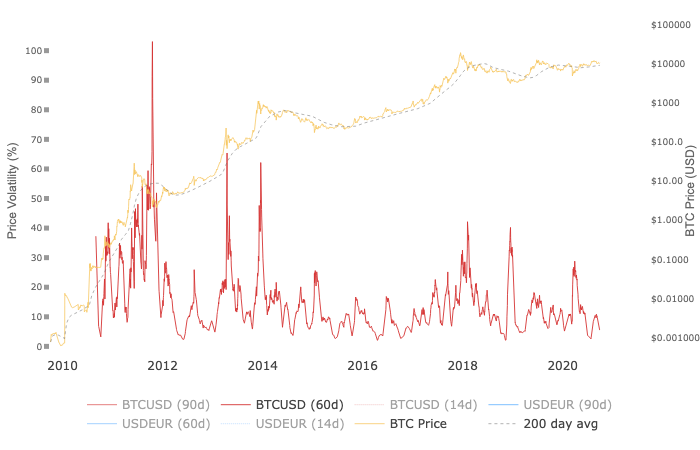

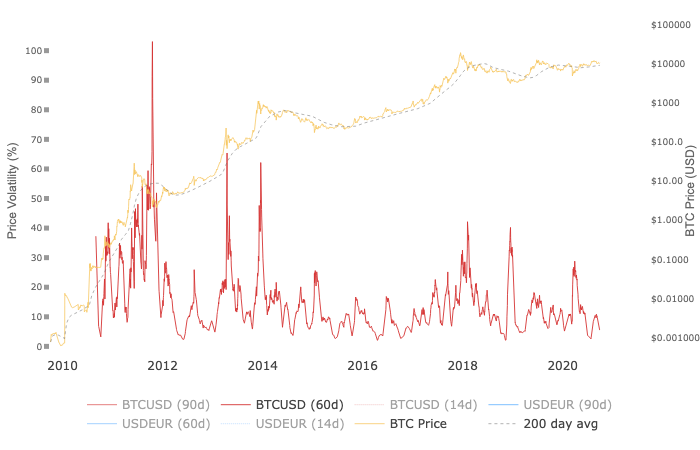

Bitcoin inflow to exchanges has dropped to record levels and as demand/ supply also continues to drop this may be the calm before the storm, however, inactivity on spot/ derivatives exchanges can be explained by Bitcoin’s volatility level. According to Bitcoin’s 60-day volatility chart by Willy Woo, Bitcoin’s volatility has dropped to the 2019 level.

Source: Woobull

However, the price is above the 200-day moving average and the general perception is that traders are moving funds from Bitcoin to Altcoins, DeFi projects, or simply accumulating. However, based on a recently published research paper by the Department of Economics, Rutgers University, there is an increased percentage of high-frequency trading (HFT) firms. These firms have entered the market since 2020 and this may explain Bitcoin’s volatility.

The research compared Bitcoin trading on CME and four settlement spot exchanges that transact $146 million per day in the BTC/USD pairs. Spot market median trade sizes are under $1300 but they exceed $18000 on the CME. Bid-ask spreads average 0.0298%. The size of trades over $1 million is less than 1% in the current market. Over 2.5% of trades and 15.5% of cancellations on Coinbase happen in less than 50 milliseconds. This HFT activity also increases Bid-Ask spreads for seconds every now and then.

Larger executions on exchanges like Coinbase are executed within milliseconds, but there are estimated losses of $36 M in trade-through better quotes. However, price discovery is driven primarily by derivatives exchanges.

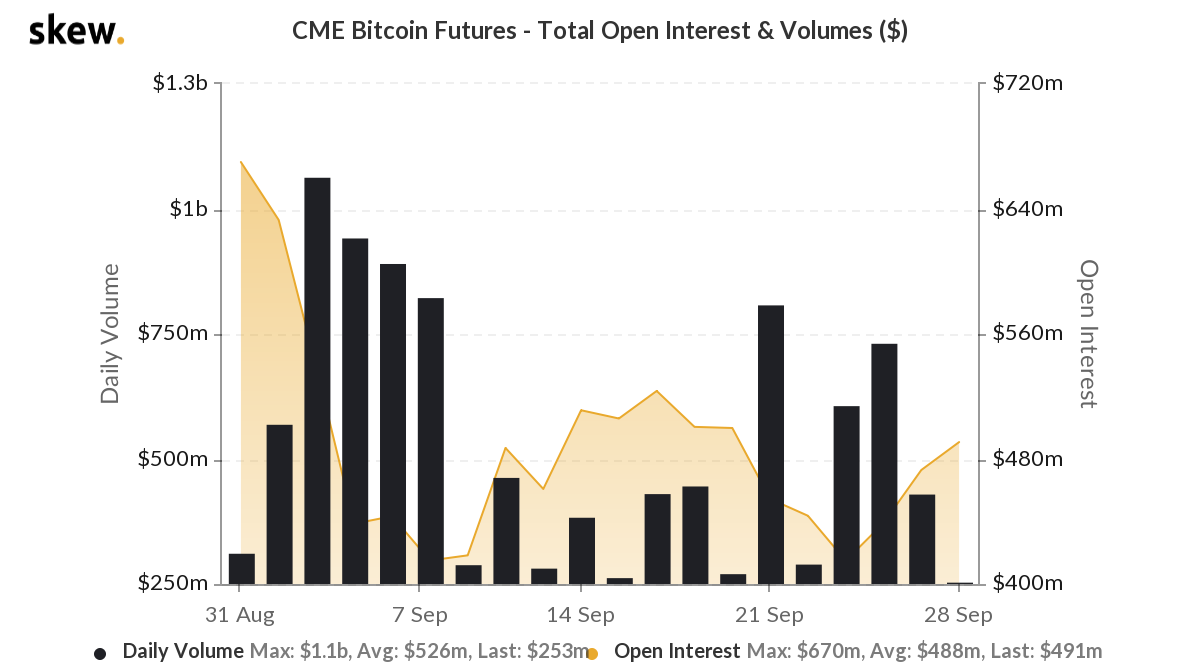

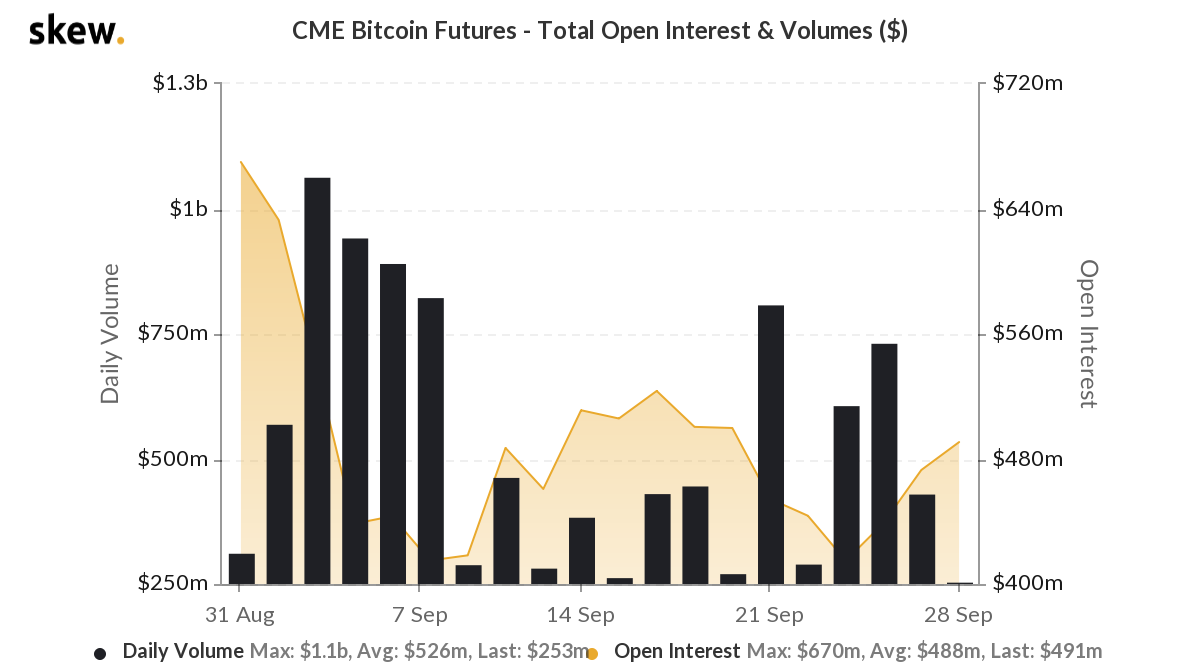

Source: Skew

Institutional investors trade in Bitcoin derivatives on CME and events like options expiry have a direct impact on spot prices. However, the last options expiry on September 26 didn’t have the anticipated impact on spot exchange prices.

HFT activity has increased on spot and derivatives markets in the past 4 months and this coincides with the lowering influence of CME Bitcoin options expiration on the price. According to the paper, the fragmentation of Bitcoin markets may be responsible for this. To put this in perspective, let’s consider the HFT activity statistics on spot and derivatives exchanges. 2.56% of Coinbase trades are HFT. On Bitstamp it’s 8.1 and in tech stocks on exchanges 30-35% trading activity is HFT.

So as of now, more hedge funds are entering Bitcoins and engaging in HFT and it can be anticipated that the volatility may drop further as that happens. Bitcoin may perform akin to tech stocks like Apple. HFT on the top 4 exchanges accounts for 59% of average weekday volume and CME futures make up 41%. The volatility is relatively high at the moment, when compared to pre-2016 levels, however, it may drop as institutional interest goes up.

The Bitcoin futures market is less than 2% the size of Brent Crude, and top-four spot exchanges have the combined volume of a single midcap stock. As such, a market of this size may experience high volatility when retail traders are trading, with the active participation of Hedge Funds, volatility will slowly drop to match traditional stock market levels. Low market capitalization is largely responsible for this and unless there is an unprecedented rise in market capitalization, volatility may drop further increasing the difficulty and slimming the margin for retail traders.

The post appeared first on AMBCrypto