Bitcoin’s hashrate, or computing horsepower, has hit its highest ever level indicating that the network has never been in better shape in terms of security.

Hashrate High

The new milestone of 170 exahashes per second was noted by on-chain analytics provider Glassnode which added that it is a 40% increase since the halving in May.

#Bitcoin hash rate hits a new ATH and touches 170 exahash for the first time in history on the hourly chart (24h MA).

That is an increase of around 40% since the halving in May, substantially adding to the security of the network.

Live chart: https://t.co/lpSkIAtfFm pic.twitter.com/Wl1MUODHdZ

— glassnode (@glassnode) October 8, 2020

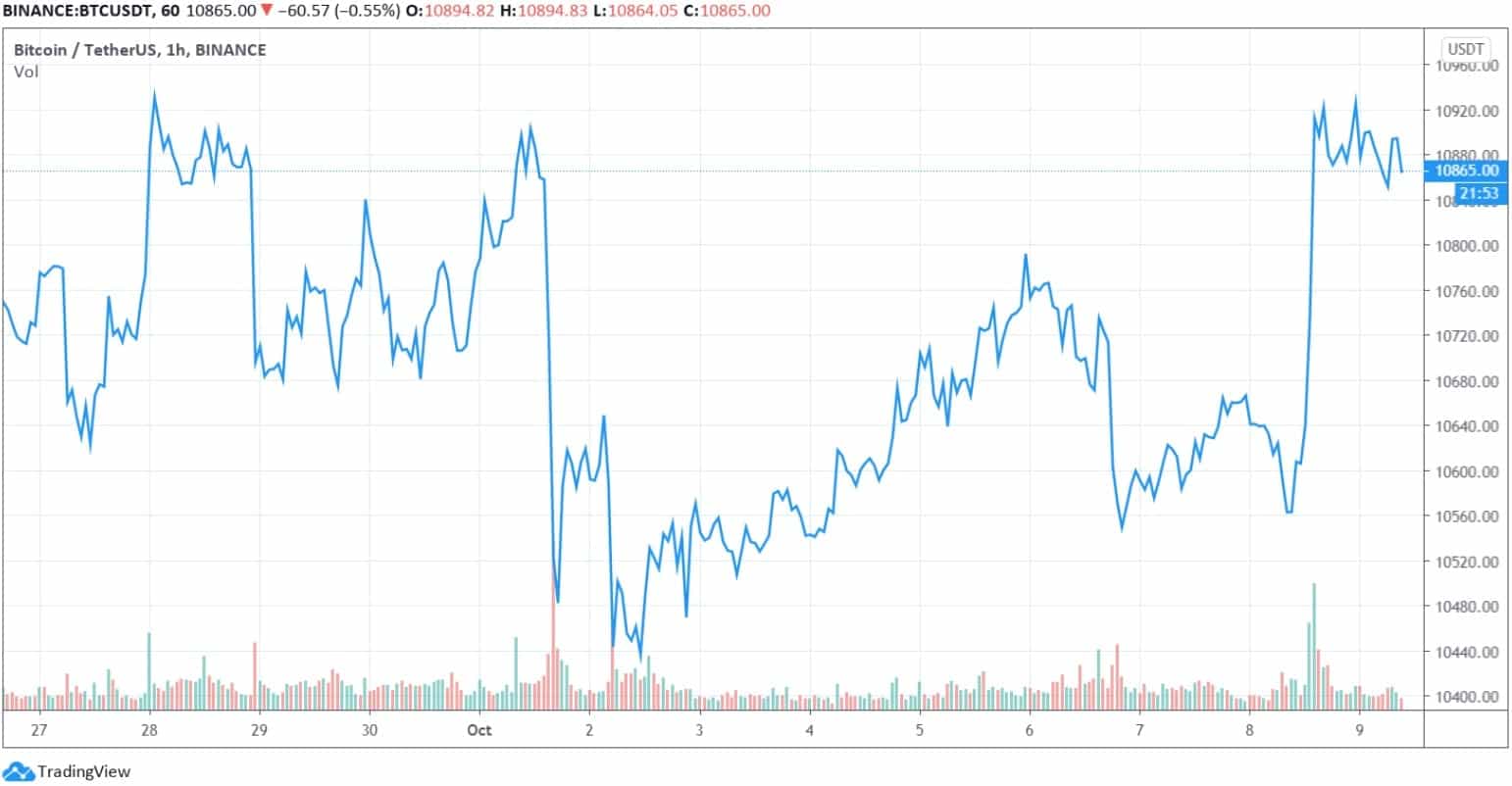

The hashrate high is not correlated with prices, however, which remain stuck in a range bound channel.

Bitinfocharts.com confirms the new peak but reports it slightly lower at 155 EH/s. It also reports that the hashrate has increased by 63% since the same time last year.

There was widespread fear that miners would capitulate after the halving which reduced the block reward from 12.5 BTC to 6.25 making it more expensive to produce each new coin.

Bitcoin has shed a lot of its volatility over the past month and has remained above five figures for 65 days in a row according to recent reports. The 50 and 200 weekly moving averages also remain at all-time highs, and the on-chain fundamentals such as hashrate continue to show signs of positivity.

Chart guru, Peter Brandt, stated that weekly and daily charts are flashing ‘big buy signals’ at the moment.

It is a major development that a global corporation is now putting $BTC onto its balance sheet. The weekly and daily charts a poised to flash a big buy signal. https://t.co/p6652SfqVc pic.twitter.com/rCoKZCY5LB

— Peter Brandt (@PeterLBrandt) October 8, 2020

Large institutional-grade funds continuing to buy BTC at current levels is a bullish indication that another rally could be around the corner.

Bitcoin Price Outlook

On the daily timeframe, Bitcoin touched an intraday high of $10,950 a few hours ago but has still failed to break that $11k psychological barrier. The move marks a 3.8% climb from its low point of $10,550 during Thursday’s trading session.

Trader and analyst ‘CryptoHamster’ noted the break of the pennant to the upside which could lead to a larger move over the weekend.

Triangle has been broken to the upside.

The price is testing the resistance again. $BTC $BTCUSD #bitcoin pic.twitter.com/MXudmq6uVk— CryptoHamster (@CryptoHamsterIO) October 8, 2020

The rest of the crypto market is enjoying the momentum as total capitalization climbs 2.5% on the day adding $10 billion to digital assets. Ethereum has returned to $350 while Polkadot and Chainlink are making strong moves with over 8% gained on the day.

The post appeared first on CryptoPotato