Here’s How It Works And How It Affects The Price appeared first on CryptoPotato.

The post appeared first on CryptoPotato