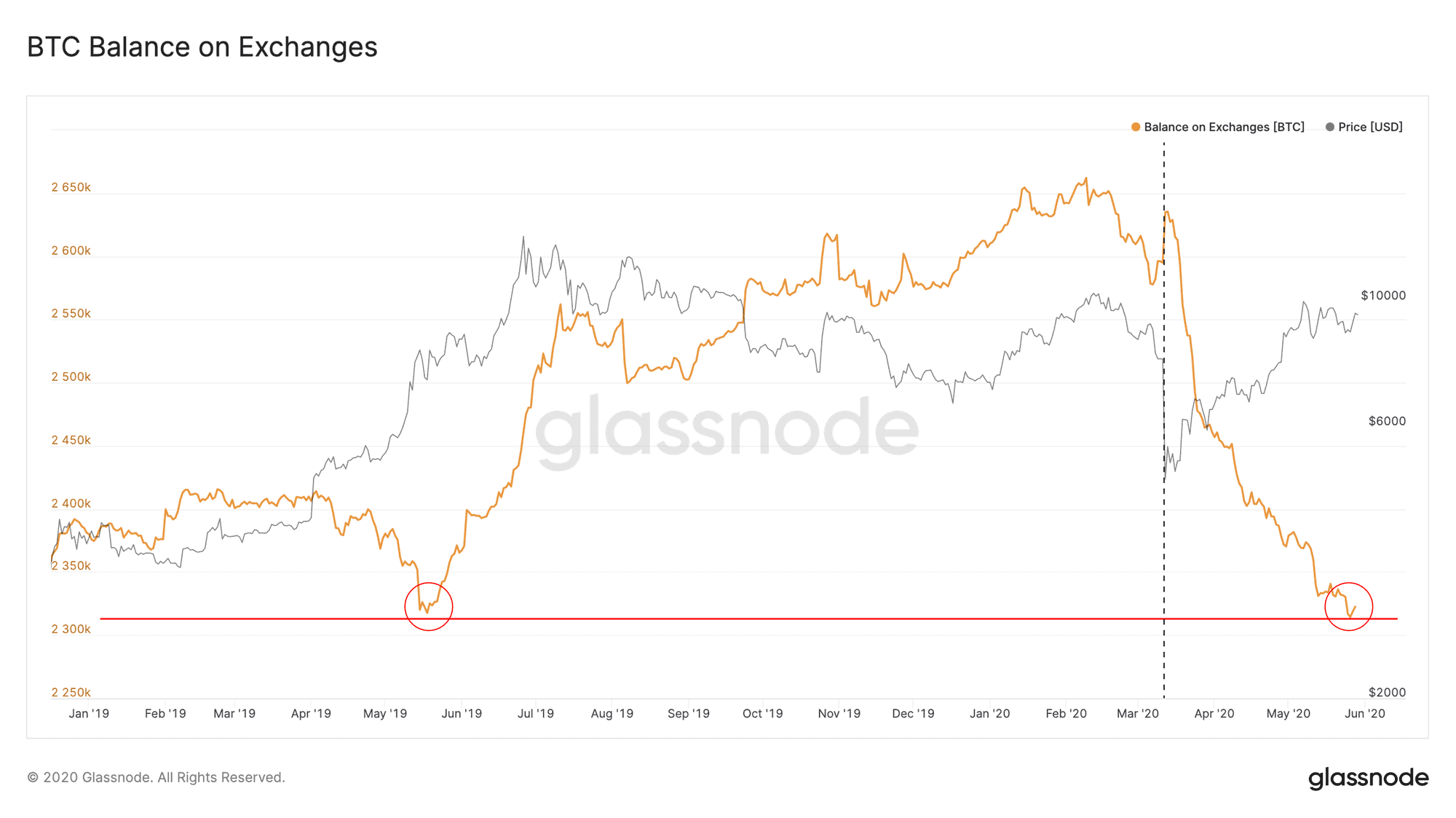

Bitcoin investors have been transferring their assets outside of specific exchanges lately, new data shows. Ultimately, the BTC balance on platforms has reached its lowest point in over a year by decreasing with more than 320,000 coins since Black Thursday.

Bitcoin HODLers Mentality On The Rise

During the notorious Black Thursday event in March, when most cryptocurrency assets lost substantial portions of their value, investors – especially short-term holders – transferred sizeable shares of their holdings to exchanges to participate in the massive sell-offs.

Since then, however, data provided by Glassnode indicates that the number of BTC held of exchanges has been continuously declining. In fact, this metric reached its lowest yearly point just recently, registering a 12% decline since mid-March.

In other words, Bitcoin investors prefer storing their assets outside of exchanges, which is typically regarded as an optimistic sentiment for an upcoming bull run. The previous yearly low came in late May/early June 2019, right before Bitcoin’s price surged to nearly $14,000.

Now, two other metrics can also support the positive sentiment. Firstly, the number of Bitcoin addresses containing more than 1,000 BTC (also referred to as Bitcoin whales) recently reached its highest level in two years. Secondly, 60% of the asset’s total supply hasn’t moved in over a year, displaying again HODLers mentality, perhaps anticipating a price surge.

Not The Full Story

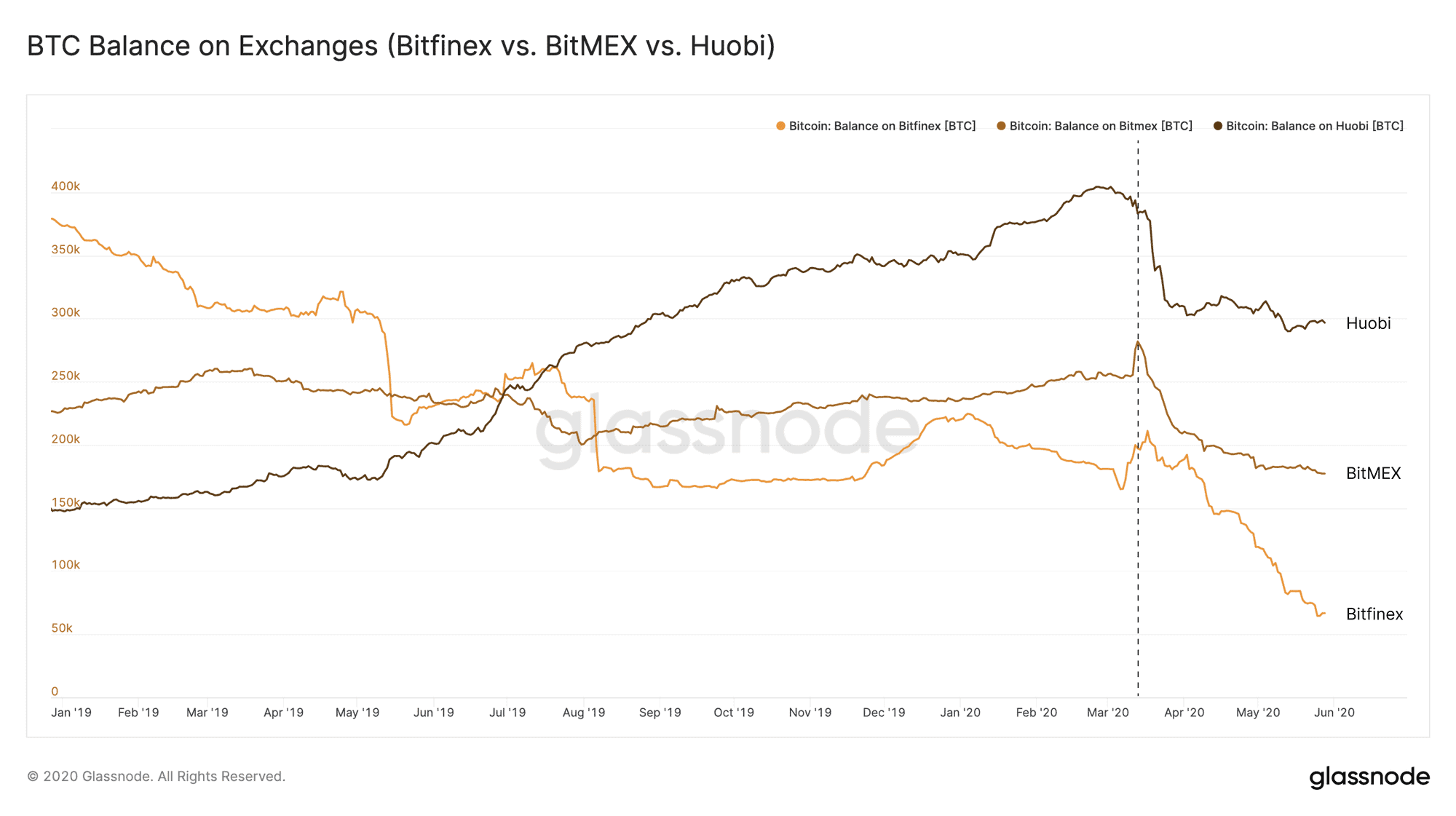

By going into details, however, Glassnode informs that investors have been withdrawing funds from specific exchanges. The data shows that the largest outflows since the Black Thursday came from Huobi (-97,000 BTC), BitMEX (-105,000 BTC), and Bitfinex (-133,000) BTC.

The decrease on Bitfinex has resulted in losing 66.6% of its total BTC balance. Nevertheless, Glassnode says that the declines had started on Bitfinex and Huobi in the months prior to Black Thursday. BitMEX, being the subject of two DDoS attacks during those hours, experienced “a much more rapid decrease in BTC balance than any other exchange.”

Contrary, the largest US-based exchange Coinbase registered a Bitcoin balance drop of only 0.2%. It remains as the most popular platform for holding the primary cryptocurrency with a current balance of 968,000 BTC.

The BTC balances on Bitstamp and the largest exchange by users and volume – Binance – “have actually seen a slight increase” during the same period.

Therefore, a bullish sentiment may not be the only reason investors have been withdrawing their assets from certain exchanges. However, the rising accumulation levels of BTC whales and the increased HODLers mentality from the dormant holdings could suggest otherwise.

The post Bitcoin Held On Exchanges At Yearly Lows As Investors Gear Up For The Moon appeared first on CryptoPotato.

The post appeared first on CryptoPotato