Since its mysterious inception to being a well-known asset, bitcoin has come a long way. The bitcoin community, however, has moved from doubt to amusement to where it stands now, a fan, follower, etc. People have come into the community and stayed while others haven’t. The point is that the community has retained a few things that are, to-date, common.

Bitcoin, Moon, and DCA

Take for example the word “moon”; this word means something entirely different to the crypto community as they expect their bags of coins, be it bitcoin or any altcoin, to moon. The first usage of this word was in September 2010, when a user “Bimmerhead” said that the price of bitcoin is going to “skyrocket to the moon” while referring to the number of bitcoins capped at 21 million only.

Although he did mention the other possibility:

“With a maximum of only 21 million in circulation no one will ever be able to do a ‘helicopter Ben’. Either bitcoins are going to catch on and their value is going to skyrocket to the moon, or they will wither on the vine.”

Today, as bitcoin contends the $12,000 level, we are on the verge of recovery from the bear market and on the cusp of a bull market… then onto the moon.

While the reference of the moon came up when discussing the value of bitcoin and how to get more of them, another important word – “DCA” was admitted to the bitcoin community in 2011. This was done by the legendary and OG bitcoiner – Hal Finney.

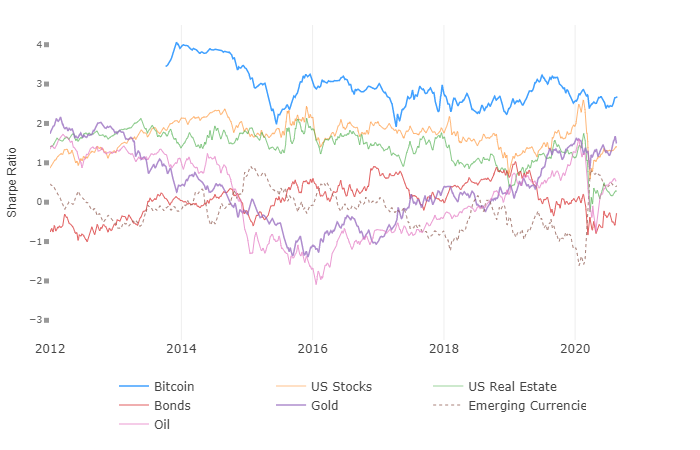

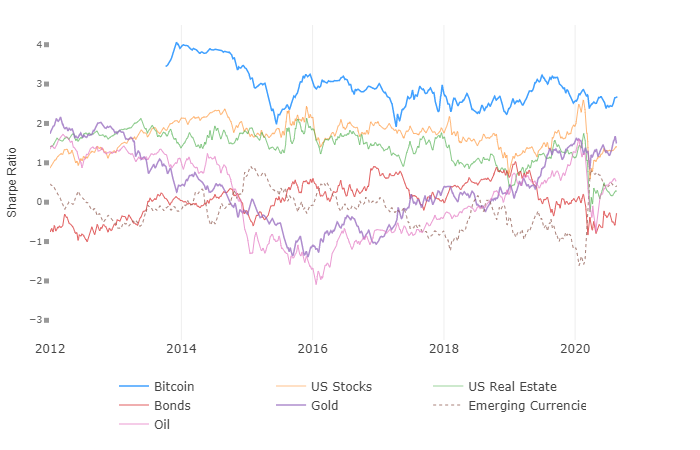

Hal Finney referred to a method to get more bitcoin and that was via DCA aka Dollar-Cost Averaging. Even though bitcoin is extremely volatile, it has managed to outperform many real-world assets. Not only that, but the risk-adjusted return of bitcoin is also far better/superior to other assets.

Source: Woobull

The chart shows bitcoin’s risk-adjusted return higher than that of gold, US stocks, US real estate, bonds, emerging currencies, and even oil.

Is it still bitcoin?

Bitcoin started out as an experiment but it evolved to something bigger and better. From being an Internet sensation localized to a few enthusiasts to being a value transfer in the depths of the darknet. From being touted a fad, bubble and even announced dead a few hundred times, bitcoin has finally received the recognition and adoption to truly deserves.

Not just that, companies that swore and advised people to stay away from it have now come around to the idea of bitcoin.

These companies are also experimenting with it by including it as a portfolio diversification instrument. VanEck’s experiments showed the impact of having bitcoin in one’s portfolio. JP Morgan released a report that came to the exact same conclusion as VanEck, that bitcoin remains uncorrelated to the global market, and allocation of it in a portfolio would be good.

“Bitcoin’s co-movement with all markets over the past five years has been near zero, which would seem to position it better than the Yen or Gold for hedging purposes.”

The post appeared first on AMBCrypto