Bitcoin dived once more under the $10,000 mark, but it rapidly bounced off and sits above it now. The rest of the market resembled BTC’s movements with initial dumps and quick recovery.

Given the high correlation, all eyes are now on Wall Street as the market will open today for the first time since Friday and it’s interesting to see how this will impact Bitcoin’s price.

Bitcoin Dips Below $10K (Again)

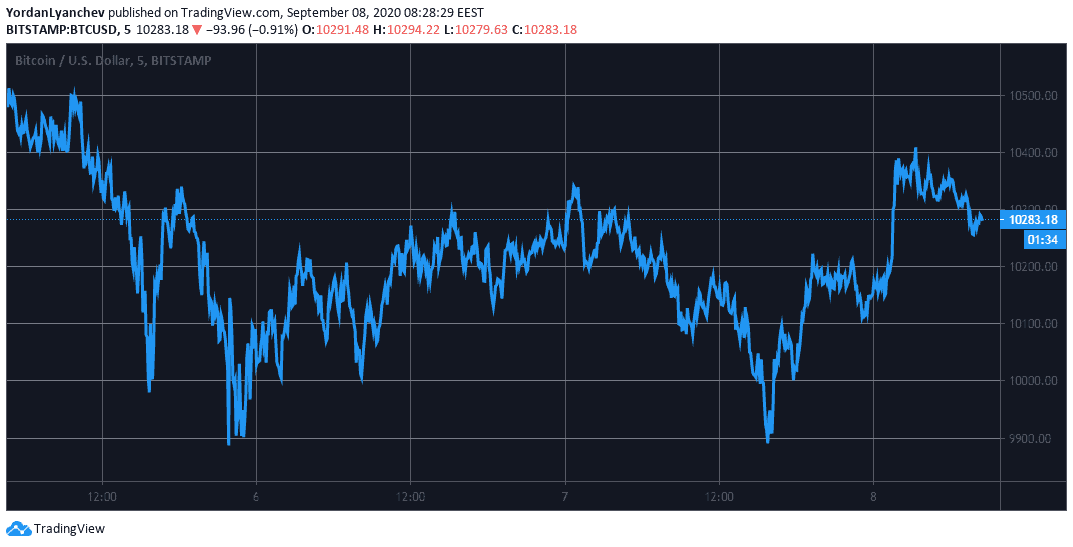

As reported yesterday, Bitcoin was struggling to remain above $10,000. A few hours ago, bears took control and drove it below the coveted mark once more. The asset bottomed at $9,880 (on Bitstamp) and came close to filling the CME gap at $9,600.

However, instead of dipping further and closing the gap, BTC reversed and spiked. The primary cryptocurrency reached an intraday high of $10,400 but has retraced slightly to $10,280 now.

According to the data analytics resource Santiment, Bitcoin’s network activity displays bullish behavior, despite the most recent dip beneath $10,000. The company noted that the daily active addresses, which sometimes could indicate upcoming price developments, are “sustaining nicely.”

Additionally, Santiment reported that the BTC transaction volume has been increasing lately, suggesting “rising interest around this $10k price level.”

Altcoins Follow Bitcoin

The alternative coin market tends to resemble Bitcoin’s larger moves frequently, and yesterday was no exception. Ethereum bottomed at $325, surged to its intraday high of above $350 and has retraced to $345. Ripple also dumped in value to $0.23, pumped back up, and is currently sitting at $0.24.

The entire market cap slumped by $15 billion following the daily lows, but it’s now hovering at approximately $330 billion.

On a 24-hour scale, most of the market is in green. Despite the intraday dips, Chainlink retains its position in the top 5 after a 1% increase. Bitcoin Cash (0.5%), BitcoinSV (5.2%), Binance Coin (2.4%), and Litecoin (1.3%) pump in value from the top 10 coins. Contrary, Polkadot loses 4% and trades at $4.5.

IOST has entered the top 100 after a 28% increase. Two privacy-oriented coins follow with double-digit price increases – Dash (10.5%), and Zcash (10%).

Elrond is up by 9% to above $14. It’s worth noting that the company recently completed a 1000:1 token swap and renamed the native cryptocurrency from ERD to eGLD.

On the other hand, Ampleforth drops by 12% to $0.7, followed by Yearn.Finance (-10%), Serum (-9%), and DFI.Money (-8%).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato