Bitcoin slid once again beneath the $10,000 mark, but it stands above it now. Most of the altcoin market retrace today, especially DeFi representatives.

BTC’s high correlation with the stock markets could suggest further declines, as Wall Street marked significant losses during yesterday’s trading session.

Bitcoin Recovers From Another Sub-$10K Trip

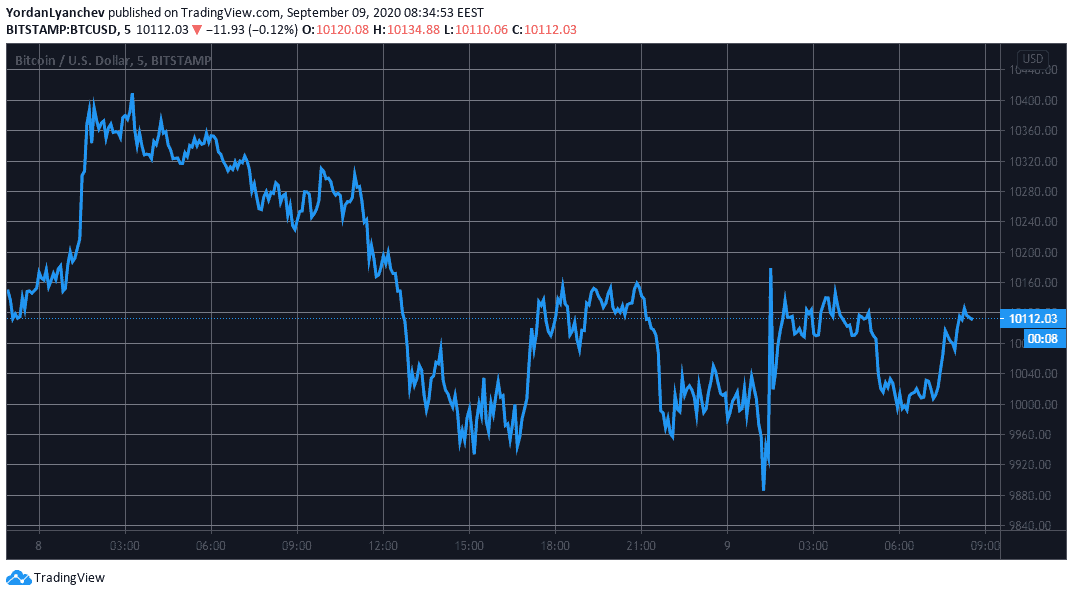

As reported yesterday, BTC reached an intraday high of $10,450. However, the asset couldn’t maintain its position and dropped to about $10,200 before dipping under $10,000.

The scenario repeated once again in the next few hours, and BTC bottomed at $9,880 (on Bistamp). The bears quickly intercepted the dip and spiked the primary cryptocurrency towards $10,200. Since then, BTC has traded at about $10,100.

Some of the price developments charted yesterday could be linked to BTC’s increased correlation with the US stock markets that started last week. Bitcoin’s volatility increased approximately at the time when Wall Street began trading after the long weekend.

Ultimately, the S&P 500 closed with a nearly 3% drop, the Dow Jones Industrial Average with 2.25% in the red, and Nasdaq Composite lost the most substantial chunk of value – over 4%.

Alts In The Red

Most alternative coins are retracing today. On a 24-hour scale, Ethereum is down by 3% to $335, and Ripple is below $0.24 after a 2% drop.

The battle for the top 5 spot continues. Chainlink and Polkadot decline by over 5%. Bitcoin Cash’s “only” 2% drop has helped BCH to reclaim the 5th position in terms of market cap.

Binance Coin is the only top 10 coin that rises in value by 3%. The increase comes after the successful launch of Binance Launchpool – the platform enabling users to farm new tokens by staking BNB. According to the leading cryptocurrency exchange, users have already staked over $250 million worth of BNB.

Further losses are painted by Hyperion (-25%), SushiSwap (-18%), DFI.Money (-12.5%), BitShares (-12%), THORChain (-12%), Band Protocol (-11%), Serum (-11%), and Ocean Protocol (-10%).

On the other hand, Tron leads as the most impressive gainer with an 8% pump. Blockstack follows with 7.5%, and Ontology with 5%.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato